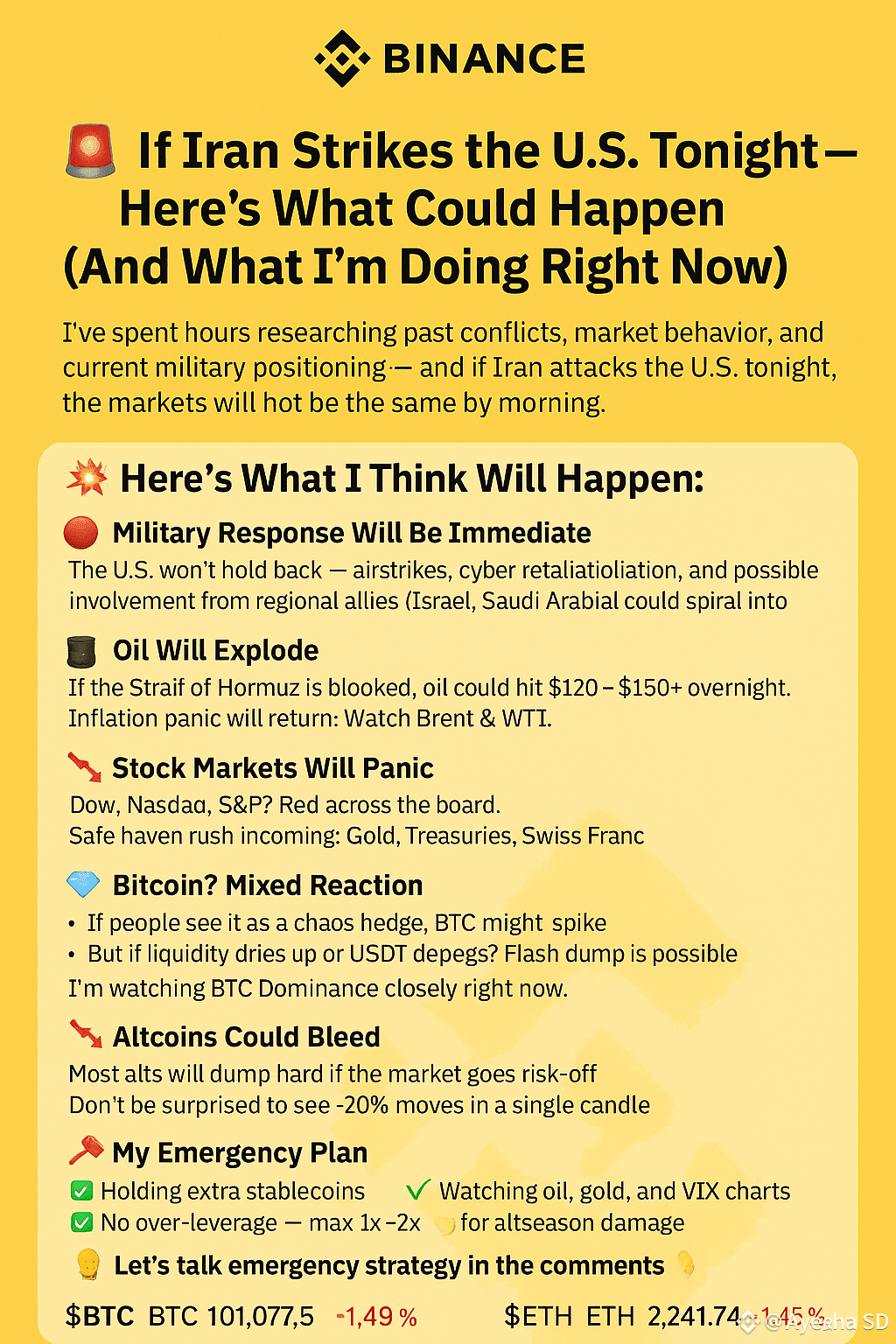

I’ve spent the past few hours deep in research — studying past conflicts, market reactions, and current military posture. If Iran attacks U.S. forces or territory tonight, the world could wake up to a very different financial landscape.

This is not hype. This is risk management in real time.

💥 What Happens Next If Conflict Ignites:

🔴 1. Military Response Will Be Swift and Massive

The U.S. won’t hesitate. Expect immediate retaliation: airstrikes, cyberattacks, and potential coordination with regional allies like Israel and Saudi Arabia. This could escalate rapidly into a wider Middle East conflict.

🛢️ 2. Oil Prices Could Explode

If the Strait of Hormuz is threatened or blocked, Brent and WTI could gap up to $120–$150+ overnight.

➡️ Inflation fears return

➡️ Supply chains stress again

➡️ Energy stocks and commodities will spike hard

📉 3. Stock Markets Will Panic

Dow, Nasdaq, and S&P futures? Likely deep red by morning.

Watch for a classic flight to safety:

🟡 Gold

📜 U.S. Treasuries

🇨🇭 Swiss Franc

💎 4. Bitcoin — The Wildcard

BTC could go either way:

Up if traders see it as a geopolitical hedge

Down if liquidity evaporates or USDT confidence cracks

👉 I'm closely watching BTC Dominance to judge risk-on vs. risk-off flows.

📉 5. Altcoins Will Likely Bleed$ETH

In a panic, alts are the first to get dumped. A -20% move in one candle isn’t out of the question.

Don’t try to be a hero here — preserve capital first.

📌 My Emergency Market Plan

✅ Holding extra stablecoins — mostly USDC

✅ Watching Brent, Gold, and the VIX like a hawk$BNB

✅ Keeping leverage low (1x–2x max)

✅ Monitoring ETH/BTC ratio + Total3 for altcoin pain signals

This is not the moment to YOLO into low caps.

🧠 Final Thoughts

We’re not in a normal macro environment anymore. If this conflict escalates, we’re stepping into war-level volatility — both in TradFi and crypto.

📢 Are you prepared? Or still chasing pumps?

👇 Drop your emergency playbook or questions in the comments 👇

#BTC $BTC

BTC: 101,077.5 (▼ -1.49%)

#ETH $ETH

ETH: 2,241.74 (▼ -1.45%)

#Geopolitics #MarketCrash #CryptoStrategy #OilPrices #USNationalDebt #RiskOff #WarVolatility #Binance