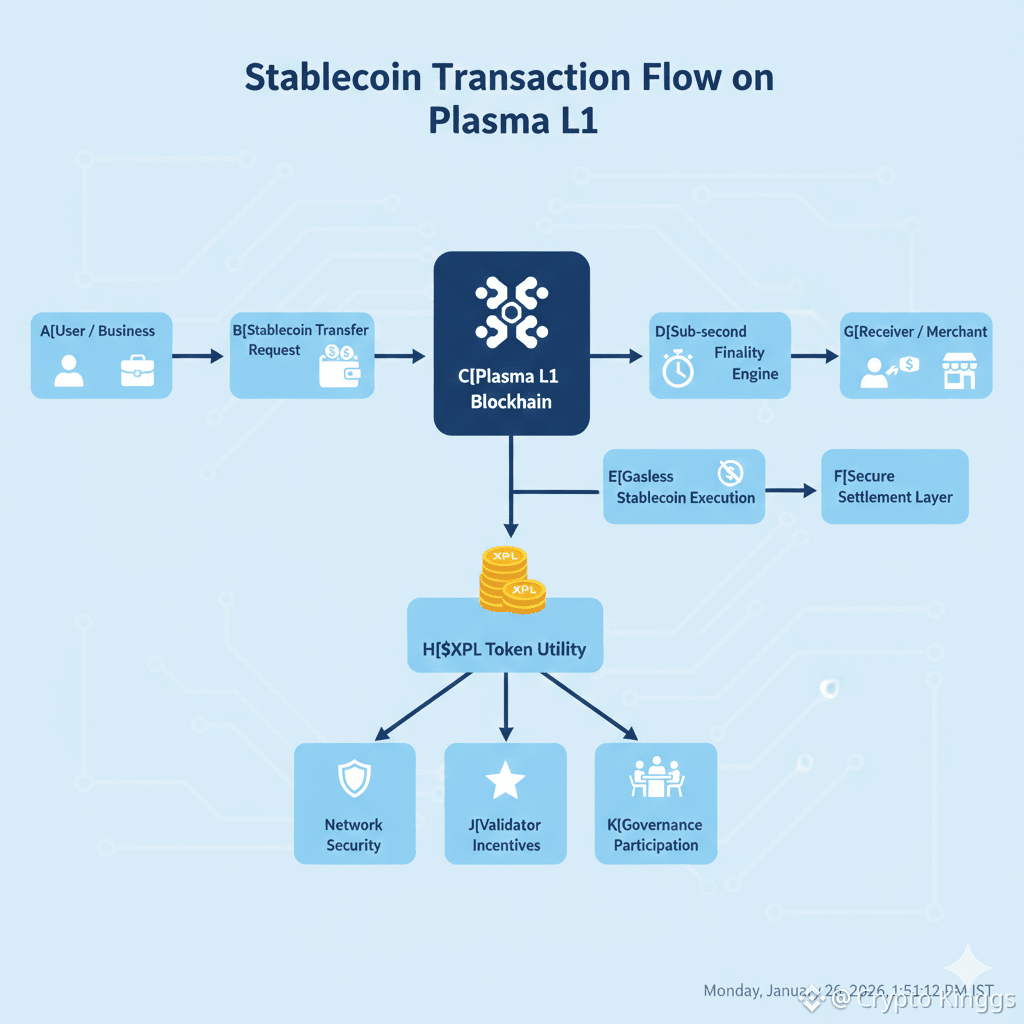

Plasma is a Layer 1 blockchain designed from the ground up to solve one very specific problem: efficient, neutral, and scalable stablecoin settlement. While most blockchains treat stablecoins as just another token type, Plasma reverses this logic. Stablecoins sit at the center of its architecture, influencing everything from gas design to consensus speed and security anchoring. This focus positions Plasma as a practical infrastructure layer for real world payments rather than a purely speculative network.

At its core, Plasma offers full EVM compatibility through Reth, a high performance Ethereum execution client. This means developers can deploy existing Ethereum smart contracts on Plasma with minimal friction. Wallets, tooling, and developer workflows remain familiar, which lowers the barrier to entry for teams building payment apps, financial protocols, or settlement systems. EVM compatibility also ensures Plasma can tap into the broader Ethereum ecosystem while optimizing for its own use case.

Performance is another defining pillar of Plasma. Using its PlasmaBFT consensus mechanism, the network achieves sub second finality. For stablecoin payments, finality speed is not a luxury, it is a requirement. Retail payments, remittances, and institutional settlement flows all demand near instant confirmation. PlasmaBFT is designed to provide fast, deterministic finality while maintaining network stability, making it suitable for both high volume consumer usage and time sensitive financial operations.

What truly differentiates Plasma is its stablecoin centric feature set. Gasless USDT transfers remove one of the biggest pain points for everyday users: the need to hold a separate volatile token just to move funds. In addition, Plasma supports stablecoin first gas, allowing transaction fees to be paid directly in stablecoins. This creates a much more intuitive experience, especially in high adoption markets where users already think in terms of stable value rather than native gas tokens. For institutions, this simplifies accounting, reconciliation, and risk management.

Security and neutrality are addressed through Bitcoin anchored security. By anchoring key elements of the network to Bitcoin, Plasma aims to increase censorship resistance and reduce reliance on any single validator set or ecosystem. Bitcoin’s long standing security model adds an additional layer of trust, which is especially important for institutions in payments and finance that operate under strict compliance and risk frameworks. This design choice signals Plasma’s intention to be a neutral settlement layer rather than a closed or highly opinionated ecosystem.

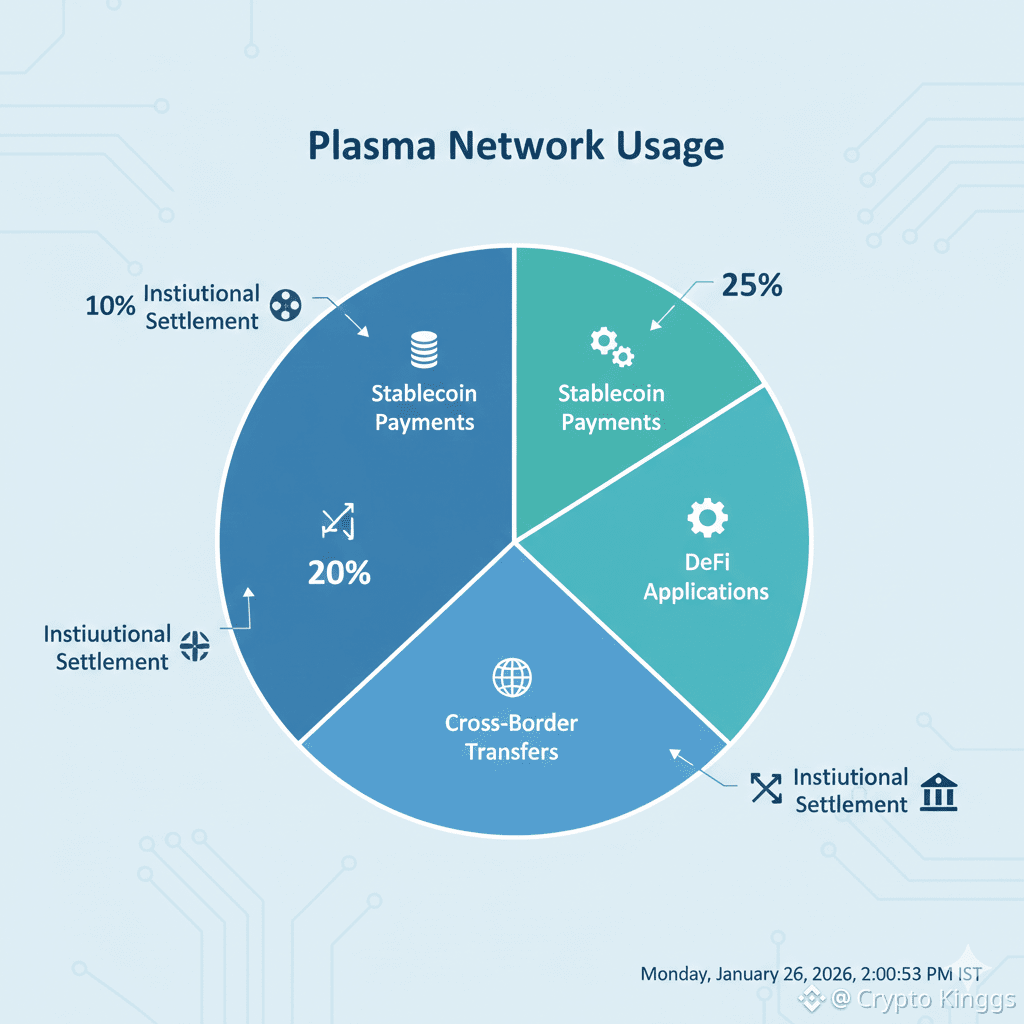

Plasma’s target users span two major groups. On one side are retail users in regions where stablecoins are already widely used for savings, transfers, and daily payments. For them, Plasma offers speed, low friction, and simplicity. On the other side are institutions, including payment providers, fintech platforms, and financial services firms. These users benefit from fast finality, predictable fees, EVM compatibility, and enhanced security guarantees. By serving both segments, Plasma positions itself as a bridge between everyday usage and institutional scale.

In a market crowded with general purpose blockchains, Plasma stands out by being specific. Its design choices are not about supporting every possible use case, but about doing stablecoin settlement extremely well. As stablecoins continue to play a larger role in global finance, infrastructure that prioritizes usability, neutrality, and performance will become increasingly important. Plasma aims to be that foundational layer.@Plasma #Plasma $XPL