Gold & Silver Prices Climbing

Gold rebounded ~2–3.7 % from recent lows, lifting spot gold to roughly $4,770–$4,850/oz on Feb 3. �

The Financial Express +1

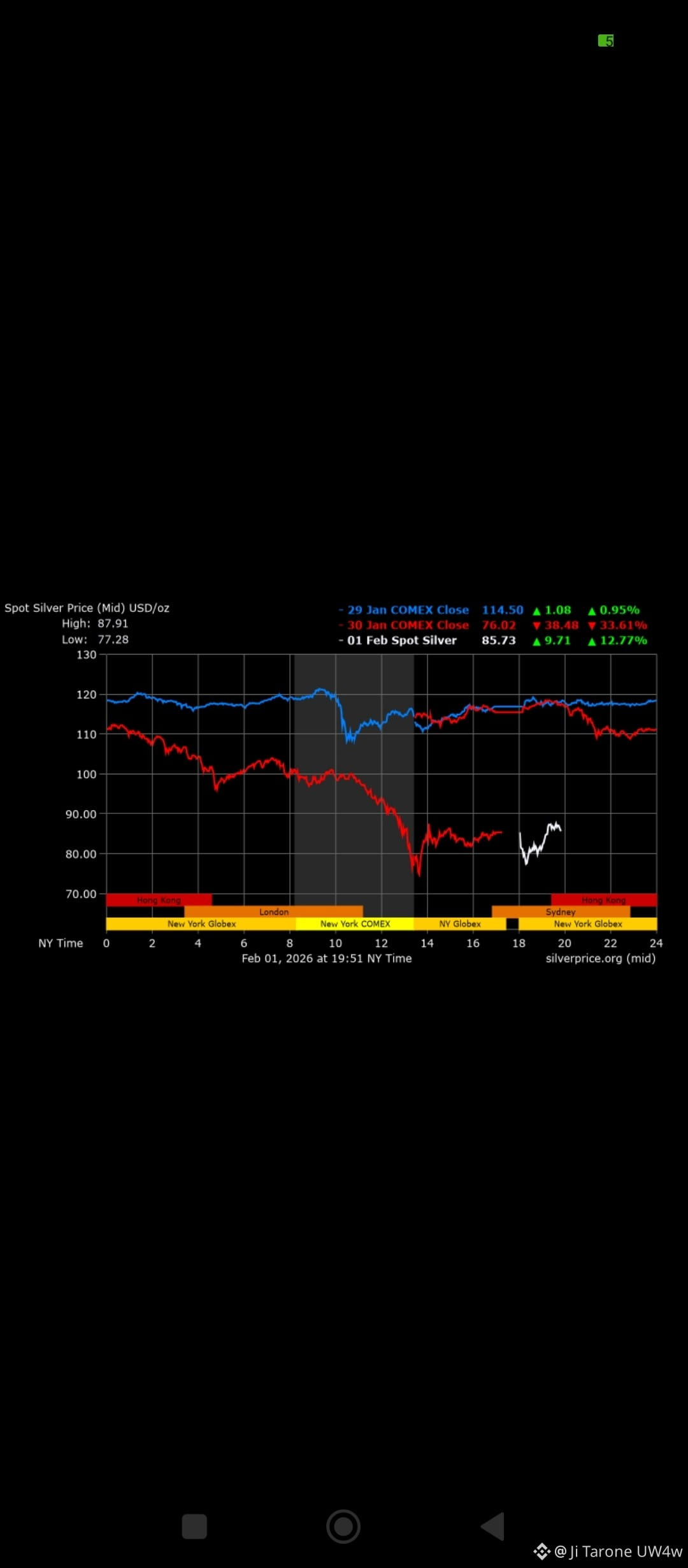

Silver showed an even stronger comeback, climbing ~6–11 % and reclaiming levels above $84–$85/oz after recent steep losses. �

The Financial Express +1

On India’s MCX, silver futures hit a 6 % upper circuit and gold jumped about 3 %, signalling strong buying interest after days of selling. �

mint

📊 ETF Bounce

Precious metal ETFs also rebounded up to ~10 % after a massive crash in recent sessions, supporting optimism among investors. �

Moneycontrol

🌏 Broader Market Moves

Asian markets and commodities are also stabilizing, with metals reversing earlier slides as volatility calms. �

Reuters

Value buyers stepped in after multi-day declines, especially in silver prices. �

Moneycontrol

📊 Why the Rebound Is Happening

1️⃣ Forced Liquidation & Value Buying

After a sharp sell-off last week that saw dramatic drops in both metals, many traders hit technical support levels — prompting dip buying and forced position covering. �

The Financial Express

2️⃣ Macro Forces at Play

Dovish Fed expectations and hopes for future rate cuts still support safe-haven assets. �

Reuters

A weakening U.S. dollar increases appeal for gold and silver priced in USD. �

Prosper Trading Academy

3️⃣ Commodities Rotation

Broader commodities are regaining footing after temporary panic selling; metals often rebound fastest after exaggerated drawdowns. �

Reuters

📉 Market Impact – Illustrated Chart

Here’s a visual of the price rebound trend following the recent slump (illustrative example searching online):

Search this to view a current market chart 👇

🔍 “Gold silver price rebound chart Feb 3 2026 COMEX spot gold silver”

📈 Typical Pattern:

Sharp drop → deeper support tested → strong bounce

Silver rebounds stronger than gold due to higher volatility + industrial demand

Gold often leads in safe-haven rebounds

(You can find live charts using financial websites like TradingView or commodity platforms.)

📌 What This Means for Investors

🔹 Short-Term

Rebound often signals short covering and technical recovery — not necessarily a long-term trend turn yet.

High volatility remains — prices could retrace again if macro sentiment shifts. �

mint

🔹 Medium-Term

Many analysts see support at key levels — gold above ~$4,400 and silver above ~$65/oz — which could form bases for future rallies. �

The Economic Times

🔹 Long-Term

Safe-haven demand remains strong due to geopolitics, inflation concerns, and central bank gold buying. �

Prosper Trading Academy

🧠 Quick Snapshot

Metric

Rebound Today

Gold

+~2–5 % from recent lows �

The Financial Express

Silver

+~6–11 % rebound �

FX Leaders

ETFs

Up to ~10 % bounce �

Moneycontrol

Investor Behavior

Value buying, dip buyers returning �

Moneycontrol