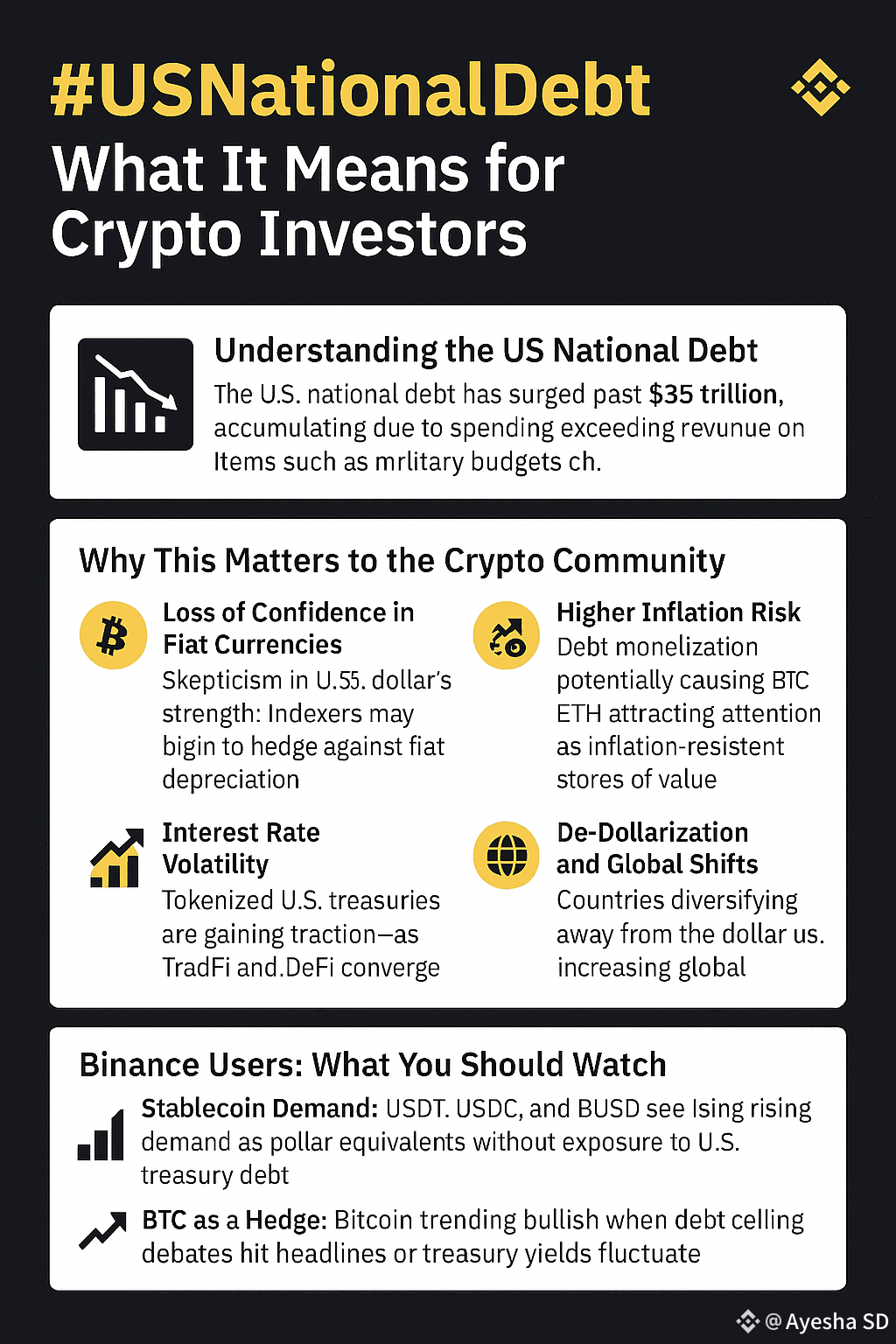

📉 #USNationalDebt: What It Means for Crypto Investors

In 2025, the U.S. national debt continues to surge past $35 trillion, raising alarm bells across global financial markets. But what does this mounting debt mean for crypto investors, and why is it relevant to platforms like Binance?

🚨 Understanding the US National Debt

The U.S. national debt is the total amount the federal government owes to creditors. It accumulates due to spending exceeding revenue — think of military budgets, healthcare, stimulus packages, and interest on existing debt.

The debt is now equivalent to over 120% of the U.S. GDP, a level historically seen in post-war economies or emerging markets in crisis. The Congressional Budget Office (CBO) projects this trend to worsen without major reforms.

🔍 Why This Matters to the Crypto Community

1. Loss of Confidence in Fiat Currencies

As the debt spirals, so does skepticism in the U.S. dollar's long-term strength. Investors may begin to hedge against fiat depreciation, turning to Bitcoin and stablecoins as alternatives.

2. Higher Inflation Risk

Debt monetization (printing more money to cover deficits) can spark inflation, diminishing the purchasing power of dollars. Crypto assets like BTC and ETH, often dubbed “digital gold,” attract attention as inflation-resistant stores of value.

3. Interest Rate Volatility

To control inflation, the Federal Reserve may raise interest rates, causing volatility in traditional markets. But crypto markets, while risky, remain less tied to central bank policy, offering diversification.

4. De-Dollarization and Global Shifts

ntries diversify away from the dollar in response to U.S. debt, crypto adoption could increase globally, especially in economies looking to bypass dollar-dominant systems.

📊 Binance Users: What You Should Watch

Stablecoin Demand: USDT, USDC, and BUSD could see rising demand as people seek dollar equivalents without exposure to U.S. treasury debt.$ETH

ETH2,644.56-3.45%

ETH2,644.56-3.45%BTC as a Hedge: Expect Bitcoin to trend bullish whenever debt ceiling debates hit headlines or treasury yields fluctuate sharply.$XRP

XRP1.6969-3.24%

XRP1.6969-3.24%

Tokenized Treasuries: Paradoxically, tokenized U.S. treasuries (like those offered by Ondo or Franklin Templeton) are also gaining traction — a sign of how TradFi and DeFi are converging.

💡 Final Thoughts

The growing U.S. national debt is more than a political issue — it's an economic time bomb with global consequences. For Binance users, it reinforces the value proposition of decentralized assets, especially in times of uncertainty.

As always, stay informed and diversify. In a world drowning in debt, crypto may be the life raft many are looking for.