⬆️ Here's the play by play ,One softer inflation number drops, and the entire market architecture shifts. It wasn't just a rally, it was a violent repricing

Crypto ripped 10% on a billion dollar short squeeze, pulling stocks along with it

The Fed's still cautious, but the market's betting the inflation is over. So, is today the day the trend definitively turned, or are we just setting up for a nasty disappointment if the data doesn't stay this friendly?

Big numbers sound exciting, but they can mislead

The $1.5 trillion headline feels dramatic

It doesn’t mean new money rushed in

Prices just moved higher

When prices rise, market value jumps automatically

That’s how the math works

Stocks and crypto went up together

They often do when fear cools down

Investors feel a bit safer

This looks more like a bounce than a new trend

One good day changes mood fast

It doesn’t fix bigger problems

After heavy selling, people relax

Some even start buying back

That can push prices up quickly

What matters now is what happens next

If buying continues, the move sticks

If not, it fades

Okay, let's talk about the big market decline ⬇️

Bitcoin posted its first ever daily decline of OVER -$10,000.

Not even the record -$19.5 billion liquidation on October 10th came close to today

It appears that someone "big" was liquidated

Calling this historic focuses on the candle, not the context. Markets periodically need violent moves to remind participants that leverage is borrowed time

The broader setup matters more than the drop itself: whether demand appears once selling becomes voluntary again

This is the point where conviction replaces noise, because price stabilisation after stress tells more than the stress event itself

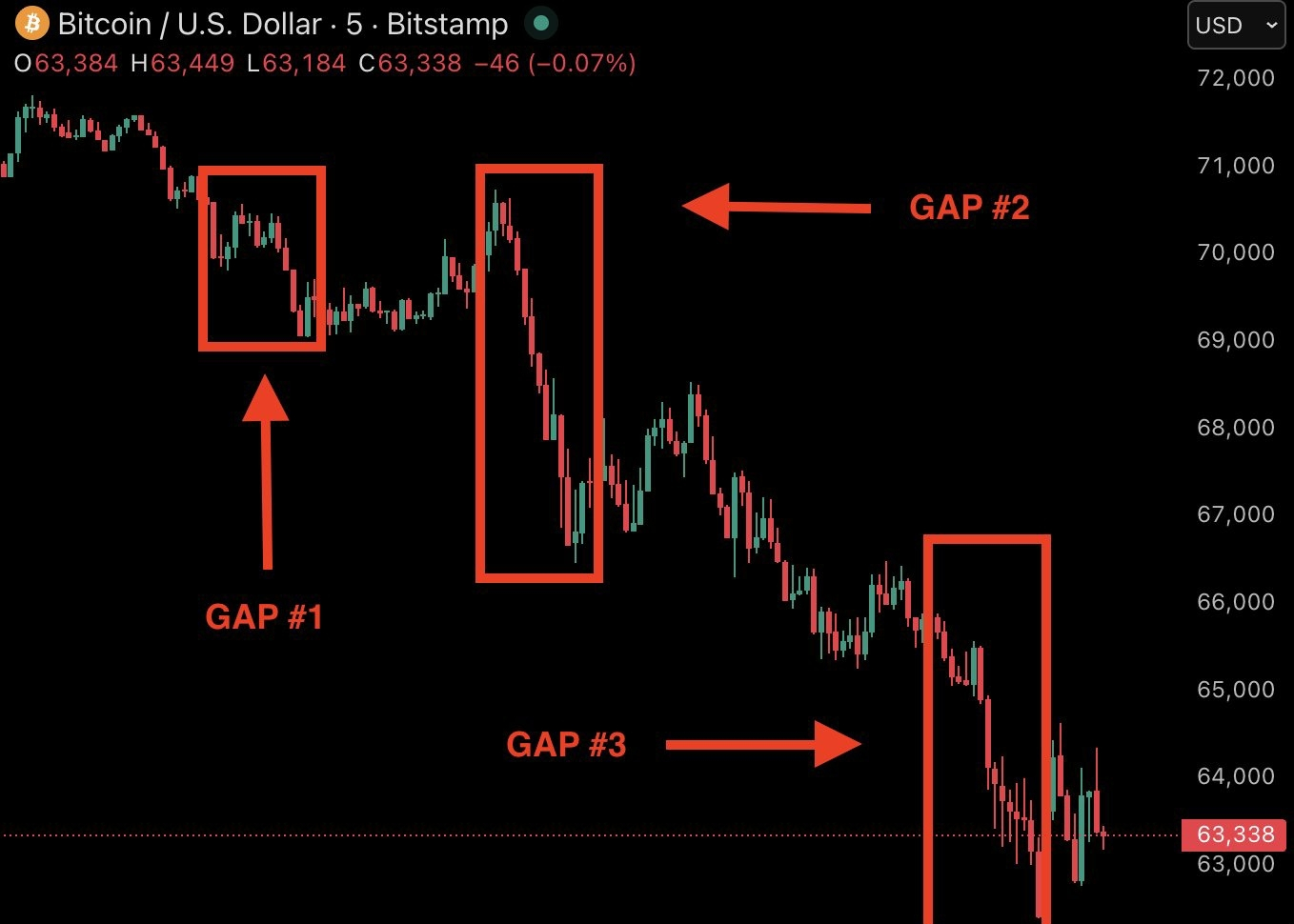

Look at the picture ⬇️

⬆️ Sometimes, Bitcoin drops by $2,000 in a matter of minutes.

It appears that a large player, perhaps an institutional investor, has sold/liquidated

Look at the picture ⬇️

⬇️ Since January 24th, we have seen $10 billion worth of levered positions liquidated.

That's ~55% of the record amount seen on October 10th.

Look at the picture ⬇️

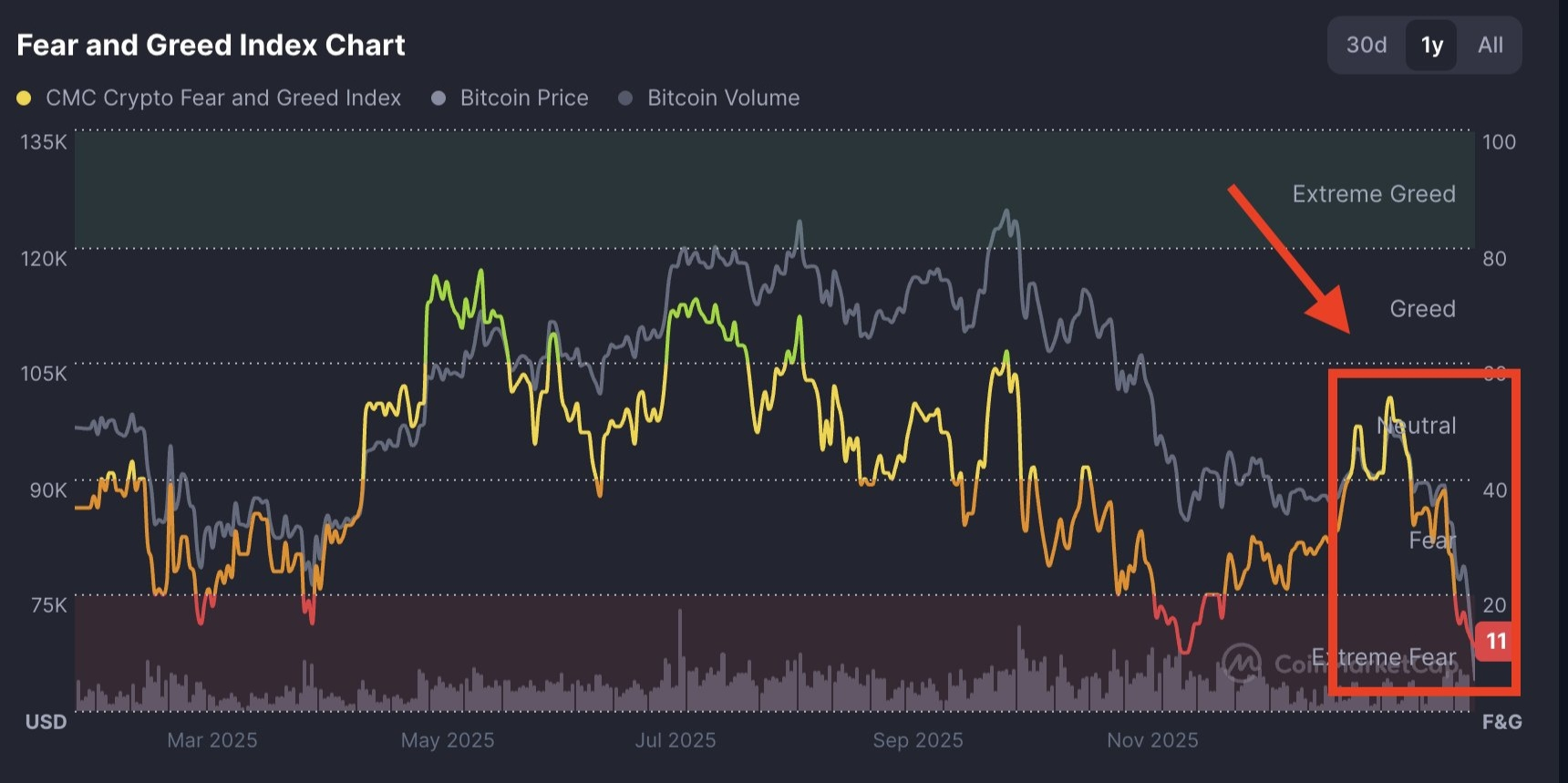

⬆️ As price action deteriorated, so did sentiment

If previous crypto cycles have taught us anything, it's the sentiment is ALL that matters

As seen below, sentiment has traded in a near straight-line lower since October 10th

Even relief rallies failed to shift sentiment

Look at the picture ⬇️

⬆️ The most recent TOP in crypto came on October 6th, just 4 days before the -$19.5 billion record liquidation

Something structural appears to have shifted on October 10th

And, markets never truly recovered

Look at the picture ⬇️

⬆️ over the last 60 days, the fundamental picture for crypto is actually vastly unchanged.

This is why many investors are confused.

Why is crypto crashing if the fundamental picture is unchanged?

Look at the picture ⬇️

⬆️ Since October 10th, crypto markets are now down -50%, erasing $2.2 TRILLION worth of market cap.

Bitcoin has officially erased ALL of its post-election rally, now down -10% since Trump's election

Look at the picture ⬇️

⬆️ Bitcoin is still way down from where it was a month ago ,There was a massive red candle on Thursday, and then when Friday had a green candle almost as big, but not enough to fully rebound from the previous day, people are celebrating the green

Don’t chase day-one explosions, scale in on pullbacks

Trim risk into strength, not weakness

If you’re long-term: rebalance winners, don’t double down emotionally

If you’re trading: define exits before the next dopamine hit

Markets can add $1.5T today… and take it back in two bad CPI prints 🔚

🚸 Warning 🚸 I do not provide financial advice 🔞The intent of this content is for you to be aware of market conditions before starting to invest 👌Thank you for reading 👌

#RiskAssetsMarketShock #WhenWillBTCRebound #MarketCorrection