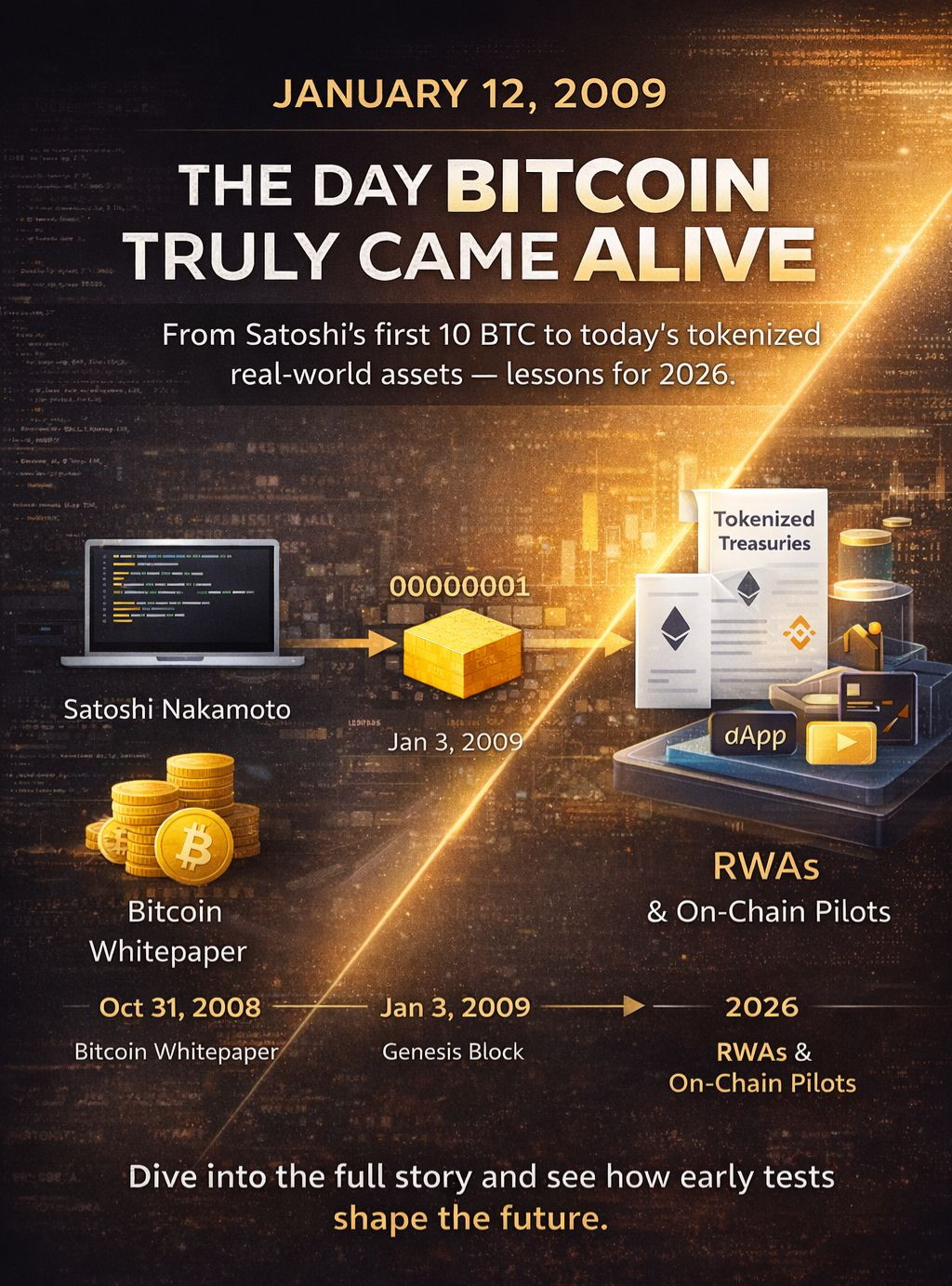

It's early 2009. The world is still reeling from the financial crisis. Banks are getting bailouts left and right, and most people have never heard the word "bitcoin". Then, on January 12, 2009, that changed. Satoshi Nakamoto sent 10 BTC to Hal Finney, marking the first real peer-to-peer Bitcoin transaction ever recorded.

This wasn’t about profit, Bitcoin had zero market value. It was a simple question being tested:

Can value move directly from one person to another without banks, intermediaries, or trust?

And the answer was yes. And that answer changed everything.

In this article, let’s revisit that moment the context around it, why it mattered so much, and what it quietly teaches us in 2026, as on-chain pilots, tokenized assets, and real-world blockchain utility continue to grow beneath today’s market uncertainty.

𝟭-𝗙𝗿𝗼𝗺 𝘄𝗵𝗶𝘁𝗲𝗽𝗮𝗽𝗲𝗿 𝘁𝗼 𝗳𝗶𝗿𝘀𝘁 𝗻𝗼𝗱𝗲𝘀

The story begins a few months earlier:

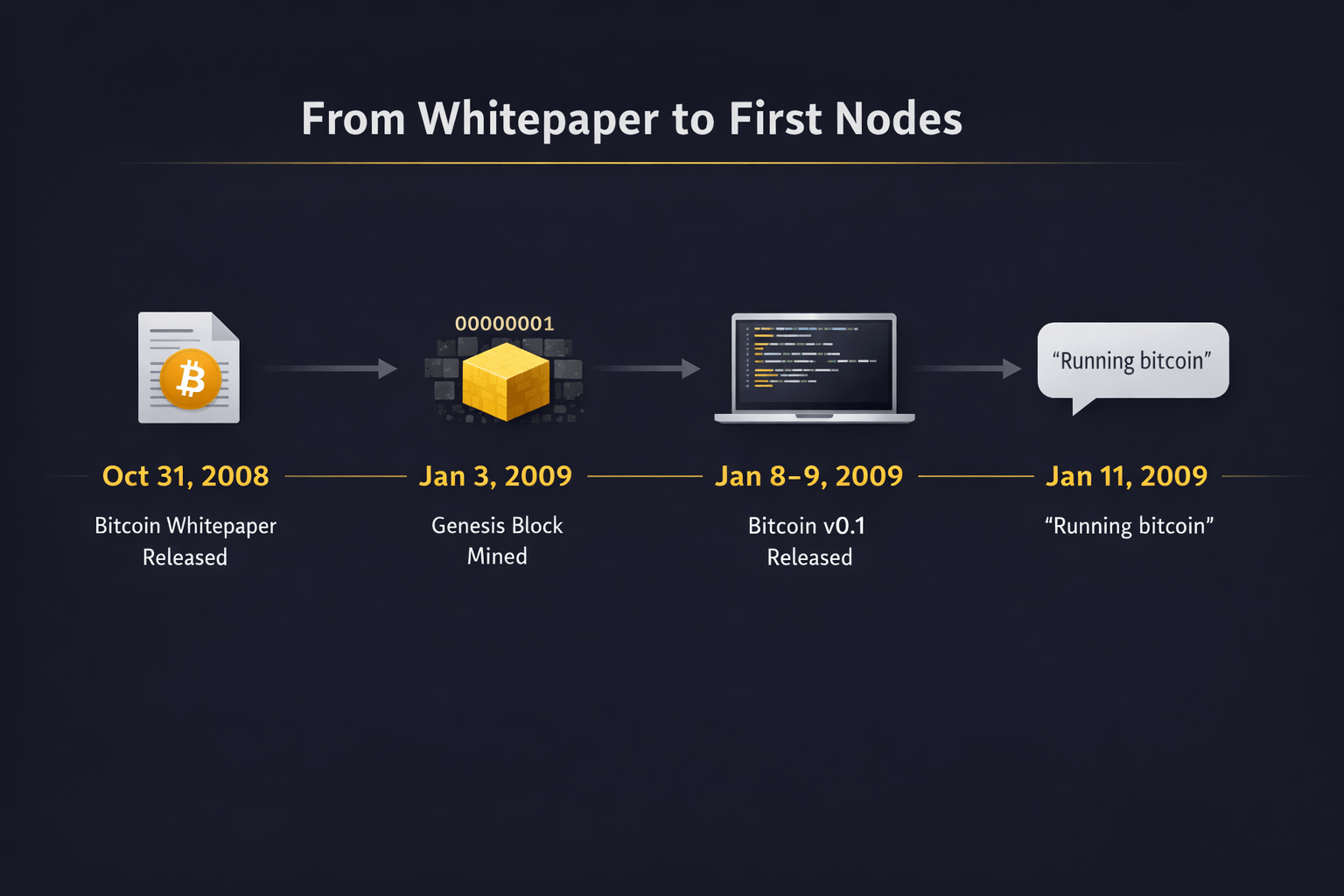

● October 31, 2008: Satoshi publishes the Bitcoin whitepaper on the cryptography mailing list, introducing a peer-to-peer electronic cash system powered by Proof-of-Work.

● January 3, 2009: The Genesis Block is mined, embedding the now-famous headline: “Chancellor on brink of second bailout for banks.”

● January 8–9, 2009 – Bitcoin v0.1 is released publicly. Satoshi emails the mailing list and personally reaches out to early cryptographers.

One of them was Hal Finney.

A respected cypherpunk, cryptographer, and PGP developer, Finney had already explored reusable proof-of-work years earlier. He immediately understood what Bitcoin was trying to do.

On January 11, 2009, he tweeted just two words: “Running bitcoin”

That tweet mattered more than it looks today. It meant the network was no longer just Satoshi. Bitcoin had its first independent participant.

𝟮- 𝗧𝗵𝗲 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝘁𝗵𝗮𝘁 𝗽𝗿𝗼𝘃𝗲𝗱 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝘄𝗼𝗿𝗸𝗲𝗱

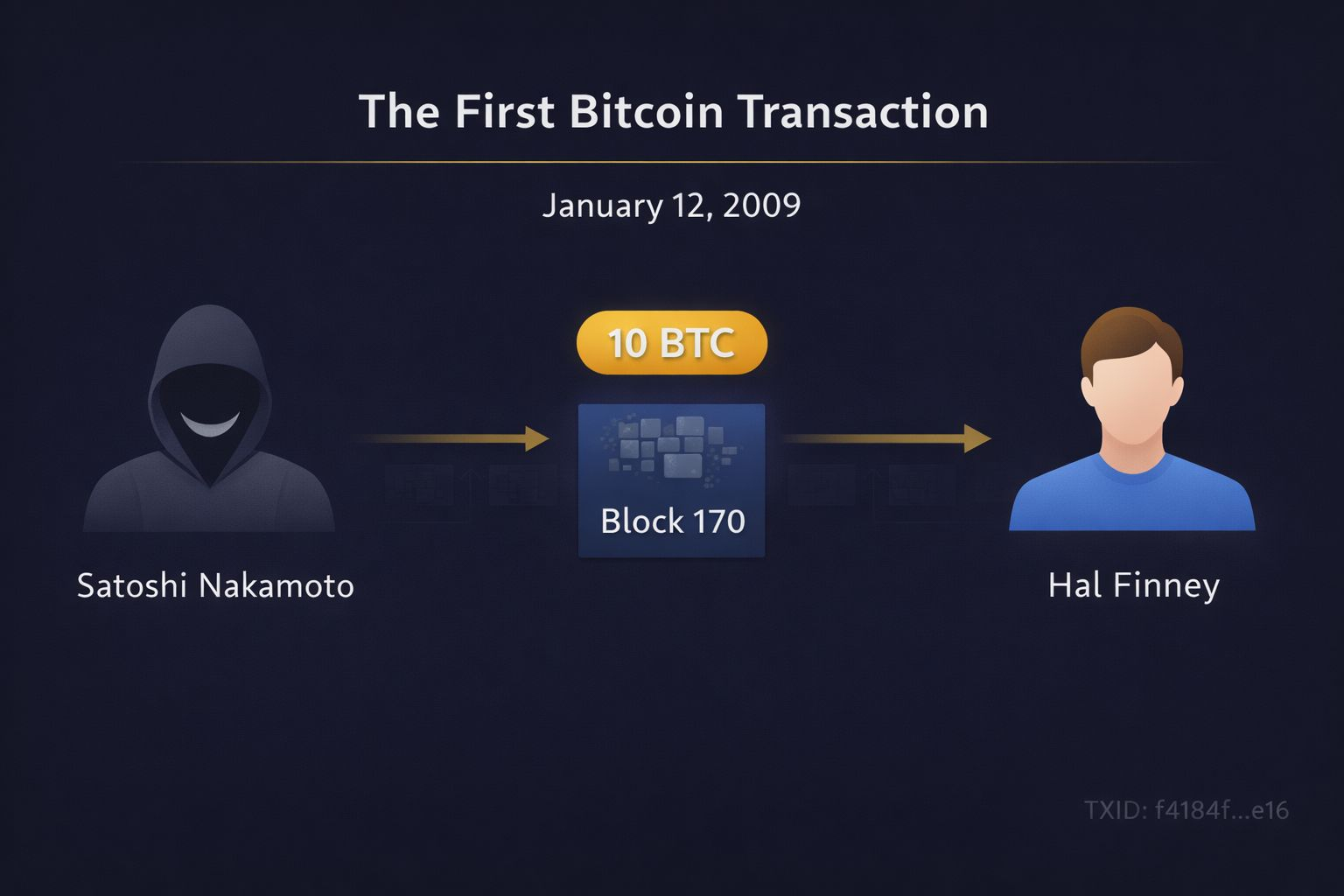

A few hours later, the test happened.

• Amount: 10 BTC

• From: Satoshi Nakamoto

• To: Hal Finney

• Block Height: 170

• Timestamp: ~03:30 UTC

• TXID: f4184f…e16

This was not a mining reward. It was the first spendable transaction value moving from one private key to another across a decentralized network.

Later, Finney explained that he mined blocks, reported bugs, and helped test stability. When Satoshi needed a second node to confirm that transfers actually worked, Finney was there.

The transaction was basic, no memo, no fanfare just a successful broadcast, validation, and confirmation on the blockchain. But it proved the core promise: 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱, 𝘁𝗿𝘂𝘀𝘁𝗹𝗲𝘀𝘀 𝘃𝗮𝗹𝘂𝗲 𝘁𝗿𝗮𝗻𝘀𝗳𝗲𝗿 𝘄𝗮𝘀 𝗽𝗼𝘀𝘀𝗶𝗯𝗹𝗲. That quiet cooperation turned theory into reality.

𝟯- 𝗪𝗵𝘆 𝘁𝗵𝗶𝘀 𝗼𝗻𝗲 𝘁𝗲𝘀𝘁 𝗰𝗵𝗮𝗻𝗴𝗲𝗱 𝗲𝘃𝗲𝗿𝘆𝘁𝗵𝗶𝗻𝗴?

This single transaction shown three things:

● Proved functionality: Bitcoin wasn't vaporware. The blockchain updated correctly, nodes agreed, and value transferred without a central server.

● Built early momentum: Finney became Bitcoin's first active tester and bug reporter, helping stabilize v0.1. His involvement encouraged others on the cypherpunk mailing list.

● Symbolic milestone: This was the only known time Satoshi sent BTC directly to someone (outside mining rewards). It showed faith in the system.

Without this test, Bitcoin might have stayed theoretical. Instead, it gained its first real user outside Satoshi, paving the way for Pizza Day (2010), exchanges, and global adoption.

𝟰- 𝗘𝗮𝗿𝗹𝘆 𝘁𝗲𝘀𝘁𝘀 𝗯𝘂𝗶𝗹𝗱 𝗹𝗮𝘀𝘁𝗶𝗻𝗴 𝘁𝗿𝘂𝘀𝘁

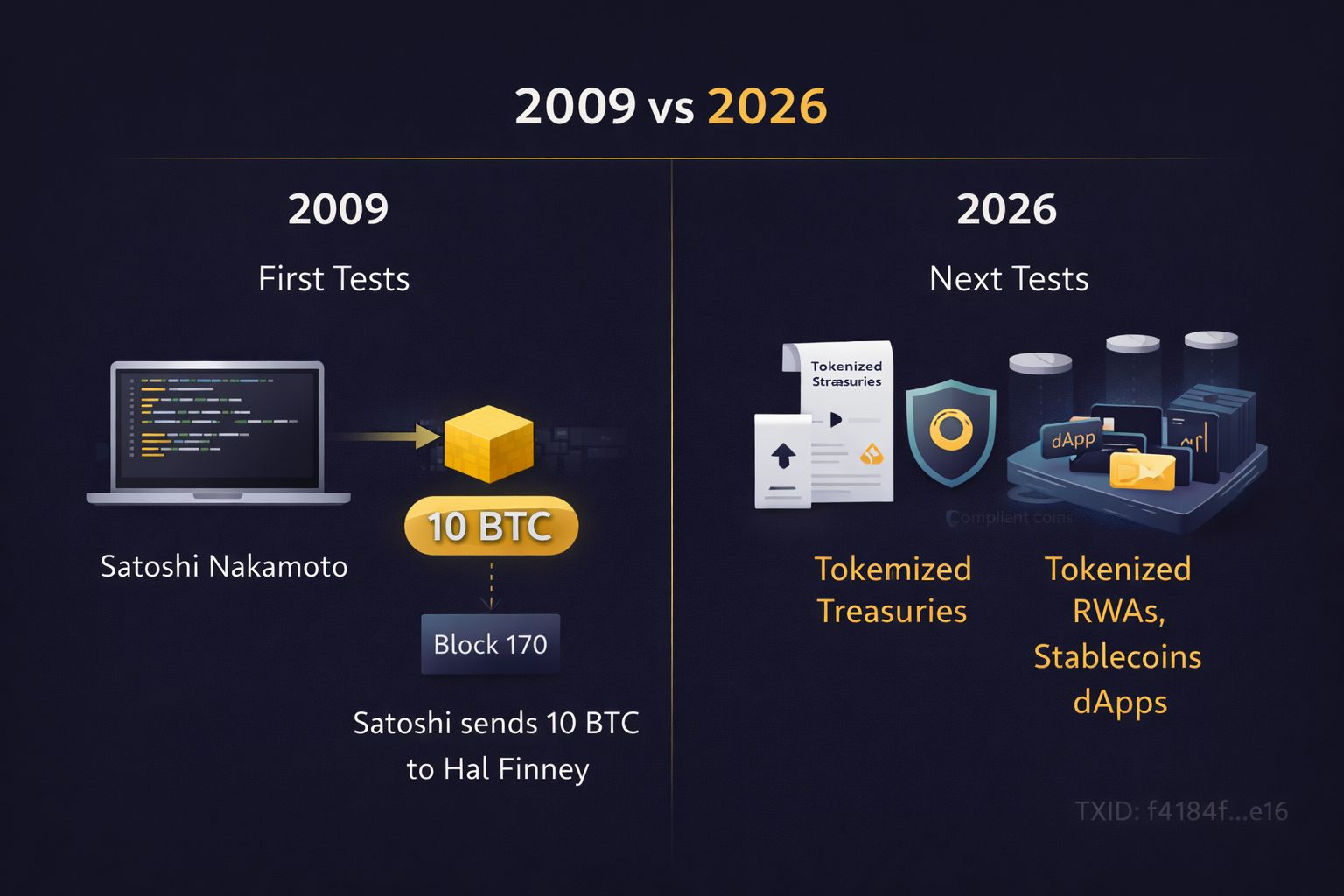

Fast-forward to today (January 31, 2026): BTC is dipping below $83K amid U.S. shutdown fears, Fed Chair speculation, and regulatory debates (Clarity Act delays). Yet real utility is surging, tokenized RWAs (real-world assets like bonds, treasuries), on-chain pilots for payments/remittances, and compliant stablecoin frameworks.

The parallel is clear:

📍Just as Satoshi's 10 BTC test proved peer-to-peer transfers worked in 2009...

📍Today's on-chain RWA pilots (e.g., BlackRock/ Ondo tokenized treasuries on Ethereum/Base/BNB Chain) prove real assets can move trustlessly on blockchain.

𝟱- 𝗪𝗵𝗮𝘁 𝗰𝗮𝗻 𝘄𝗲 𝗹𝗲𝗮𝗿𝗻 𝗳𝗿𝗼𝗺 𝘁𝗵𝗶𝘀 ?

Early tests build trust. They de-risk adoption. They attract builders, institutions, and everyday users.

For 2026, the mindset is simple:

● Start small: Test tiny positions in emerging utilities (like stable yields or tokenized funds on Binance Earn/bridge).

● Patience wins: Finney held through zero-value days; today's quiet accumulators in RWAs/stables could see similar multi-year gains.

● Verify everything: Self-custody, audited protocols, and transparent teams echo Finney's bug-hunting ethos.

● DYOR on pilots: Track on-chain activity (e.g., inflows to RWA protocols via Dune or Arkham) before hype hits.

Hal Finney didn’t know Bitcoin would succeed. He just knew it was worth testing. In a market full of noise, remember this: 𝗧𝗵𝗲 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀 𝘁𝗵𝗮𝘁 𝗺𝗮𝘁𝘁𝗲𝗿 𝗺𝗼𝘀𝘁 𝘂𝘀𝘂𝗮𝗹𝗹𝘆 𝘀𝘁𝗮𝗿𝘁 𝗮𝘀 𝗾𝘂𝗶𝗲𝘁 𝘁𝗲𝘀𝘁𝘀.