Motion Is Cheap. Payment Traffic Has Weight.

I’ve started noticing when a system “feels” reliable before I can explain why. It’s the same feeling you get when a door closes with the right weight, or when a train arrives with no drama. Nothing heroic happened, and that’s the point.

Most infrastructure earns trust by being forgettable. Not invisible, but unremarkable in the best way.

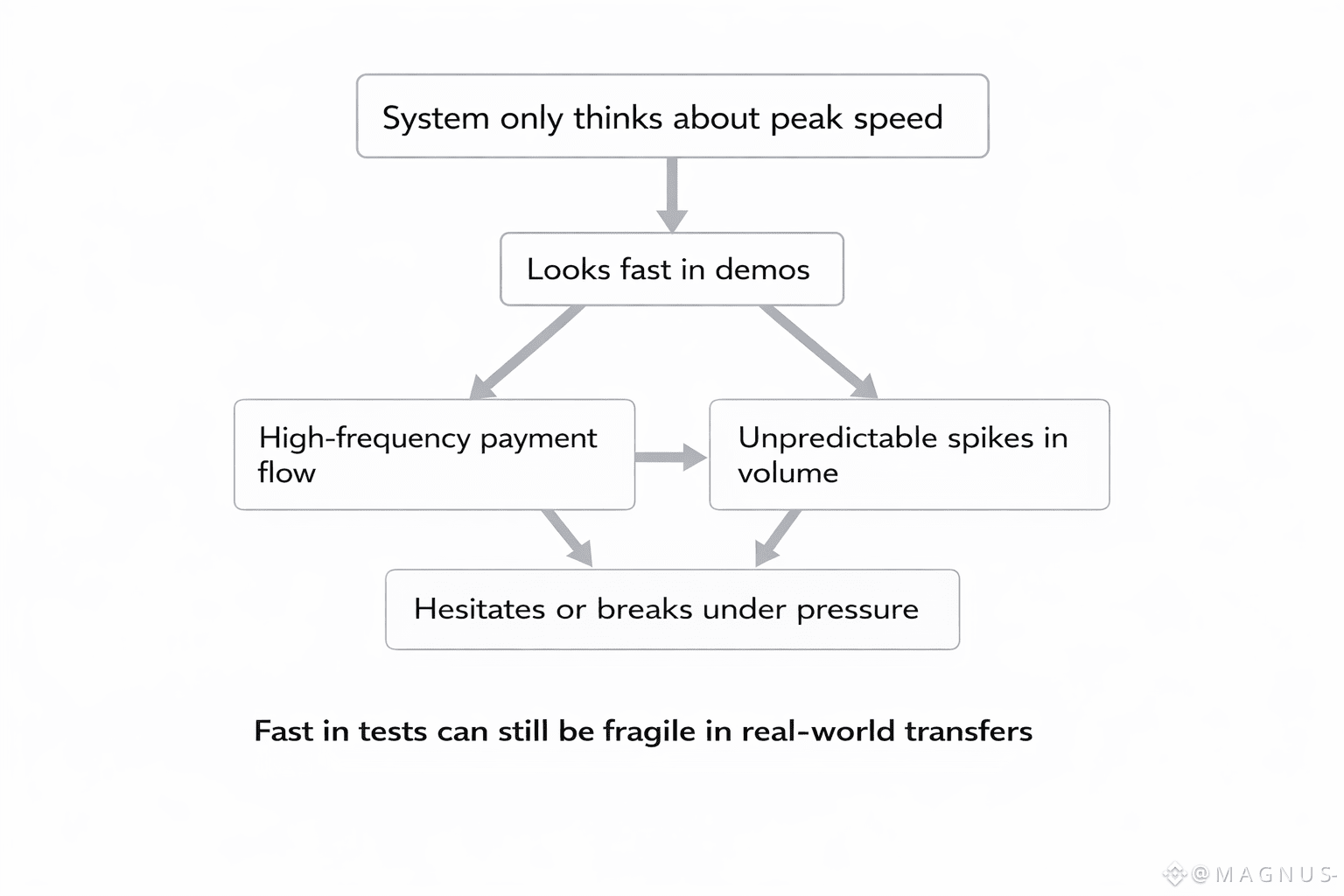

The popular narrative in crypto still leans on a single image: raw speed. Higher throughput, lower latency, bigger benchmark numbers. The story is motion, and the proof is a screenshot.

But what’s actually missing from that story is the shape of real payment traffic. Payments aren’t a highlight reel. They’re a long, quiet stream of small transfers: salaries breaking into many outputs, merchants settling in bursts, users topping up balances, subscriptions renewing, microtransactions inside apps.

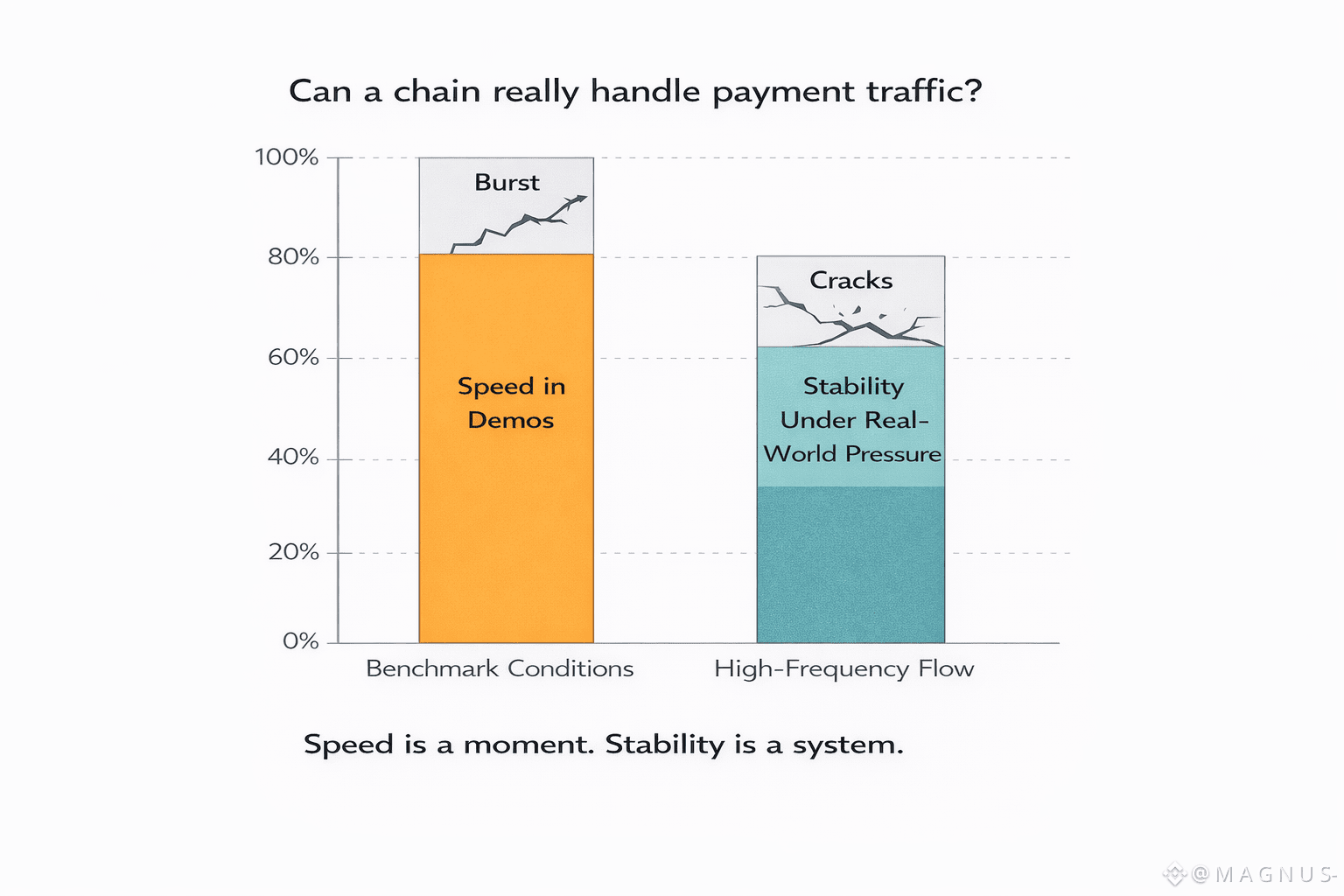

The performance challenge here isn’t “Can you go fast once?” It’s “Can you keep the same rhythm when nothing is special?”

That’s why Plasma’s framing around architecture tuned for high-frequency flows is interesting. Not because it’s claiming some magical number, but because it’s starting from the texture of payment reality. Payment networks don’t live in demos. They live in Tuesdays.

A helpful metaphor is traffic engineering.

A chain optimized for occasional large transfers is like a highway designed for weekend road trips. It can look impressive. Wide lanes, high top speed, plenty of room to accelerate. In a calm moment, it feels effortless.

A payment chain is closer to a metro system during rush hour. The challenge isn’t a single train hitting a maximum velocity. The challenge is throughput with timing. Doors opening and closing, people moving through gates, trains arriving in sequence, no bottleneck turning into panic. Flow is not speed. Flow is coordinated repetition.

If you build a beautiful highway and then ask it to behave like a metro, you discover a strange truth: the system can be fast and still feel unreliable. Congestion doesn’t show up where you expected. Latency appears in spikes. The user experiences it as hesitation.

And hesitation is where trust leaks out.

There’s a second metaphor I keep coming back to: the difference between a sprint and a heartbeat.

Benchmarks measure sprinting. Payments demand a heartbeat. A heartbeat doesn’t need to be the fastest thing in the room. It needs to be steady, resilient, and boringly consistent. When it stutters, you don’t congratulate the body for having “high peak performance.” You treat it as a problem.

High-frequency flows behave the same way. A payment system can be technically capable and still operationally fragile if it only performs under ideal conditions.

Flow Is the Real Benchmark

This is where the “motion vs meaning” theme shows up.

Motion is the transaction count. Meaning is the lived experience of the system under repetition. Did the confirmation feel the same at noon as it did at 2 a.m.? Did fees behave like a stable assumption or like weather? Did the system leave clean footprints, or did it smear under load?

Plasma’s model, as it’s commonly framed, is that payment traffic is made of many small transfers, and that the architecture needs to be tuned for that pattern. High throughput matters, but not as a trophy. It matters because it allows the system to absorb constant, low-value, high-count usage without turning every busy hour into a crisis.

To ground this, here are a few clearly labeled estimates that reflect how payment systems tend to behave.

In some environments, roughly 70 to 90 percent of payment activity is small-value transfers. That doesn’t mean the “big” transfers don’t matter. It means the dominant engineering load is the unglamorous middle. The network is judged by the behavior of the stream, not the occasional wave.

Early signs from consumer apps suggest that once a payment confirmation consistently feels “slow,” the drop-off is nonlinear. A delay that looks minor to an engineer becomes a psychological cliff to a user at checkout. Roughly speaking, the difference between a sub-second response and a multi-second wait is not a few seconds. It’s doubt. It’s the moment someone reaches for an alternative.

And in real payment usage, demand is rarely smooth. In some environments, transaction load can jump roughly 3x to 10x during synchronized bursts. That’s not exotic. It’s what happens when people behave like people. Lunch hours. Market volatility. Major app updates. Payroll windows. A system designed for averages gets surprised by reality.

This is where “architecture tuned for high-frequency flows” stops being a phrase and becomes an actual worldview.

A system built for this kind of traffic needs to prioritize predictable confirmation, stable fee behavior, and smooth handling of bursts. It needs to keep the noise of constant transfers from drowning out the signal of finality and correctness.

Because payments are not forgiving. In most financial contexts, the tolerance for “maybe” is low. A payment is either done or it isn’t. People don’t want an explanation. They want closure.

Now for an honest critique.

When you build a chain around high-frequency payment flows, you risk narrowing your design space. You optimize for repeated transfers and low-latency settlement, and you may end up less expressive for certain kinds of complex, highly composable activity. You also take on an operational burden: payment rails can’t be “mostly reliable.” They have to be reliably boring, which is a harder standard than it sounds.

That’s a real risk. And pretending otherwise is how systems disappoint their users.

The mature rebuttal is that focus is not a weakness when the job is clear.

If the purpose of a chain is to be a stablecoin-native payment rail, then prioritizing flow is not a tradeoff you apologize for. It’s the cost of being taken seriously by payment reality. Payments don’t reward versatility as much as they reward consistency. The most valuable infrastructure in finance is often the least talked about, precisely because it doesn’t create drama.

There’s also a second-order effect that people miss.

When confirmation and fee behavior become predictable, businesses plan differently. They stop building “just in case” buffers. They reduce manual checks. They integrate payments into product flows instead of isolating them as a risky step. In other words, reliable flow changes behavior, which changes adoption dynamics. Not through hype, but through reduced friction.

That’s meaning.

I’m not arguing that speed doesn’t matter. It does. But speed without flow is like a loud engine in a car with bad suspension. It performs on paper and rattles in the real world.

When I think about high-frequency payment flow, I picture a candlestick chart. Most people stare at the wicks, the spikes, the dramatic moments that look impressive in hindsight. But market truth lives in the close. A chain can print beautiful wicks in a demo and still fail where it counts if the “close” is inconsistent under real load. Payment traffic is the same. The product isn’t the peak. The product is the close, repeated thousands of times a day, leaving a clean settlement trail instead of a messy wick.

@Plasma #Plasma $XPL