Sideways markets, often referred to as consolidation phases, are a natural part of any financial market cycle. While they may feel boring or confusing to many participants, these phases actually play a critical role in shaping the next major move.

What Is Market Consolidation?

Consolidation occurs when charge actions within a slender range, without forming clean higher highs or decrease lows. in the course of this section, shopping for and selling stress stays noticeably balanced, which prevents charge from trending strongly in either course.

rather than momentum, the market makes a speciality of stability and absorption. This is often seen after sharp moves, where the market needs time to digest previous activity.

Why Big Moves Often Follow Sideways Phases

Historically, strong directional moves tend to emerge after periods of consolidation. The reason is simple: electricity builds while rate remains compressed within a variety.

As volatility decreases and participation slows, liquidity accumulates around key ranges. as soon as the stability among customers and sellers breaks, fee often reacts with elevated momentum. this is why experienced investors pay near attention to sideways markets in preference to ignoring them.

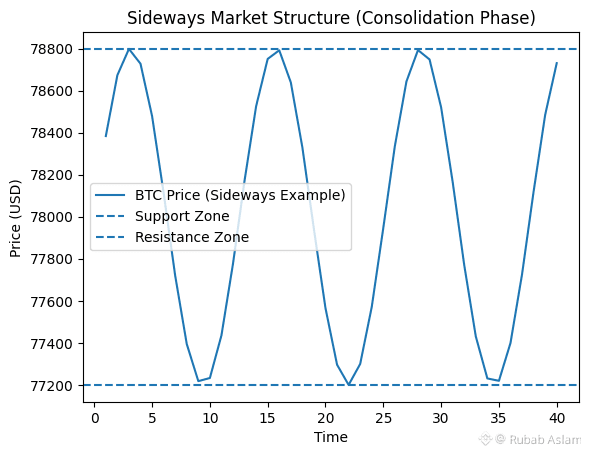

This example highlights how price oscillates between support and resistance during a consolidation phase.As shown in the chart, price remains confined within a narrow range. Such behavior is typical during consolidation, where the market pauses before deciding its next direction.

Common Mistakes Retail Traders Make

Many retail traders struggle during consolidation because:

They expect constant movement and force trades

They misinterpret small fluctuations as trend reversals

They overtrade due to impatience

These actions often lead to unnecessary losses, especially when price continues to respect the same range. Sideways markets reward discipline, not aggression.

What to Observe During This Phase

Instead of predicting direction, traders can use consolidation phases to observe:

Key support and resistance zones

Volume behavior (expanding or contracting)

Signs of participation returning to the market

this era is better applicable for practise and evaluation as opposed to execution. knowledge how rate behaves inside a selection can offer precious context as soon as the marketplace decides its next direction.

Sideways markets are not meaningless pauses — they are structural constructing levels. studying to admire consolidation helps buyers enhance staying power, lessen emotional choices, and higher understand standard marketplace conduct.

#CZAMAonBinanceSquare #CryptoMarket #Consolidation #MarketBasics