The Dark Storefront is an interesting thing. It is about how @Dusk making something big for Institutional DeFi. This something big is like a box. DUSK is building the box for Institutional DeFi. The idea of the black box is really important here. DUSK is working hard to make this black box a reality for Institutional DeFi. The black box that DUSK is building is going to be a deal for Institutional DeFi.

The public ledger has two sides to it. On the one hand it is really good because everything is out in the open and people can check it. On the other hand it is like being on a stage where everyone is watching what you do. If you are a regular person trading a few hundred dollars this is not a big deal.. For a big hedge fund that is dealing with millions of dollars or a pension fund that is handling a bond or a company that is managing its money being on this public stage is just not possible. It makes them easy targets for people who want to take advantage of them and it shows their competitors what they are doing. It creates a lot of problems with rules and regulations. The public ledger is a problem for these companies because it puts them out in the open for everyone to see and that is not what they want when they are dealing with the public ledger and its effects on their business.

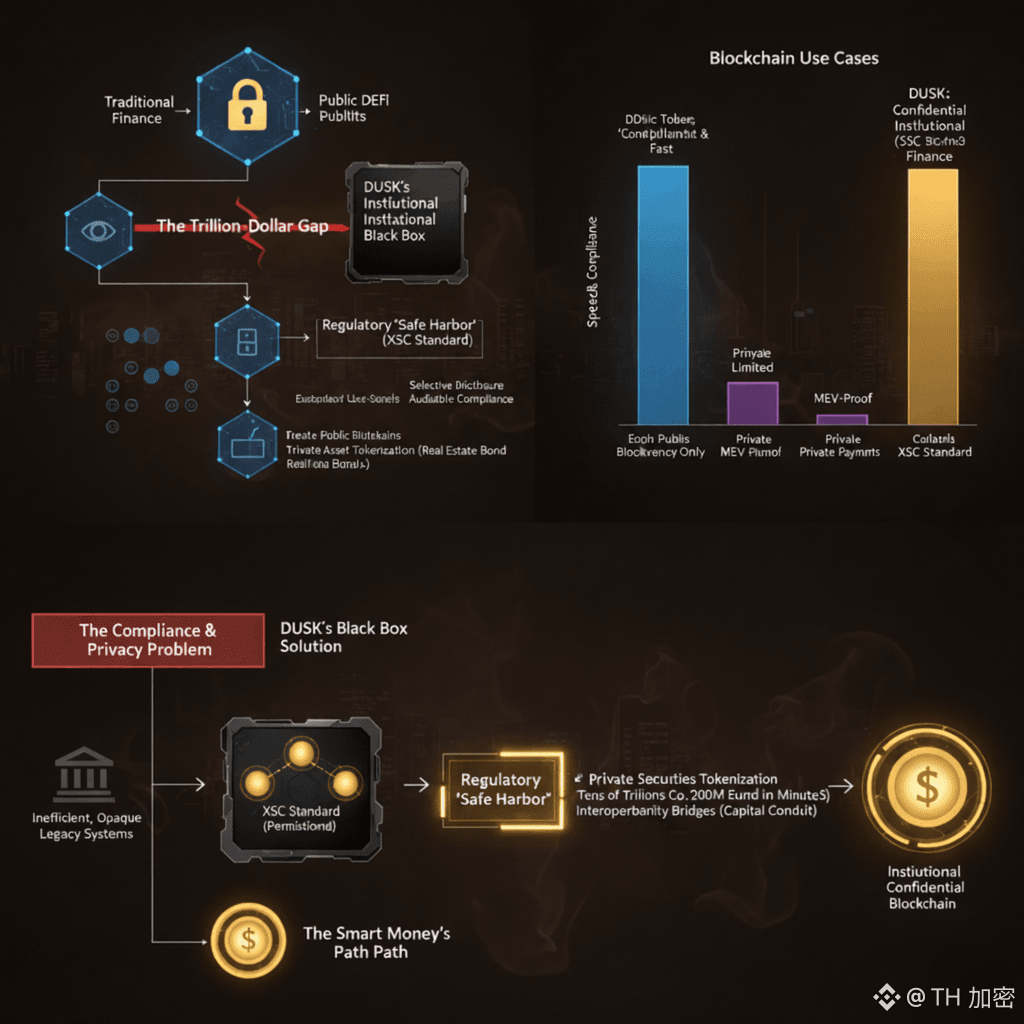

There is a gap between traditional finance and decentralized finance. This gap is so big that it is worth trillions of dollars. Traditional finance and decentralized finance are very different. A lot of money has been spent on making public blockchains work better so that more people can use them.. There is one important thing that has been missing: a secret place to buy and sell things on the internet. This secret place is like a store that's not easy to find.

Enter Dusk Network and its token Dusk Network token $DUSK . Do not think of Dusk Network as another system that can handle a lot of users. Dusk Network has plans and a clear goal: it wants to be the secret and safe way for big institutions to move money on the blockchain. Dusk Network is not trying to create a place where everyone can see what is going on. Instead it is building a private space for big financial companies to make trades and settle deals quickly and securely which is what these companies really need from Dusk Network.

1. The MEV-Proof Vault is a place where the MEV-Proof Vault keeps your information private. That is what makes the MEV-Proof Vault secure.

DeFi Miner Extractable Value or MEV for short is a really big industry that is worth a lot of money. We are talking billions of dollars. There are these bots that are always looking for ways to make money so they try to run, sandwich and arbitrage transactions that are visible to everyone in the tempol. This can be a problem for people like you because it can mean you get a deal when you make a trade, which is called slippage. But for institutions Miner Extractable Value is a much bigger problem, like a leak that costs them money and also gives away their plans and strategies.

Dusk's main tool is the Confidential Smart Contract. Now I want to look at this from a perspective. Think of the Confidential Smart Contract not as a way to keep things private but as the best way to stop Maximum Extractable Value problems. The Confidential Smart Contract is really good at stopping these problems.

When a company like Dusk starts a trade or a complicated loan everything about it is locked away and secret. This means that nobody can see what is going on with the trade until it is finished. The Dusk company does this by putting all the information and steps into a secret box.

Nothing about the trade can be seen by the public until it is done. The computers on the network called nodes check to make sure everything was done correctly without seeing what happened. They use math to do this called zero-knowledge proofs.

The result is that the bad things that can happen with MEV on Dusk are stopped from working. The Dusk company is able to keep the trade safe from people who might try to take advantage of it. This makes the Dusk trade a lot safer, for everyone involved. For the time being, an institution can do a $50 million deal on the blockchain with the same secrecy as a private Bloomberg terminal or a secret trade. The institution gets the secrecy it wants from these private systems. Privacy is not something extra; it is the foundation of keeping financial things secure, for the institution and its $50 million strategy.

2. Beyond CBDCs: The Real Pipeline - Securitized Asset Tokenization

Central Bank Digital Currencies get a lot of attention. The big change in the way money is raised is really happening with private securities tokenization. This market includes things like paper, private equity, syndicated loans and special debt deals. And it is worth a huge amount of money, tens of trillions of dollars, in private securities tokenization.

Let us paint a real life example of something that Dusk makes possible. We are talking about Dusk here. Dusk is what we are focusing on.

So what can Dusk do for us?

We can use Dusk to do something new

Dusk is the key to making this happen.

A German car company needs to get 200 million euros for a way to pay its suppliers. Normally this would take a time and involve a lot of paperwork with a few banks.. This company is trying something different. It is using a system called Dusk to sell a kind of security. This security is private so only certain people can buy it. The company uses Dusk's token, called the XSC to make sure everything is done correctly. This means that only big investors who have already been checked out and are allowed to buy can participate. The whole process, from selling the security to giving it to the buyers happens fast. In just a few minutes. This all happens in a place called a CSC. The German car company can get its money quickly and easily without all the hassle of banking. The terms and the participant identities and the individual holdings are kept secret. The people in charge of making sure the rules are followed at the company that issued something can make special documents that show everything was done correctly without giving away any secrets, about the participants or the individual holdings and these documents are called zero-knowledge attestations, which prove that the issuer followed all the rules.

This is not a dream, it is the logical endpoint of Dusk's design. #Dusk design moves the narrative from compliance to a specific billion dollar workflow. This workflow is currently very inefficient and not transparent, in traditional finance, where Dusks design is going to make a big difference. Dusk's design is taking the narrative of compliance. Turning it into something real is a billion dollar workflow that Dusk's design can improve.

3. The Regulatory "Safe Harbor" By Design

Institutions do not just fear companies that want to take their money, they also fear the people who make the rules. The idea of "decentralization" is not something that can protect them from the law. Dusk takes care of this problem by making sure it follows the rules, from the beginning, which could make it a safe place for institutions to operate without worrying about the regulators.

The XSC standard and Dusks per missioning layers make something useful possible: selective disclosure of the XSC standard and Dusks per missioning layers. We can prove that a transaction happened with the XSC standard and that it ended in a way with Dusk's per missioning layers but the details of the transaction can stay hidden. What is more important about the XSC standard and Dusks per missioning layers is that they can mathematically prove that the rules were followed with the XSC standard and Dusks per missioning layers.

This means that the XSC standard and Dusks per missioning layers can show that approved investors had tokens that no banned parties were involved with the XSC standard and Dusks per missioning layers and that ownership limits were respected by the XSC standard and Dusks per missioning layers.

All of this can be done with the XSC standard and Dusks per missioning layers without showing who the people really are, with the XSC standard and Dusks per missioning layers.

This changes the blockchain from something that causes problems to something that helps with audits. A regulator does not have to deal with a public ledger. Instead they get a report that they can trust, which shows that everything is okay. This report is. Secure. The blockchain is the key to making institutional legal and risk departments happy.

4. Interoperability as a Stealthy Capital Conduit

Dusk's vision is not something that stands alone. The new connections that Dusk is going to make should be seen as ways for people to get money from Confidential Capital, not as places to buy things. Dusk's upcoming bridges are, like roads that help people get money from Confidential Capital.

Imagine this is how it works: a private real estate bond is created on Dusk. This is because Dusk is good at keeping things private and following the rules. This private real estate bond is like a token that represents a high quality asset that we know is real.

Then this bond can be used as collateral when someone wants to borrow money on Ethereum or a second layer.

How does this work? Well we use a kind of proof that shows the bond exists and that it is not already being used for something else without telling anyone who made the bond or what it is for. This proof is used on Dusk.

In this model Dusk is like a safe and private place where big institutions can put their valuable assets. These Dusk assets can then make money. Be easily bought and sold in the bigger and more open DeFi ecosystem and the secret information about where these assets came from stays hidden in the Dusk "dark storefront". This way Dusk keeps the information about the assets private.

Lower TPS/Finality

Public & Fast (Top-Left): Good for speculation, public NFTs, transparent apps.

Public & Slower (Bottom-Left): The settlement layer for trust-maximized, transparent value.

Private & Limited (Bottom-Right): Great for simple, private payments, not complex finance.

Private, Compliant & Fast (Top-Right): Dusk's uncontested quadrant. The space for confidential, programmable institutional finance.

Conclusion: The Race for the Dark Storefront

The story about blockchain is changing. At first it was about making blockchain available to everyone. Now the next big wave of blockchain, which's worth a lot of money, is about working with the big companies that already exist without making them give up the things they need to operate: privacy following the rules and blockchain security. The blockchain companies need to think about how to make blockchain work for these companies and that is what the blockchain is all about now. Blockchain adoption is really about making sure that these big companies can use blockchain without worrying about privacy, compliance and blockchain security.

The Dusk Network is doing something different. It is focusing on smart contracts, a special kind of security token and a design that prevents something called MEV. The Dusk Network is not just trying to be like everyone in the L1 race. The Dusk Network is actually making a kind of thing: the Institutional Confidential Blockchain, for the Dusk Network.

The big question for people who manage assets, investment banks and companies that handle money is not if they will use blockchain technology. Now people are wondering which system they can really trust to keep their information safe. There is a competition to create the best secret marketplace for global finance and Dusk has come up with a very good and one of a kind solution. Dusk has found a way to make blockchain technology work, for asset managers, investment banks and corporate treasuries in a way that keeps their secrets safe.

$DUSK isn't just a token; it’s a bet on where the smart money will need to go to play.