Core Technology

🧠 Neutron Compression

AI-powered compression at 500:1 ratio. Reduces 25MB files to 50KB "Seeds" stored on-chain. Both physical and semantic compression preserves file meaning, not just bytes.

⚡ Kayon Reasoning Engine

On-chain AI engine that lets smart contracts query and reason over live compressed data. Enables AI agents with persistent memory and context.

🔐 True On-Chain Storage

Unlike blockchains that point to IPFS or AWS, VANAR stores actual data on-chain. Proven resilient during April 2025 AWS outage that disrupted major exchanges.

💡 The Value Proposition

$VANRY transforms blockchains from simple ledgers into intelligent systems. By embedding AI compression and reasoning directly into Layer 1, it enables truly autonomous on-chain applications with memory, context, and intelligence.

Real-World Adoption

🎮 Gaming Ecosystem

World of Dypians: 30,000+ players. VGN Gaming Network: 15M users with 12 partner games launching early 2026.

🏢 RWA Tokenization

$230M project in Dubai. Focus on PayFi and tokenized real-world assets with compliance-ready infrastructure.

📊 Business Model

Shifted to subscription model (late 2025). myNeutron AI assistant now paid. 9M+ daily transactions with 280% increase in VANRY burned.

✅ Strengths

Genuinely differentiated AI-native tech stack

Proven resilience during AWS outage

Real gaming adoption with millions of users

500:1 compression enables true on-chain storage

RWA and PayFi positioning in growth sectors

Utility-driven tokenomics emerging

⚠️ Risks

Only $2.5M raised—minimal funding vs competitors

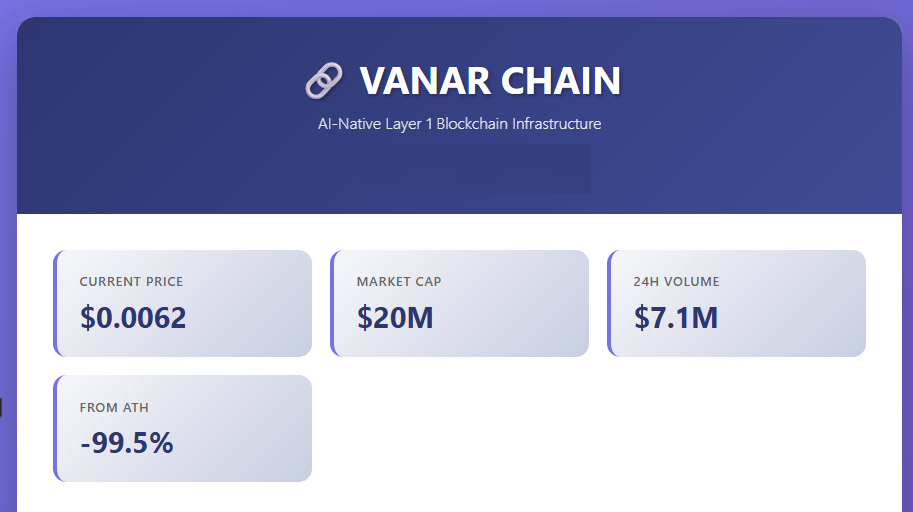

Down 99.5% from all-time high

Bearish technical sentiment for 2026

Low social mentions (#562 ranking)

Subscription model untested at scale

Infrastructure plays take years to mature

Investment Thesis

VANAR represents a high-risk bet on AI-native blockchain infrastructure becoming essential rather than experimental. The technology is sophisticated and solves real problems—true on-chain storage, AI agent memory, semantic compression. The AWS outage provided real-world validation.

However, at a $20M market cap with bearish momentum, this is a micro-cap position requiring conviction that VANAR can achieve network effects before competitors catch up or the market moves on. Gaming traction and RWA deals show early adoption, but the shift to paid products will test whether users see enough value to pay.

For smart, busy investors: Watch daily transaction metrics and subscription conversion rates. If VANAR maintains 9M+ daily transactions while growing paid users, the utility thesis strengthens. If volume drops post-paywall, market skepticism is justified.

#VANAR built what other blockchains promised: truly intelligent on-chain infrastructure. Whether that translates to sustainable value depends on adoption velocity versus competition. The next 6-12 months will determine if this is breakthrough infrastructure or impressive engineering searching for product-market fit.