The era of "AI as a feature" is over; we’ve officially entered the era of AI as a participant. In 2026, the intersection of artificial intelligence and blockchain has evolved from speculative hype into the invisible backbone of the digital economy.

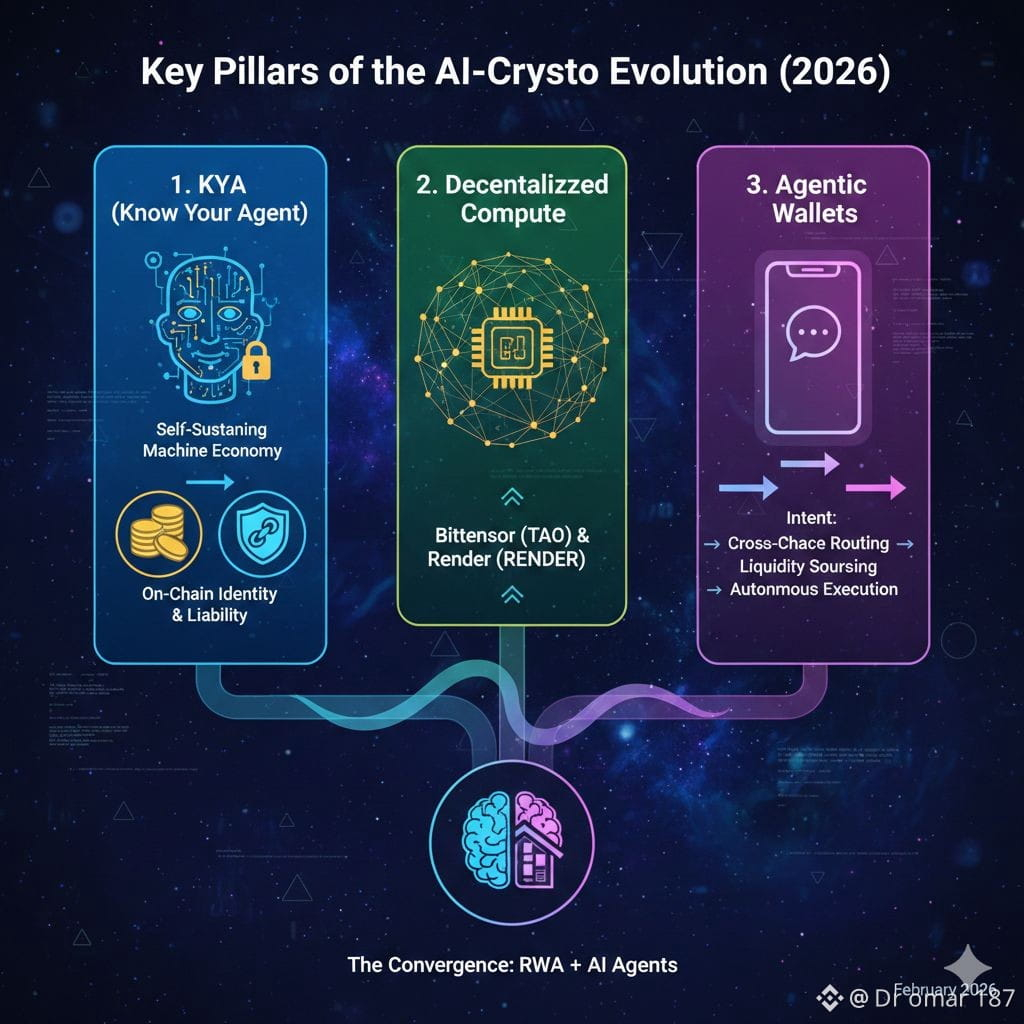

1. From KYC to KYA (Know Your Agent)

The biggest shift this year isn't humans using AI to trade—it's AI agents trading for themselves. We’ve moved beyond simple bots to autonomous entities with their own "on-chain identities."

The Trend: Major protocols are now implementing KYA (Know Your Agent) frameworks. These are cryptographically signed credentials that allow an AI agent to prove its origin, its financial constraints, and its liability without revealing the human owner's private data.

The Impact: AI agents are now paying for their own API calls and cloud storage using stablecoins, effectively creating a self-sustaining Machine Economy.

2. Decentralized Compute is the New Oil

As centralized AI models face increasing censorship and skyrocketing costs, decentralized physical infrastructure networks (DePIN) have become the go-to resource for developers.

The Evolution: Projects like Bittensor (TAO) and Render (RENDER) are no longer just "altcoins"—they are functioning marketplaces where global GPU power is traded like a commodity.

Today's Reality: If you’re training a niche LLM in 2026, you're likely sourcing your compute from a decentralized mesh of miners rather than a single tech giant.

3. Smart Wallets: The "Invisible" UI

The complexity of "seed phrases" and "gas fees" is being abstracted away by Agentic Wallets.

Instead of manually swapping tokens, users now give high-level intent: "Rebalance my portfolio to 10% yield while keeping risk low." * The AI handles the cross-chain routing, liquidity sourcing, and execution in the background.

Why It Matters Right Now

While the market remains volatile, the utility layer of AI in crypto is decoupled from price action. We aren't just trading "AI coins" anymore; we are building a financial system where machines are the primary users.

While the market remains volatile, the utility layer of AI in crypto is decoupled from price action. We aren't just trading "AI coins" anymore; we are building a financial system where machines are the primary users.

The Alpha for 2026: Watch the "Convergence" projects—those merging Real World Assets (RWA) with AI agents. The ability for an AI to manage a tokenized real estate portfolio in real-time is no longer sci-fi; it’s the current beta.

#Write2Earn #Aİ #KYA #Binance #DePIN