@Dusk #dusk $DUSK In the real world, money is never just money. It comes with rules, audits, obligations, and consequences when things go wrong. Any blockchain project that wants to touch real financial activity has to accept that reality instead of arguing with it. DUSK matters because it starts from that assumption. It does not pretend that finance can exist without regulators, institutions, or accountability. It tries to build infrastructure that can live inside those constraints without losing the benefits of decentralization.

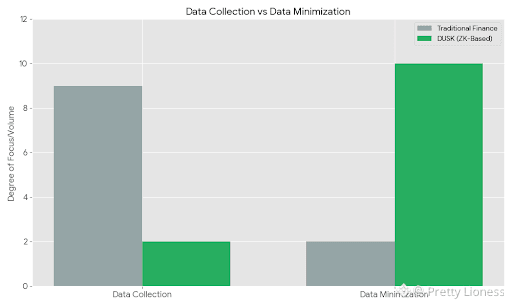

The core idea behind DUSK is simple but demanding. Privacy is necessary in finance, but secrecy is not the same as privacy. Markets need confidentiality for participants, positions, and strategies. At the same time, regulators and counterparties need assurance that rules are being followed. DUSK’s design philosophy is about holding those two truths at once. It does not chase total anonymity, and it does not default to full transparency. Instead, it focuses on selective disclosure. Information can stay private by default and become visible only when there is a legal or operational reason for it.

This balance shows up in how the network is structured. Execution and settlement are treated carefully. Transactions can be validated without exposing sensitive data, using zero-knowledge techniques that are purpose-built for financial workflows. This is not about hiding activity. It is about proving correctness without oversharing. For developers, the tooling reflects this mindset. Smart contracts are designed to handle private state in a controlled way, so compliance logic can exist alongside privacy logic rather than fighting it.

Incentives on DUSK are aligned with this slower, more careful approach. Validators are rewarded for doing boring but essential work. Staying online. Following protocol rules. Participating in governance decisions that affect network stability. There is no attempt to gamify participation through extreme yields or short-term rewards. The incentives are meant to attract operators who think in years, not weeks. That matters when the network is supposed to support financial instruments that cannot afford downtime or unpredictable behavior.

One sign of maturity has been how the project has handled protocol updates and delays. There have been moments where features were pushed back, tested longer, or redesigned after feedback from auditors and partners. From the outside, this can look slow. From the inside, it looks responsible. In financial systems, shipping late is often less dangerous than shipping wrong. Choosing caution over speed is an operational decision that signals seriousness.

The DUSK token itself plays a narrow but important role. It secures the network through staking, pays for transaction execution, and aligns validators with the long-term health of the system. Its design does not rely on constant growth in usage to remain viable. Sustainability comes from predictable costs and incentives, not from speculation. The token exists to support the network’s function, not to be the product.

Watching DUSK over time feels less like following a startup launch and more like observing infrastructure being laid carefully underground. There are no loud promises. Progress is incremental. Sometimes quiet. But that is often what real finance looks like. Real on-chain finance requires restraint, clear incentives, and respect for the fact that trust is earned slowly. DUSK is not trying to escape the financial system. It is trying to meet it where it actually is.