In an industry where "trust" is the most valuable currency, Binance just made a massive statement that underscores their commitment to user security. While the market focuses on daily price candles and macro trends, the infrastructure behind the scenes is being reinforced with heavy-duty protection.

In a significant move to fortify its ecosystem, Binance has injected an additional 3,600 Bitcoin into its Secure Asset Fund for Users (SAFU). At current market valuations, this represents a staggering $233.37 million commitment to the safety of global capital.

What is the SAFU Fund?

For those who might be new to the space or need a refresher: the SAFU Fund is an emergency insurance pool established by Binance in 2018. Its primary purpose is to act as a backstop—a financial cushion designed to protect user interests in extreme, unforeseen circumstances.

Think of it as the ultimate "break glass in case of emergency" vault. By consistently rebalancing and topping up this fund with high-liquidity assets like BTC, Binance ensures that its promises of security are backed by tangible, transparent reserves rather than just corporate sentiment.

Why This Matters Right Now

The timing of this top-up isn't just a coincidence; it’s a masterclass in professional risk management. Here is why this update is relevant to every trader:

• Institutional-Grade Solvency: As more institutional players enter the crypto landscape, they look for platforms that mimic (and exceed) traditional banking safeguards. A quarter-billion-dollar injection sends a clear signal of financial health.

• Market Confidence: Volatility is the heartbeat of crypto. Knowing that a platform has a multi-billion dollar safety net allows users to trade with a level of psychological peace that "uninsured" exchanges simply cannot provide.

• Lead by Example: In a post-FTX era, transparency and proactive self-regulation are the gold standards. Binance continues to set the pace for what "Total Asset Protection" should look like in a decentralized world.

The Math Behind the Move

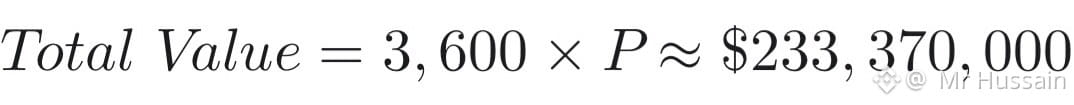

To put the scale of this into perspective using the current spot price (P):

When added to the existing balance of the SAFU fund—which consists of a diversified mix of BNB, USDT, and TUSD—this move ensures the fund remains near its target $1 Billion valuation despite market fluctuations.

The Bottom Line

Security isn't a "one and done" task; it’s a constant evolution. By shifting more weight into Bitcoin—the most secure and liquid asset on the planet—Binance is ensuring that their safety net is as resilient as the blockchain itself.

It's a reminder that while we’re all here for the gains, the foundation of those gains is a platform that can weather any storm.

What’s your take on exchange insurance funds? Do you feel more comfortable trading on a platform that maintains a transparent emergency reserve, or do you prefer to keep 100% of your assets in cold storage?

Let’s talk strategy in the comments. 👇

#WhenWillBTCRebound #RiskAssetsMarketShock #BitcoinDropMarketImpact #BTC #Write2Earn