Bitcoin expectations across the market are extremely high. Many traders are already pricing in higher levels, while sentiment remains divided.

But here’s the uncomfortable truth:

The real game is understood by large holders and long-term capital — not by emotions on social media.

A move from 128K down toward the 70K region may look unbelievable at first glance. Yet historically, these are the very zones where opportunity quietly forms — especially for those who missed earlier expansions.

Markets don’t move to reward the majority.

They move to test patience, conviction, and timing.

What Looks Like Weakness May Be Preparation

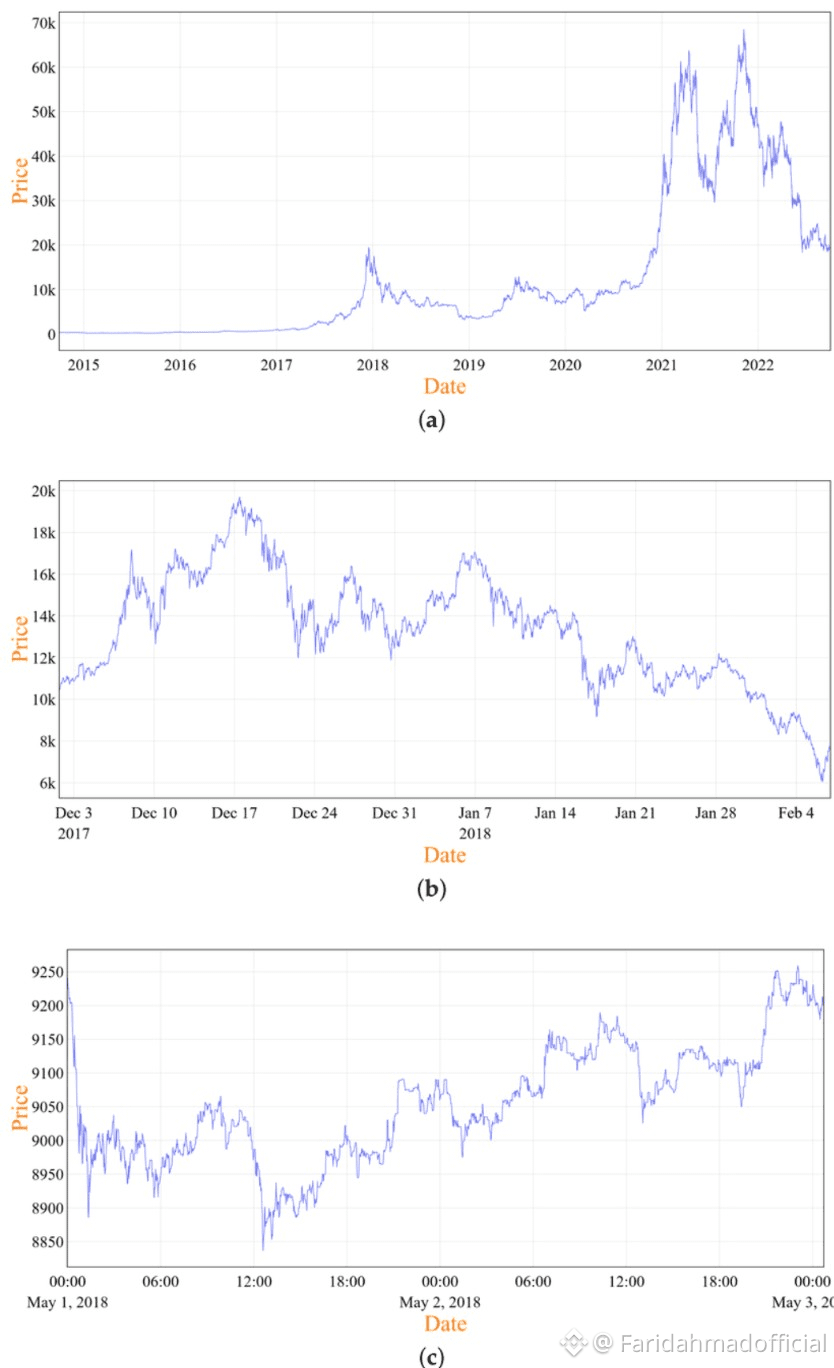

Bitcoin’s current behavior on the daily timeframe is not random. It is structured, mechanical, and liquidity-driven.

Key observations from the chart:

Price moving within a descending corrective channel

Rejection from upper resistance followed by a controlled breakdown

Entry into a historically reactive demand zone near 77K

Volatility expanding after prolonged compression

This pattern has appeared repeatedly across Bitcoin’s major cycles — not as a sign of failure, but as a late-stage correction inside a broader bullish structure.

Daily Timeframe Reveals Institutional Intent

Lower timeframes are ruled by leverage, emotion, and noise.

The daily chart, however, reflects:

Capital rotation

Accumulation and redistribution

Liquidity engineering

Risk reset across the market

The recent drop triggered liquidations, invalidated late breakout buyers, and cleared excessive optimism — all classic characteristics of a healthy corrective phase, not a macro top.

Price didn’t collapse into chaos.

It moved with order and intent.

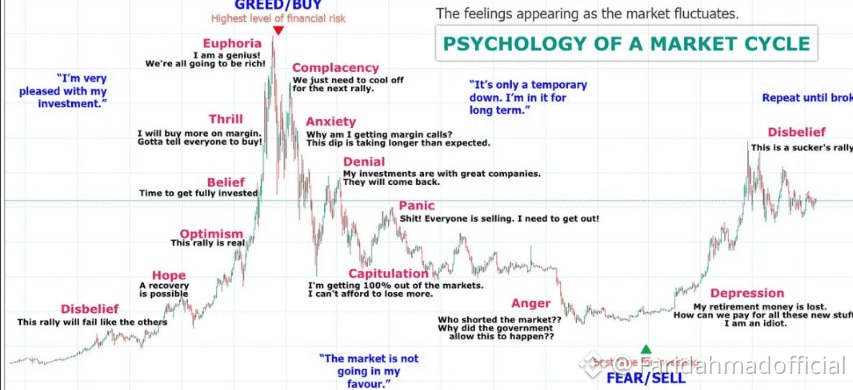

Market Psychology: Maximum Doubt Before Expansion

Bitcoin has never entered sustained upside phases without first creating discomfort.

This phase is doing exactly that:

Confidence is shaken

Sentiment is compressed

Leverage is flushed

Historically, such moments are later remembered not as bearish beginnings — but as final shakeouts before continuation.

Looking Ahead

From a higher-timeframe perspective, the current zone represents a decision point, not a conclusion.

Those who understand cycles know:

Opportunity rarely feels comfortable when it appears.

Time, not emotion, determines outcomes.

Patience has always been Bitcoin’s greatest filter.

Best wishes on your journey. 🚀

#BTC #MarketStructure #BitcoinCycle #LongTermView

Click below to take trade 👇🏻 Support for more