When I first looked at Plasma XPL, it wasn’t because a chart caught my eye or a headline promised the next big thing. It was the opposite. Everything around it felt unusually calm. No urgency. No exaggerated claims. Just a quiet assumption that value will keep moving, whether anyone is watching or not. That absence of noise made me pause, because in crypto, silence is rarely accidental.

On the surface, Plasma XPL is easy to explain. You send value. It arrives quickly. Fees stay low and predictable. Nothing dramatic happens. For a first-time user, that’s the entire experience. There’s no sense of fighting the network, no guessing whether congestion will suddenly make a small transfer impractical. It feels boring in the best way. That’s the visible layer, and it’s intentionally simple.

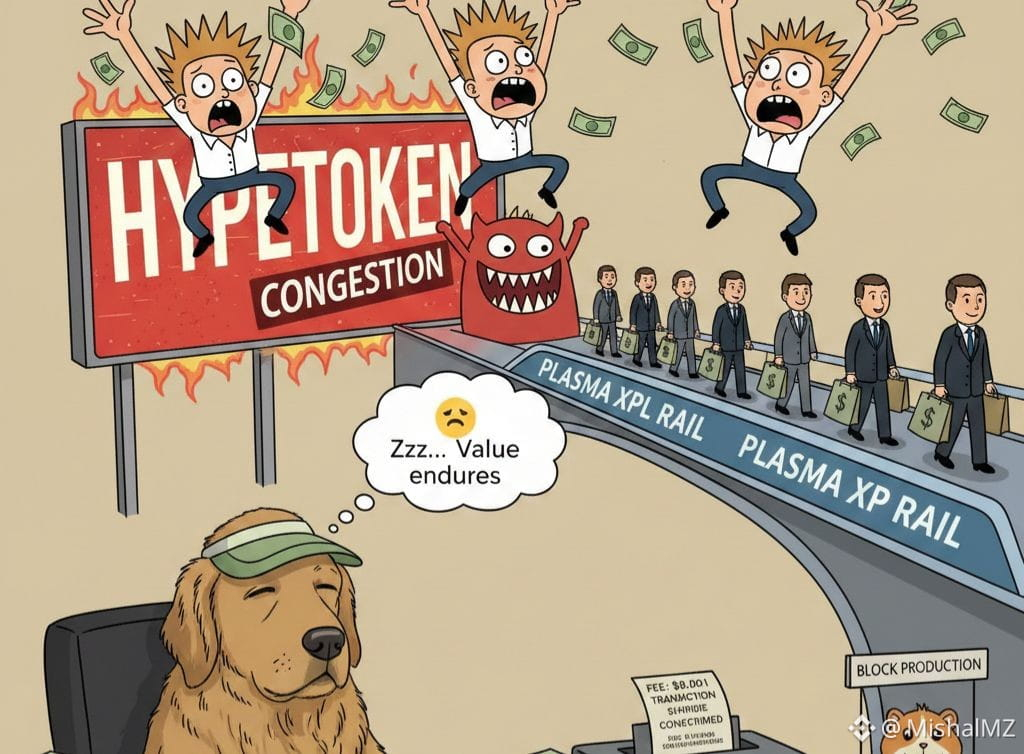

Underneath that simplicity is where Plasma starts to differ. The network is built around a specific assumption: most real on-chain activity is not speculative, it’s transactional. Stablecoins dominate actual usage because people use them to settle, pay, and move money without price anxiety. Plasma treats that behavior as the foundation, not an edge case.Instead of designing for bursts of hype-driven traffic, it optimizes for steady, repeatable flows.This changes how the chain behaves under stress.On networks where speculative activity dominates, congestion arrives suddenly and fees spike without warning.Plasma’s traffic profile is more predictable. Stablecoin transfers don’t arrive in emotional waves. They arrive because someone needs to move value now. That predictability allows the protocol to tune block production, throughput, and fee logic around consistency rather than extremes.

When you look at block times and confirmation behavior, the numbers only matter in context. A fast block time isn’t impressive if it collapses when usage rises. Plasma’s focus is on maintaining similar confirmation experiences whether the network is quiet or moderately busy. That steadiness is what payment systems rely on. It’s not about peak performance. It’s about not breaking trust on an ordinary day.

1XPL sits quietly at the center of this design. Technically, it functions as the staking and fee asset, but that description misses its deeper role. XPL coordinates behavior. Validators stake it to signal commitment. Delegators allocate it to signal trust. Fees paid in XPL link actual network usage back to security incentives. When transaction volume grows, demand for security grows with it. That feedback loop is deliberate.

What’s happening underneath is an incentive alignment exercise. Plasma tries to avoid the common trap where usage grows but the security model lags behind.By tying fees and validation directly to XPL, the network keeps economic signals clear. If people rely on the chain more, validators are rewarded more. If reliance drops, incentives weaken naturally. It’s a system that reflects behavior instead of masking it.

This restraint extends into technical scope. Plasma doesn’t try to host every possible application type. Fewer assumptions are made about exotic contract behavior. That reduces complexity at the protocol level. Fewer edge cases mean fewer unexpected interactions, fewer attack surfaces, and easier reasoning for validators and developers alike. Security here isn’t flashy. It’s cumulative.

Compatibility choices reinforce this approach. Plasma leans toward familiar development patterns so builders aren’t forced into entirely new mental models. That matters more than it sounds. When tooling is familiar, mistakes are fewer. Audits are clearer. Applications behave closer to expectations. The result is a smoother experience not because the system is simpler, but because it respects what developers already understand.Of course, this design comes with trade-offs. A network optimized for payments may never attract the speculative energy that fuels rapid ecosystem growth. Attention in crypto often follows novelty, not reliability. Plasma risks being overlooked during cycles where experimentation dominates conversation.That’s not a flaw, but it is a constraint.

There’s also the question of decentralization depth. Maintaining consistent performance often requires careful validator coordination. Plasma has to balance throughput with validator diversity, and that balance is fragile. Too much concentration invites trust concerns. Too much fragmentation risks performance degradation. This tension doesn’t have an easy solution, and Plasma doesn’t pretend otherwise.

Adoption remains the largest unknown. Payment infrastructure only proves itself when people depend on it without thinking. Early usage signals interest, not reliance. For Plasma to matter at scale, stablecoin issuers, payment platforms, or financial applications must treat it as a default rail. That kind of trust is slow to earn and easy to lose. Early signs suggest intent, but the outcome is not guaranteed.

What helps explain Plasma’s measured pace is that it doesn’t seem designed for cycles. It’s designed for continuity. The protocol assumes that if it stays reliable long enough, usage will arrive when it’s needed. That’s a risky bet in an industry addicted to acceleration, but it’s also how real infrastructure is built.

Fees tell another quiet story.Plasma keeps them low enough to remain usable, but not so low that they lose meaning. Fees discourage spam, reward validators, and signal real demand. Over time, this creates cleaner economic data. Activity reflects need, not noise. If this holds, XPL’s value becomes less about speculation and more about participation.Zooming out, Plasma XPL fits into a broader shift happening across the ecosystem.The early era proved that blockchains could exist. The next chased scale and visibility. Now, there’s a slow return to purpose-built systems that accept constraints instead of fighting them. Specialized chains are emerging not because they promise more, but because they promise less — and deliver it consistently.

This mirrors patterns outside crypto. Payment networks, settlement layers, and financial infrastructure don’t win by being exciting. They win by being trusted. The closer a blockchain gets to real money movement, the quieter it becomes. Plasma seems to understand that gravity. Its design choices feel less like ambition and more like acceptance.

Still, uncertainty remains. Markets change. Regulation shifts. User behavior evolves. Plasma’s assumptions about stablecoin dominance could be challenged by new models. Its incentive structure will be tested under stress. These risks aren’t hidden; they’re simply unresolved. That honesty is part of the design.

What Plasma XPL ultimately reveals is not a promise of disruption, but a reflection of maturity. Crypto is slowly learning that infrastructure is not declared, it’s endured. Value accrues where systems remain usable when enthusiasm fades. And sometimes, the clearest signal of where things are heading is a network that builds for being used, not noticed.