ETH to the Moon...

This shift is much bigger than just one bank issuing a stablecoin.

For years, banks said crypto was risky, unregulated, and unnecessary.

Now they’re realizing something critical: blockchains solve real banking problems.

When SoFi launches SoFi USD on Ethereum, it’s not chasing hype — it’s choosing infrastructure.

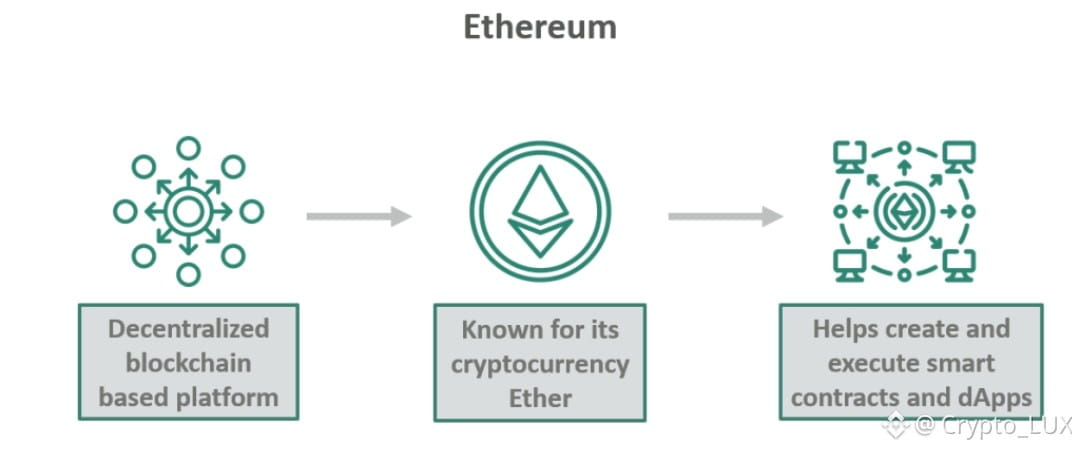

Why Ethereum?

Ethereum has quietly become the settlement layer of global finance.

In 2025 alone, over $55B in new stablecoins were issued on Ethereum. That’s not retail speculation — that’s institutions parking liquidity where it’s:

•Liquid

•Secure

•Auditable

•Programmable

Banks care about finality, compliance, and uptime. Ethereum delivers all three.

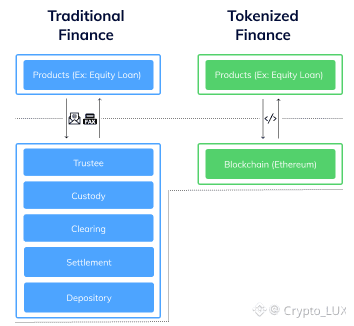

~What changes for banks?

Traditional banking rails are slow:

•T+1 / T+2 settlement

•Limited operating hours

•Expensive intermediaries

On-chain stablecoins offer:

•Near-instant settlement

•24/7 operation

•Lower costs

•Full transparency

•Smart-contract automation

This is a backend upgrade, not a marketing move.

Why this matters long term:

Banks issuing their own stablecoins means:

•Deposits become programmable

•Payments move at internet speed

•Cross-border transfers lose friction

•Compliance happens on-chain, not after the fact

And importantly — banks stay in control.

They keep KYC, regulation, and custody while leveraging public blockchain rails.

The big takeaway:

Crypto isn’t overthrowing banks.

It’s becoming the operating system they run on.

Ethereum isn’t “just a chain” anymore.

It’s turning into global financial plumbing — quietly, steadily, institution by institution.

Crypto isn't replacing banks. Banks are upgrading themselves... quietly, on-chain.

$ETH $BTC $SOL is Future. Banks going to extinct soon if they won't shifted to Web-3

Smart money already noticed.

Did you?