Market Summary: A Weekend of Financial Chaos

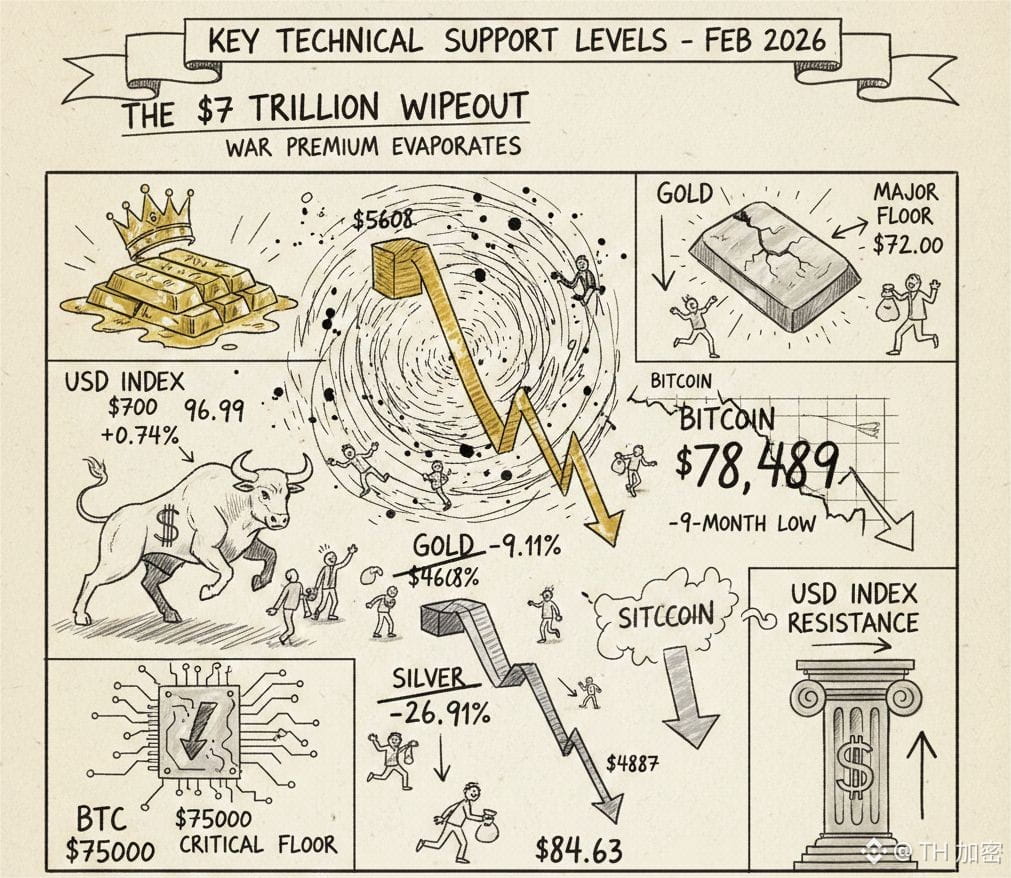

The "War Premium" that drove commodities to stratosphere-level heights in January 2026 has abruptly evaporated. Following news of a potential de-escalation in Middle Eastern tensions alongside a hawkish stance from the Fed, investors triggered a "sell everything" event to lock in generational profits.

Precious Metals: After Gold touched a record high of $5,608, it suffered a staggering 9% drop on Friday, the largest single-day dollar decline in history. Silver fared even worse, plunging 31% in a single session after hitting a peak of $121.

Cryptocurrency: The "Digital Gold" narrative for Bitcoin has shattered. BTC failed to hold as a safe haven, dropping below the psychological $80,000 mark as liquidations exceeded $2.5 billion. Analysts are now debating if the 2025-2026 bull run is officially over.

The USD Factor: The US Dollar Index (DXY) has surged back to 96.99, acting as the ultimate vacuum for global liquidity as investors flee riskier assets.

Key Technical Support Levels

Note: Markets are currently in "Price Discovery" on the downside. The following levels are critical for the coming trading week.

1. Gold (XAU/USD)

Immediate Support: $4,700 (Friday's low).

Major Floor: $4,500. If Gold falls below this, the 2026 rally could be considered a "blow-off top."

Resistance: $5,000 (Psychological).

2. Silver (XAG/USD)

Immediate Support: $80.00. Silver has lost its $100 handle and is struggling to find a bottom.

Major Floor: $72.00. This was a key breakout zone in late 2025.

Resistance: $90.50.

3. Bitcoin (BTC/USD)

Immediate Support: $77,000. Bitcoin bottomed here late Saturday.

Major Floor: $75,000. Many analysts believe a breach of $75k confirms a long-term bear market.

Resistance: $82,500.

4. US Dollar Index (DXY)

Support: 95.50.

Resistance: 97.50. A move above 97.50 will likely cause further pain for Gold and BTC.

#BitcoinETFWatch #GOLD_UPDATE #BitcoinWarnings #MarketCorrection #WhoIsNextFedChair