Majority of the citizens believe in privacy chain as a

secret. Dusk Network desires something different. It is developing

infrastructure in the market that allows real trading to occur without exposing

any data that would destroy fairness. Trades in regular markets remain

confidential until the time they settle. With publicity of trades before

settlement, big traders might be picked off, little traders might be imitated

and the markets might become very unpredictable. That is what a lot of open

blockchains resemble nowadays.

After many years of development, the mainnet of Dusk was

launched on 7 January 2025, and the project positioned it as the beginning of

an open financial system in which you can never share sensitive information but

still be able to prove something when you need to. It is not the aspect of

concealing everything. The idea is to conceal the right things such as

positions, order sizes and identities and still be able to provide proofs to be

audited, rules and settlement.

This paper takes a new perspective of Dusk: market fairness.

Not privacy because privacy, but privacy as the aspect that is lacking in

making on-chain markets a first come first served game.

The actual issue: information leakage makes markets games.

In a normal public blockchain, the market information

disseminates all over. When trades are in an open mempool, individuals can

observe them, replicate them, leapfrog them or push the price in their

direction. Your plan even when you are not engaging in bad things becomes

exposed. That renders serious trading prohibitive. It also drives institutions

backward to the privacy systems.

The bet made by Dusk is straightforward: in order that you

have regulated assets and stablecoin reserves, and large trades can occur

on-chain, you must have a chain where the intention of all is not revealed by

default. Privacy in this case is not a philosophical feature. It is market

hygiene.

Two forms of transactions: open when you please, private

when you have to.

The settlement layer of Dusk maintains two types of

transactions over the same network one transparent and the other shielded.

Simply put, it implies that the chain is capable of supporting the activities

in which it is helpful to be open, and also support the activities in which it

is necessary to maintain secrecy to ensure that the markets are not biased.

The shielded model employs the zero-knowledge style proofs

to ensure that the network is still able to check the reality that funds are

legitimate and not spent twice yet still remain unaware of the sender, receiver

and the amount of money being transferred. Simultaneously, the approach of Dusk

allows managing the methods of information disclosure in the future, when they

can be demanded by a regulator, auditor, or counterparty. This evidence where

it counts is what is at the heart of the way Dusk attempts to serve finance

without transforming the chain into a surveillance machine.

It is not just fairness of traders. It's also about

validators

The second place of market manipulation is the one of people

who build blocks. The validators in most proof-of-stake systems are publicly

identifiable and are easy to attack. Provided you can find validators, you can

bully them, bribe them, censure them, or put them under observation.

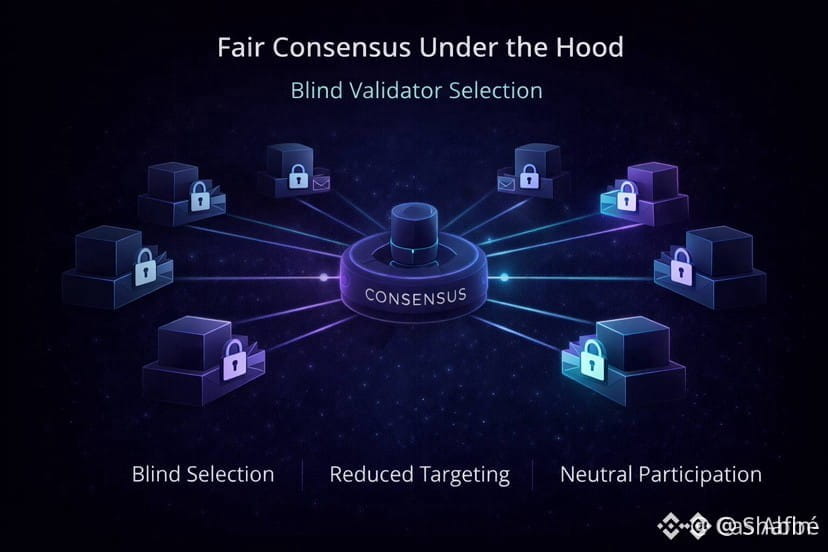

The consensus system of Dusk has a leader selection concept,

which is a blind-bid: block producers place bids in a form that is not visible

during the selection process to help discourage the practice of watching or

gaming the process. This is explained in the consensus design work of Dusk

(Proof-of- Blind Bidding into their agreement process). What matters more than

the buzzwords is that Dusk attempts to make it less predictable and less

visible - predictability gives attack surfaces, so that predictability has a

detrimental effect on it.

A system that is less prone to bullying is obtained when you

combine private transactions and a consensus process whereby public targeting

is minimized. In the case of regulated finance, that is important. When markets

are pressure riddled, then they are unreliable.

Lightspeed: Ethereum-style applications, and reconciled on

Dusk.

One of the key reasons why privacy chains fall is because

the developers do not relocate. Dusk attempts to eliminate that barrier with a

Solidity-compatible execution layer (Lightspeed / DuskEVM) to allow Solidity

developers to run in the usual way, but the settlement transpires on the base

chain at Dusk.

This is important to fairness, as it allows builders to

write the apps that look normal in the market, but in balances, trade flow, and

sensitive logic, apply privacy features where they are needed. That is, Dusk

does not request the world to study an entirely new stack in order to achieve

confidential markets.

The underestimated article: official market statistics, not

guesses of the crowd.

Markets still require reliable inputs even in the case of

private execution, in particular, regulated markets. Market data and price

feeds are not ornamentation. Settlement, margin, reporting, and basic truth all

are based on them.

This is why the reason why Dusk adopted Chainlink standards

is a bigger concern than it seems. Dusk announced that it is integrating

Chainlink CCIP, and DataLink and Data Streams, namely to transfer regulated

securities on-chain using verified exchange data.

In simple words:

Dusk is telling you, you cannot trust random oracles and

vibes, to give you compliant markets. You must have official grade data pipes.

DataLink is positioned as official exchange data delivered

on-chain and Data Streams as low latency updates to trading grade applications.

It is a new axis most individuals overlook: Dusk is attempting to establish not

only personal markets, but high-integrity markets.

Bridges do not only provide access but determine the

circulation of liquidity.

Dusk regards interoperability as being fundamental to the

market. Physical assets and liquidity do not remain in one chain. Ecosystems

spread their capital and users and strategies.

Therefore, the key to Dusk lies in the cross-chain

interoperability. We will also endeavor to ensure the portability of assets

using CCIP-style messaging and standards without forming risky and improvised

bridges. In practice, Dusk has the ability to be a secret settlement node and

other chains can provide different sources of liquidity and applications.

It is a solid institutional story: Find a place to settle,

to be safe and obedient; make a connection where there already is capital.

Hyperstaking: transforming staking to programmable finance.

One more insidious change of infrastructure is

hyperstaking-stake abstraction. Instead of human beings performing the process

of staking manually, smart contracts can perform the process of staking,

unstaking, and reward routing automatically.

The utilities of practice are automated staking pools,

liquid staking models, and turnkey yield solutions which serve as real

financial infrastructure, not hobbyist. Dusk has core building blocks, despite

not being about staking, automation, rules, and predictable behavior.

Institutions should have stable systems and not the ad hoc

click and hope solutions.

Why this matters now

Dusk holds the view that public chains fail in the markets

not due to openness, but that of being too transparent. The market becomes an

extraction machine of strategies when all the actions can be seen in advance

when they are made. Dusk maintains confidentiality when it is necessary and

gives any proofs when it is required by law and trust.

The introduction of the 2025 mainnet provided the

groundwork. New elements, such as EVM compatibility, official data rails based

on Chainlink standards and strong interoperability position, make Dusk more

closely resemble a scalable finance platform.

Conclusion

One should not consider Dusk as a privacy coin with a new

set of features, but a chain that recreates the market structure on on-chain

finance. It conceals what should not be disclosed to ensure the fairness of the

market, it gives evidence where it is stipulated according to the law, it does

not depend on weak bridges with the rest of the crypto environment.

Dusk will bring more than just private transactions in case

it is successful. What will be found is the creation of markets, which are

functioning in a way similar to real markets: where information is not being

weaponised on a daily basis, and the ability to comply is not being added after

the damage has been done.