I’ve noticed something about how crypto communities talk when they’re excited. The words get bigger, the promises get cleaner, and the hard parts get edited out. Motion fills the room, and meaning quietly steps outside.

Interoperability is one of those topics. It sounds like progress by default. “Move assets everywhere.” “Connect all chains.” It feels inevitable, almost moral.

But what’s actually missing from most interoperability conversations is the part that decides whether a token is useful in daily markets: liquidity gravity. Not whether a token can travel, but whether it can land somewhere that already has deep liquidity, composability, and real demand.

That’s the practical angle behind introducing a wrapped ERC20 version of VANRY on Ethereum.

The popular narrative says wrapping a token onto Ethereum is just a technical checkbox. Put it on an EVM network, list it on DEXs, integrate it into DeFi, and suddenly it’s “everywhere.” More addresses, more volume, more visibility.

But the deeper reason is simpler and more grounded. Ethereum is where a large share of the on-chain financial plumbing already lives. If you want VANRY to be usable in the places people already trade, LP, and integrate assets, you don’t just build your own city. You connect to the busiest port.

That port metaphor is useful here.

VanarChain is the home base. It’s the place where the native asset has its original meaning, its native security assumptions, and its primary economic life.

Ethereum, in this context, is the shipping lane. Wrapping VANRY into an ERC20 isn’t “moving the city.” It’s issuing a port-compatible container so the asset can move through existing cranes, warehouses, and routes without asking the entire logistics network to retool.

That’s what composability really is. Not a buzzword. A set of standard rails that let assets plug into existing workflows.

A second metaphor is even more blunt.

Think of Ethereum’s DeFi ecosystem like a universal socket. Many assets want to draw power from it because that’s where integrations and liquidity are already concentrated. If your asset has a different plug, it may be perfectly engineered at home, but it will struggle to be used in appliances across the rest of the world.

Wrapping is the adapter.

It doesn’t change what the asset is. It changes how easily it can be used.

Now, this is where “motion vs meaning” matters.

Motion is “our token is now on Ethereum.”

Meaning is what happens next.

Does it actually increase liquidity access? Does it reduce friction for dApp integrations? Does it allow VANRY to show up in the places where capital already has habits?

In some environments, roughly 60 to 80 percent of organic on-chain liquidity for new tokens tends to congregate where the most mature DEX infrastructure and aggregators already exist. That’s not a hard statistic, and it’s not universal. It’s an estimate that reflects how capital behaves: it pools where execution is easiest and where it can exit quickly.

Early signs in cross-chain token strategies suggest something else as well: a token’s “availability” across chains matters less than the quality of the venues it can plug into. You can be technically multichain and still be economically isolated if liquidity is thin or fragmented. A single deep pool often beats five shallow pools. Roughly, one well-integrated deployment can do more for price discovery than multiple low-liquidity listings spread thin.

And that’s the real promise of ERC20 VANRY: expanding the design space for integrations.

On Ethereum, an ERC20 token becomes legible to a massive existing toolchain. Wallets, DEXs, liquidity pools, aggregators, lending primitives, payment widgets, indexing, analytics. You don’t need every developer to learn a new pattern. You meet them where they already build.

That is how ecosystems grow in real life. Not by demanding attention, but by reducing the cost of participation.

But there’s an honest critique here, and it matters more than people admit.

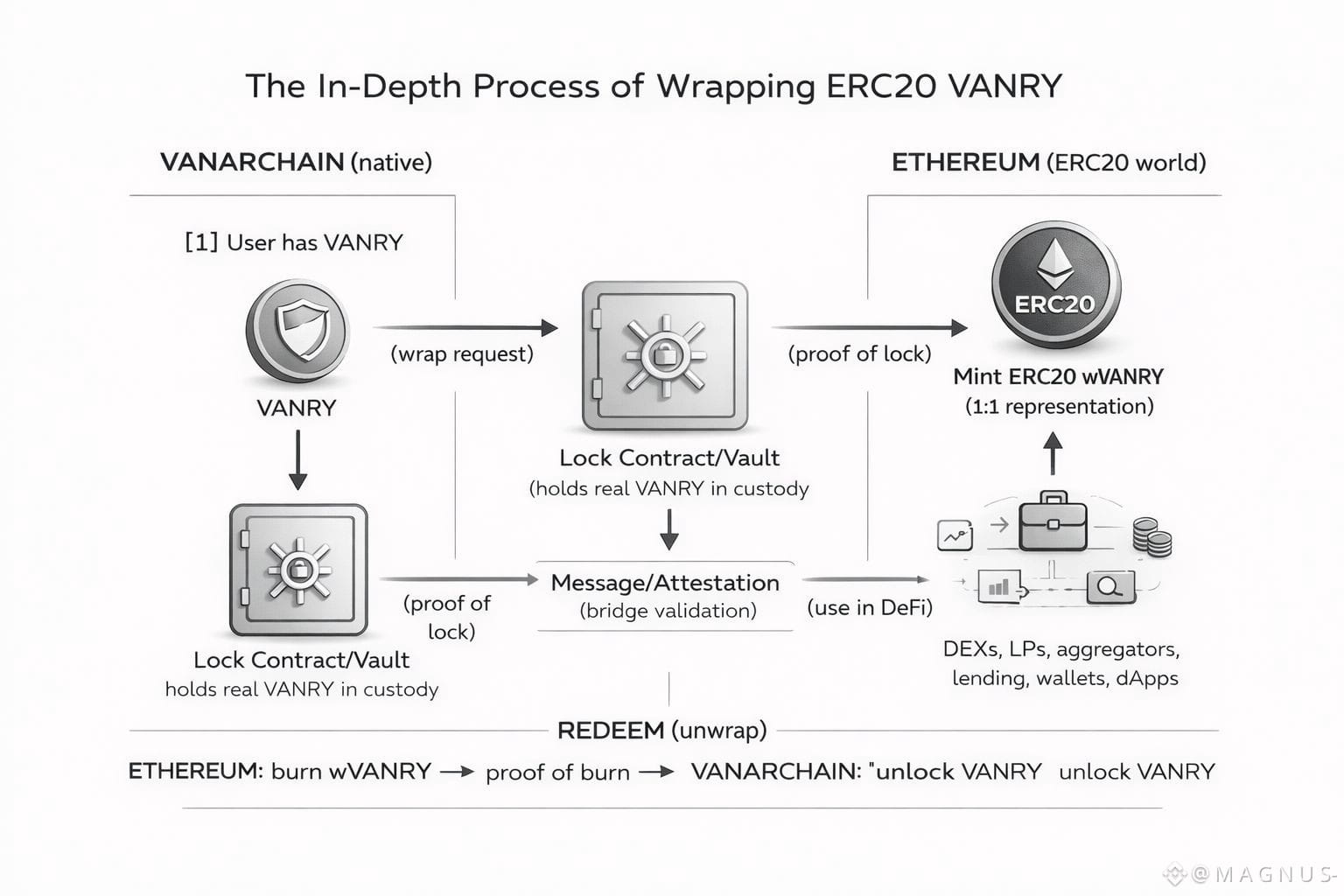

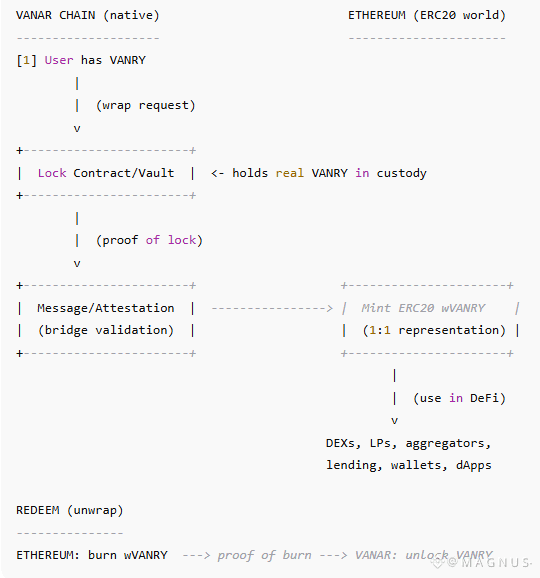

Wrapping introduces trust and risk. Somewhere, the “real” VANRY needs to be locked, and a wrapped representation needs to be minted. That lock-and-mint process is effectively a bridge, and bridges are not just features. They are security boundaries.

So the question isn’t “can we wrap.” It’s “how strong is the vault door.”

That critique is not negativity. It’s adulthood.

The mature rebuttal is that this tradeoff can be worth it if it is handled with the right discipline. The point of wrapping is not to replace the native chain’s identity. It’s to extend the asset’s reach into existing liquidity and composability without sacrificing the principles that made the asset valuable in the first place.

If the bridge design is conservative, transparent, and hardened, then the wrapped token becomes a pragmatic interface layer. It becomes a way for VANRY to participate in Ethereum’s capital markets while the native chain continues to build its own core utility.

There’s also a subtle second-order effect.

Liquidity isn’t just about trading. Liquidity is a social proof layer in crypto. When a token becomes easy to price, easy to integrate, and easy to use in familiar DeFi contexts, developers treat it differently. They consider it. They model around it. They’re less afraid of “what happens when users want to exit.”

Composability creates optionality. Optionality attracts builders. Builders create utility. Utility creates stickiness. That cycle is slow, but it leaves real footprints.

And this is where the contrarian view lands.

Interoperability is often sold as freedom. But the real value is not freedom. It’s gravity.

The market doesn’t reward tokens for being everywhere. It rewards them for being usable where liquidity already lives.

Wrapped ERC20 VANRY, in that light, is less about chasing headlines and more about accepting how the ecosystem actually behaves. It’s a bridge not just between chains, but between ideals and the hard surface of market structure.

Because in the end, the loud part of interoperability is movement.

The quiet part is arrival.

And arrival is what makes the movement mean something.

#vanar @Vanarchain $VANRY