When observing many early Layer 1 networks, it often seems they were built from a crypto-native mindset where financial mechanics and decentralization theory came before user experience. Vanar, by contrast, presents itself as something shaped by the realities of gaming platforms, entertainment ecosystems, and brand-led digital spaces. The focus is not on forcing millions of new users to understand wallets, gas mechanics, or chain architecture in detail, but on designing a system where those elements operate quietly in the background. In this sense, the network positions itself less as a destination and more as invisible infrastructure supporting the next generation of interactive digital environments.

A key shift in its architecture is the way interactivity, digital ownership, and intelligent systems are treated as equally important. Instead of functioning purely as a ledger that records token transfers, the network is designed to coordinate complex environments where assets evolve, identities persist across experiences, and application logic runs continuously. This is particularly relevant in gaming networks and metaverse-style platforms, where user actions are constant and digital items are dynamic rather than static. The infrastructure is therefore designed to support high-frequency state changes and rich application logic without overwhelming the base chain.

Its data model reflects this practical orientation. On many blockchains, storing large or frequently changing data directly on-chain quickly becomes inefficient and costly. Vanar’s approach appears designed to separate what must be immutably anchored, such as ownership proofs and core asset records, from heavier experiential data tied to virtual worlds or game states. By anchoring authenticity and value on-chain while allowing more dynamic layers to function efficiently around it, the system aims to balance security with usability. For persistent virtual environments where millions of micro-events occur, this separation is not just an optimization but a necessity.

What makes this approach notable is the presence of ecosystem products already aligned with the infrastructure vision. Platforms such as the Virtua Metaverse and the VGN games network function as live environments that illustrate how virtual worlds, branded spaces, and interconnected game economies can operate under a shared asset and identity framework. Rather than building infrastructure in isolation, the protocol appears to be evolving alongside consumer-facing platforms that continuously test its performance, scalability, and user experience under real conditions.

Another important dimension is the network’s orientation toward AI-driven automation. As digital ecosystems grow in complexity, participation increasingly extends beyond human users. AI agents can manage assets, execute rules, and adapt to user behavior. The infrastructure is designed to accommodate such agents as participants capable of interacting with smart contracts and digital assets within defined parameters. This opens possibilities for adaptive in-game economies, automated brand interactions, and virtual environments that respond dynamically rather than relying solely on fixed scripts.

The resulting ecosystem model extends beyond the traditional triangle of users, developers, and validators. It includes consumer users entering through games and virtual worlds, developers building interactive applications, validators maintaining network integrity, brands deploying digital experiences, and AI agents operating within these systems. Real-world-linked items and brand assets can be tokenized and integrated, enabling digital environments to connect more directly with existing industries instead of remaining isolated within crypto-native contexts.

The consensus framework underlying the network is presented as a practical balance rather than an ideological extreme. For consumer-facing applications such as games or live digital events, predictable performance and reliable finality are critical. A model that distributes validation while maintaining consistent confirmation times positions the network to support real-time interactions without frequent congestion or uncertainty. This balance is essential for developers designing experiences where delays or unpredictable costs could undermine engagement.

Transaction economics follow the same pragmatic logic. Interactive applications often involve large volumes of small actions, including in-game trades, upgrades, access events, and microtransactions. A fee environment designed to remain low and relatively stable makes these models viable. By structuring costs to stay accessible, the network positions itself to support gaming economies, digital collectibles, and live applications where per-interaction expense must remain minimal for the experience to feel seamless.

Sustainability considerations are also part of the broader infrastructure narrative. As blockchain adoption moves closer to institutional participation and global brands, environmental impact becomes part of due diligence. Energy-efficient consensus mechanisms and an overall design that avoids unnecessary computational waste help align the network with carbon-conscious strategies. For enterprises and large partners, such characteristics influence regulatory perception, corporate responsibility commitments, and long-term partnership decisions.

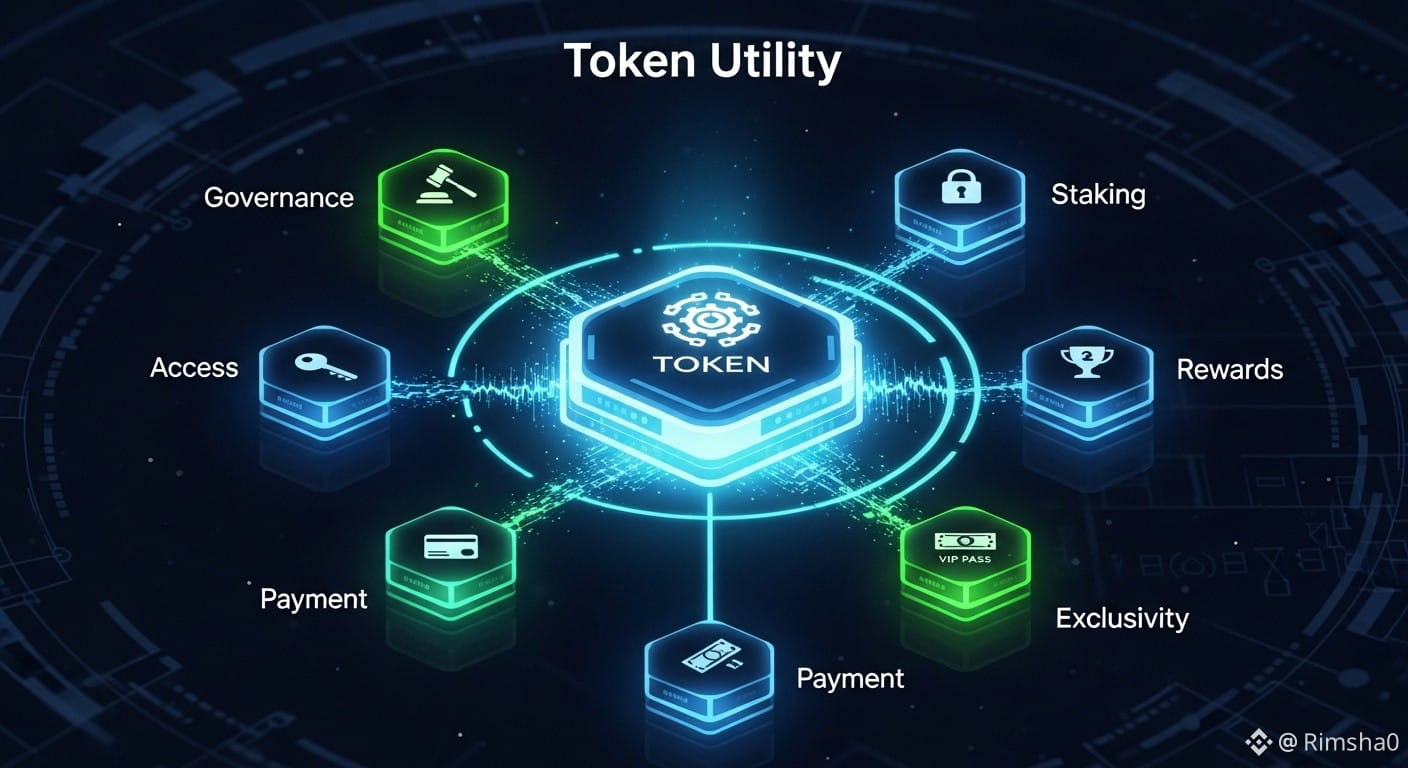

The VANRY token functions as the economic coordination layer of this ecosystem. Its supply structure is designed to support long-term participation rather than short-term dynamics. Emissions are structured to reward validators who secure the network, aligning infrastructure reliability with economic incentives. Allocations are also designed to fund development, ecosystem tools, and initiatives that expand the network’s practical utility.

Developers form a central part of this design. Incentive programs, ecosystem funds, and support mechanisms aim to encourage teams building games, metaverse environments, and interactive applications. Community-oriented rewards extend participation to users who contribute through governance, ecosystem activity, and engagement with applications. In this framework, tokenomics is positioned less as a speculative device and more as a coordination mechanism linking infrastructure security, development momentum, and user participation.

The network’s connection to real-world digital economies is another defining aspect. Brands can tokenize items, experiences, or access rights that function across virtual platforms, while gaming assets can be anchored to verifiable ownership. Payment flows within these ecosystems can occur natively on-chain, enabling value to move across platforms without heavy reliance on fragmented external systems. This supports digital economies that blend entertainment, commerce, and community under a unified infrastructure.

Compatibility with Ethereum and the broader EVM ecosystem further reduces barriers for developers. Familiar tools, languages, and standards can be extended into this environment, allowing teams to build without starting from scratch. Interoperability with established ecosystems enables the network to benefit from the broader Web3 developer base while tailoring performance and design choices to consumer-scale applications.

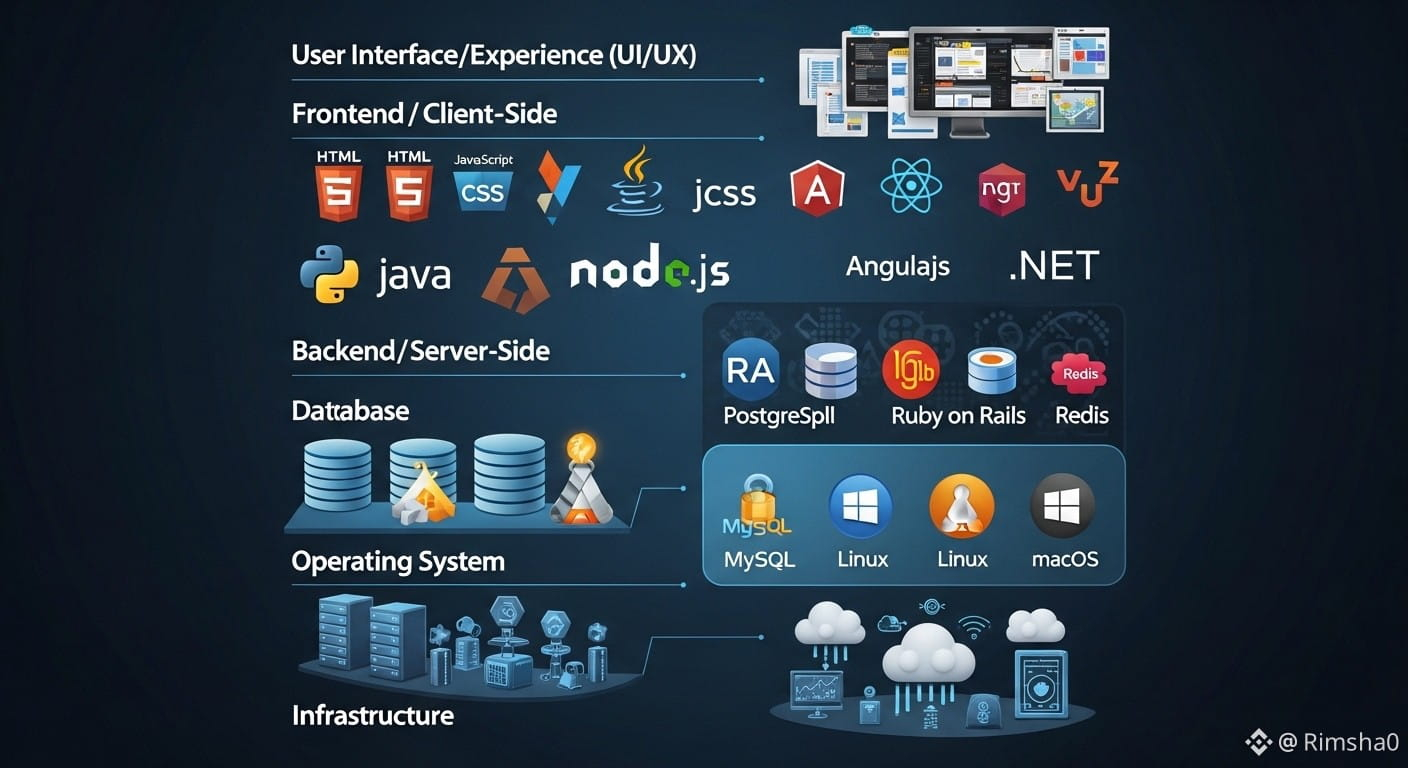

From a technical standpoint, the system can be viewed as a modular multi-layer stack. A runtime layer focuses on execution optimized for interactive use cases. An AI-oriented layer supports intelligent automation and data-driven logic. Storage components manage the separation between critical ownership data and heavier experiential information. Bridge mechanisms connect the network with other ecosystems, enabling asset mobility and cross-chain collaboration.

Ecosystem growth appears to emphasize tangible deployment and partnerships linked to real platforms. The presence of live environments such as Virtua and the VGN network suggests a focus on building and iterating under real usage conditions rather than relying solely on theoretical roadmaps. Engagements with brands and entertainment-oriented initiatives reflect an effort to integrate blockchain into spaces where users already spend time.

However, long-term outcomes remain dependent on factors beyond technology alone. Adoption requires sustained user interest, continued developer commitment, and governance structures capable of evolving as the ecosystem expands. Competition from other performance-oriented Layer 1 networks and scaling solutions within established ecosystems remains significant. Balancing openness with coordinated direction will likely be an ongoing governance challenge.

Overall, Vanar can be understood as an attempt to redefine the purpose of a Layer 1 blockchain. Instead of serving primarily as a financial settlement layer, it positions itself as infrastructure for interactive, intelligent, and brand-connected digital worlds. Its potential lies in aligning blockchain systems with mainstream digital behavior, while the risks stem from the complexity of executing across technology, entertainment, and large-scale user adoption simultaneously.