The majority of crypto-discussions are noisy with arguments on the purity of decentralization, TPS wars, and slick features. However, something more basic is the actual slayer of usage, cost uncertainty. Maybe you have ever constructed some type of building on a chain where charges can vary between nearly free and why is this costing me 18 dollars in one day? Your app is blamed by the users. Helpdesk inundated. Your team can’t budget. Unless you build automated jobs, bots, background tasks, AI agents, random fees put hard stops in.

The essence of vanar is nearly banal: stabilize the base price of transaction - make it stable, predictable, manageable by a builder in a spreadsheet and rely on it.

The gas market tax of the invisible hand corrects the most beneficial apps.

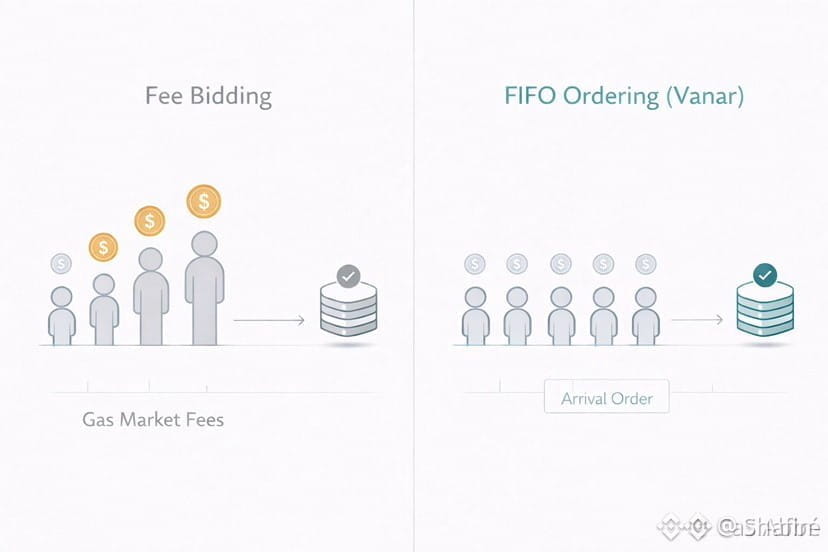

It is reasonable to consider gas auctions: when you compare blockspace to holiday airline seats, the highest bidder gets in. That prototype is inhuman to applications that look into the future. Micropayments, streaming payments, in-game moves, social apps, machine-to-machine automation, all prefer doing thousands of transactions a day when they are not bidding.

Even the average fee is not the worst aspect. It’s the uncertainty. In a fee market that goes on the spiral, minor motions cease to have meaning. A $0.05 action becomes a $2 action. Users do not care why - they leave. The ecosystem is then changed to fewer, larger transactions, which is precisely the opposite of what mass adoption should be.

Vanar is attempting a reverse of that, not hype, but a protocol-level architecture: fixed fees to a fiat value.

The fixed-fee model by Vanar: pegged to a USD target, controlled at the protocol level.

According to the documentation provided by Vanar, a system progressively maintains user-facing costs at stable fiat levels, to be more precise, aiming at $0.0005 per transaction. This is not “fixed in VANRY.” It translates it as this act will cost approximately this many dollars, even when token prices get changed.

To do so, Vanar releases a USD/VANRY price mechanism (a token) and claims that the protocol changes the price periodically, based on market information. It also authenticates the market price in a variety of sources, i.e., DEXs, CEXs, data providers, i.e., the number is not being provided by a single compromised feed.

Such a design choice is more than it seems. In regular chains, your commission is nothing but a weather report. In the model of Vanar, the fee is nearer to a posted price - a toll road, which is not going to start charging 50x due to a rise in traffic.

Why not a fairness talk is good enough why not FIFO ordering?

The model of transaction-processing is also a part of the fee model at Vanar: the First-In-First-Out (FIFO) model. On gas auction chains, order taking is transformed into a marketplace. People pay to jump the line. That brings in the whole set of strategies front-running, bidding wars, priority games all of which are not requested by the normal users.

FIFO is an unobtrusive sentence: You only do not need to play games to be part of it. Practically, it renders the inclusion of transactions more of a service, rather than a casino. This ordering philosophy is important, in case your app is to be payment infrastructure. It simplifies the prediction, explanation and auditing of outcomes.

Predictable charge is not merely a win in terms of UX, it is an anti-spam weapon, provided that it is created rightly.

At this point appears a just rebuttal: "When charges are small and constant, will not spam be cheap? The solution that Vanar proposes is to introduce predictability to tiering, such that day-to-day transactions are cheap, and abusive behavior is costly. The framing of the model by the community and ecosystem posts is that cheap to use normally, and expensive to use in large spamming.

This is significant in the sense that spam protection is normally handled independently of pricing. But they’re linked. When a chain is interested in low fees, it should design what occurs in case somebody floods the system. Tiering fundamentally is: We do subsidize normal life, but not attacks.

Put simply, Vanar is attempting to make a fee landscape that would seem like a city: walking is pleasant, there is normal traffic, but in the event that you attempt to drive a hundred trucks through a narrow street at the same time, you will pay a fee to disrupt the traffic.

The more profound justification of this model to the Vanar agent economy story.

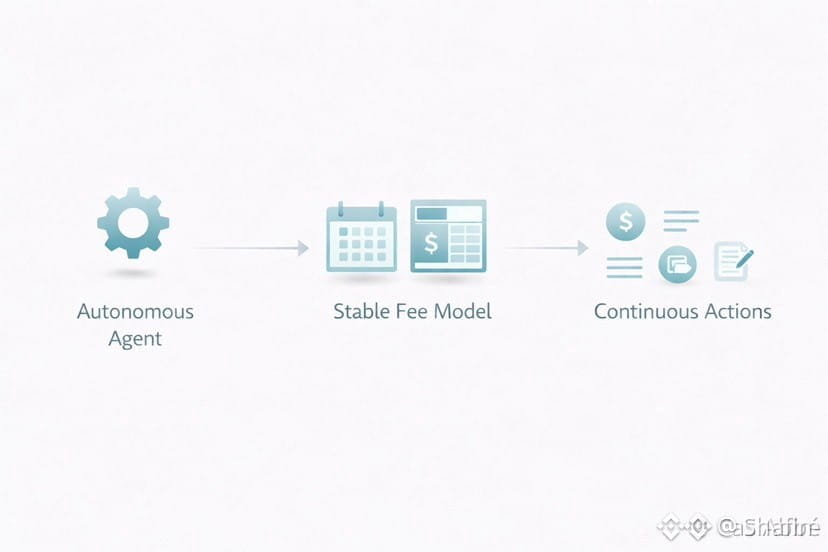

This is the broader perspective that is not generic: machines are most concerned with predictable fees, rather than the vast majority of humans. Humans can pause and decide. Machines act continuously.

Suppose that Vanar is right in his more general thesis that autonomous agents will make payments, revise state, pay small debts, and do compliance tests automatically, then machine budgeting must be supported by the chain. Agents do not work well when one of the core costs has become irrational. In which case, a USD-pegged fee structure is a prerequisite to the role of an agent future, rather than the agent future, nice to have.

It is also the reason why the design is more fintech than crypto. Fintech systems are still alive, as they are capable of quoting costs, predicting costs and explaining costs. The fee model by Vanar attempts to inject some sense of normalcy with on-chain execution.

Slow release, heavy-validator, and designed with the aim of maintaining the network: the token emissions and incentives.

The other aspect of fee stability is: in case users pay small fees, who protects the chain? In the documentation provided by vanar, there will be a long-term emission plan based on block rewards; the average rate of inflation is given over a long period, and harsher initial emissions are mentioned to promote the development of the ecosystem and initial staking rewards.

The whitepaper and materials also outline a token allocation where validator rewards are considerably higher, and other sections of the allocation are dedicated to the development and community incentives, and it specifically states that the team does not have any token allocation.

The choice of a token model is subjective. In terms of concept, the strategy of Vanar is operation continuity and network incentives which enables the chain to act as infrastructure.

What most people fail to appreciate is the pricing that can be relied upon by the builders.

Vanar fee strategy is not so cheap, but its primary advantage is that it is predictable.

The price of a product can be determined by a builder. A team may assure an experience to a user. Costs can be forecasted by a finance department. It can be understood even by non- crypto partners. The docs by Vanar explain fixed fees as an instrument of accurate cost predictions, budgets, and predictable behavior in peak seasons.

This is important since the subsequent round of adoption will not be by crypto enthusiasts, but by individuals who do not enjoy complexity but require a stable means of value and data transfer.

The actual challenge: is Vanar able to remain consistent and at the same time, be strong?

A fixed-fee model will pass or fail on the detail of implementation. The system (price-update) should be robust. The tiering must be in a way that prevents spam and does not negatively affect honest high volume apps. The chain should be able to last when under tension. It should be demonstrated that the network is credible in its measuring of market price and the frequency of updates since it lies on the trust contract with the builders. The token-price feed is described on the docs of Vanar as multi-source-validated, an encouraging fact, as on single-source the truth is a frequent cause of failure.

Should Vanar win, it will provide a luxury in crypto the assurance that real product can be constructed without the fear of touching the base layer.

What is so good about Vanar that makes him worth watching.

A number of chains have an ambitious goal to be the future. Vanar is in search of usability, the future of infrastructure. An experiment that has predictable charges, a reasonable costs of ordering, and unaffordable attack costs silently turns experiments into consistent systems. This is not spin, it is preparation in design. The discipline of designing is what survives when the market is no longer cheering but is requiring reliability.