Introduction: Beyond the Hype

Cryptocurrency often feels like a digital enigma, but its value isn’t driven by magic, it is driven by the same fundamental principles that have governed markets for centuries. Value is a reflection of necessity, the strength of a network, and the architecture of trust.

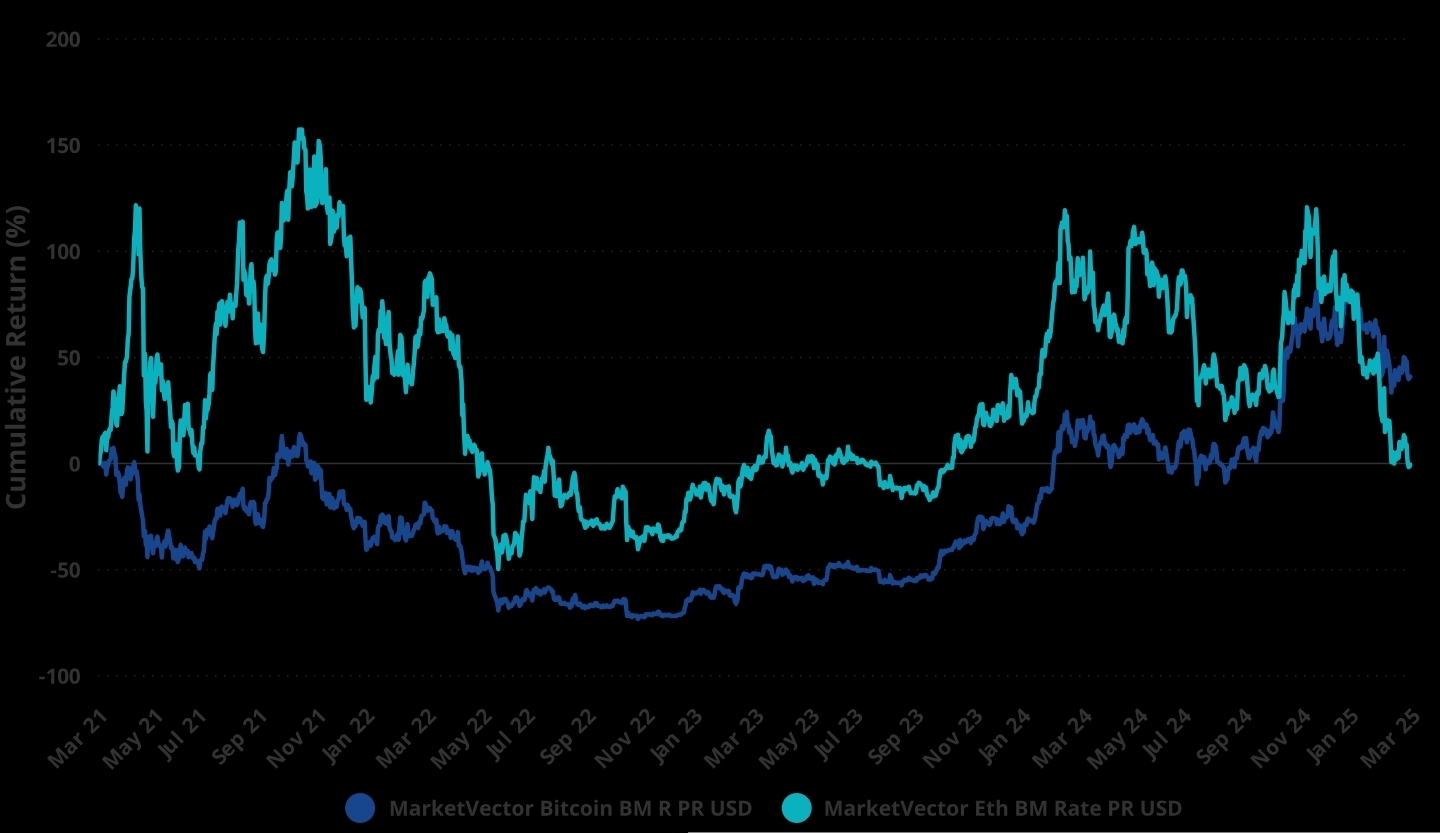

While price volatility often dominates the headlines, the underlying worth of a digital asset is built on a foundation of tangible utility and economic design. In this module, we break down the four core pillars that give a crypto token its value. Using $BTC and $ETH as our primary case studies, we will move past the speculation to explore the practical mechanics that drive long-term adoption and market price.

By the end of this guide, you will be able to look past the "hype" and identify the real-world components that make a digital asset truly valuable.

Utility and use cases

Why people use a token matters most. Bitcoin is seen as digital money for saving and moving value. Ethereum is used to run smart contracts that power apps and services. When a token has clear uses people will pay for it. For a beginner look for real world activity, like payments, lending, or apps that need the token to work. Utility creates steady demand beyond price bets same reason $BNB will only keep getting better.

Scarcity and supply

How many tokens exist changes value. Bitcoin has a capped supply of 21 million coins which creates scarcity. Ethereum does not have a simple fixed cap but upgrades changed its supply rules and often reduce net issuance. Scarcity helps when demand grows. For beginners think of scarcity like limited edition items, and inflation like more copies being printed. The supply rule tells you whether scarcity will help price over time

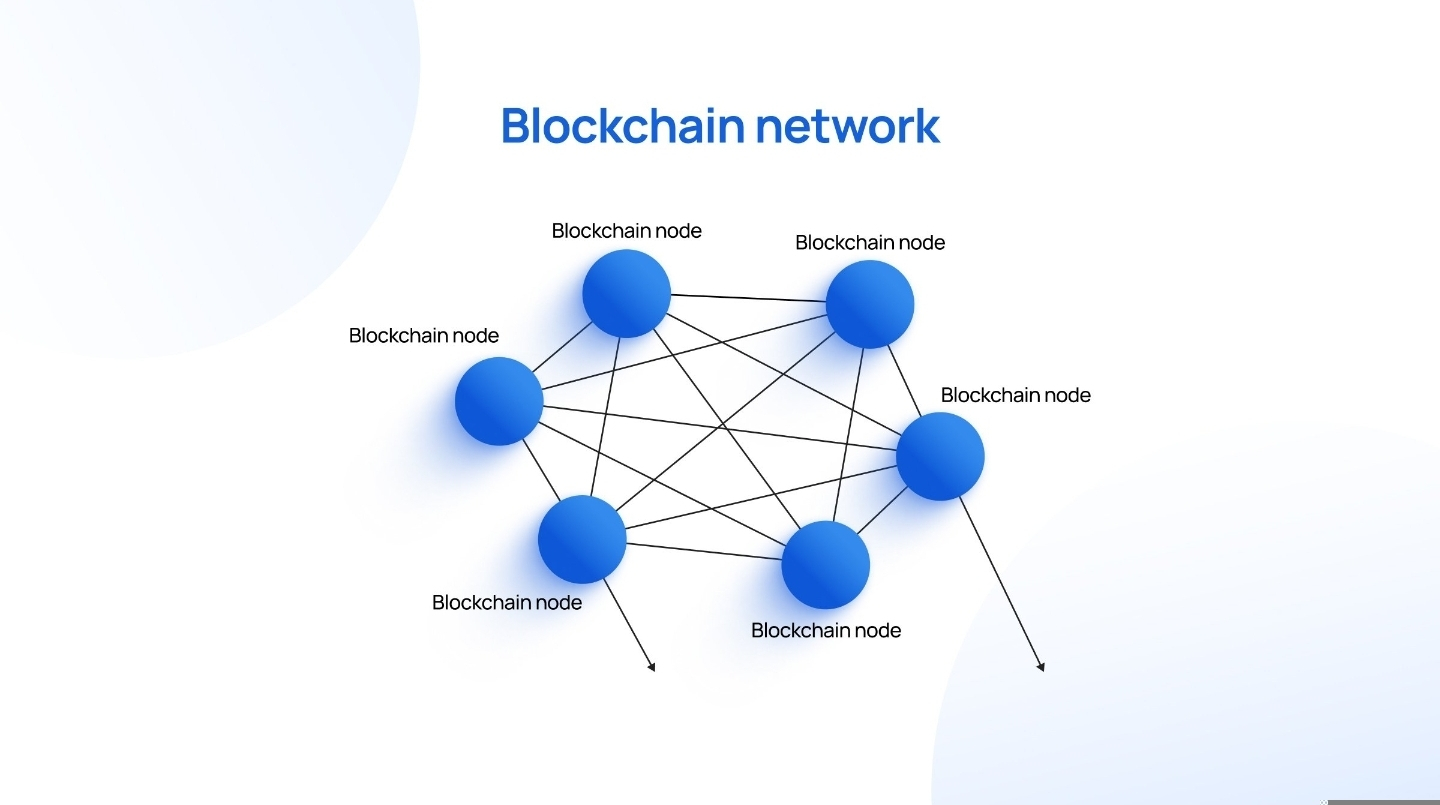

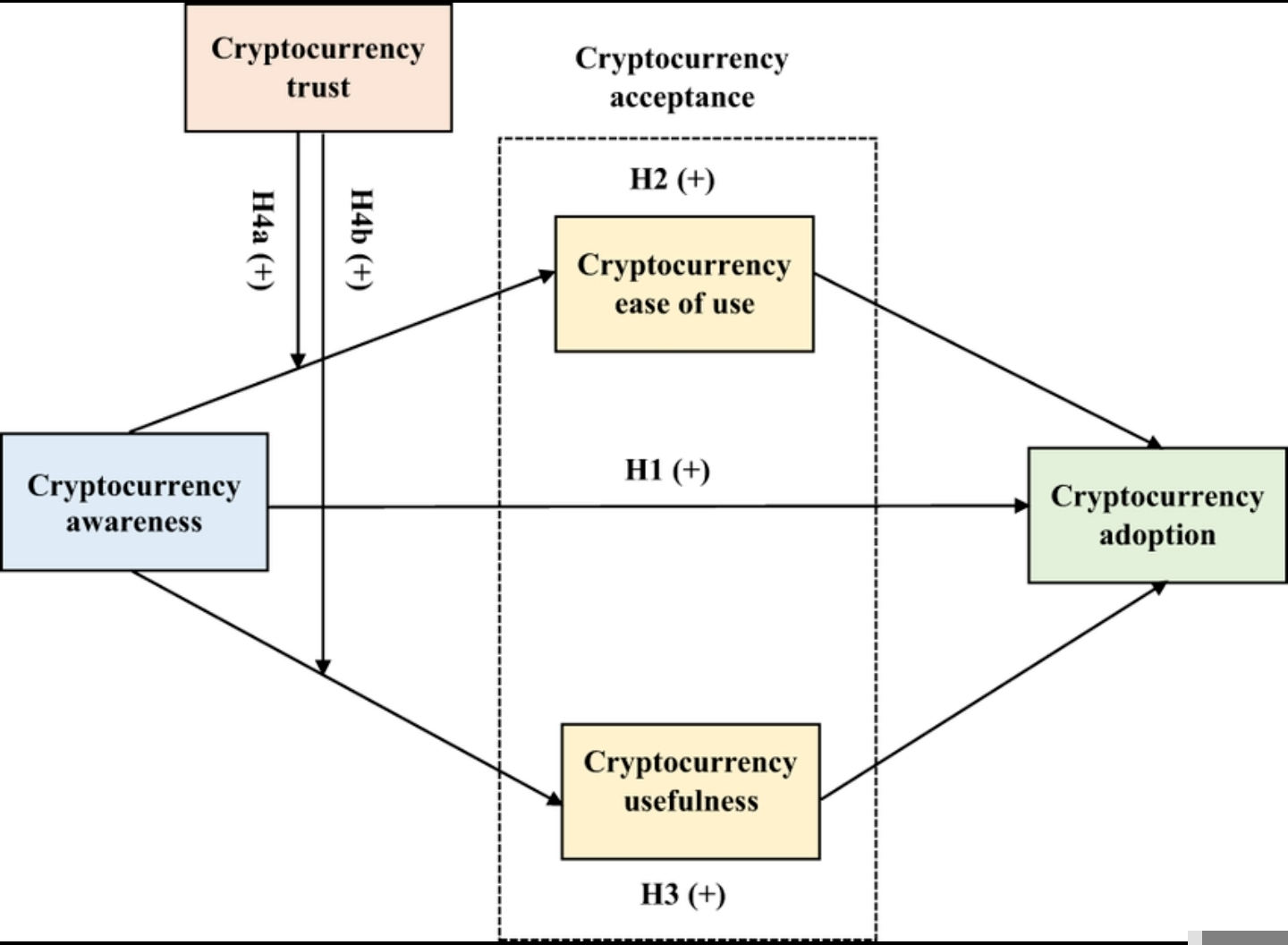

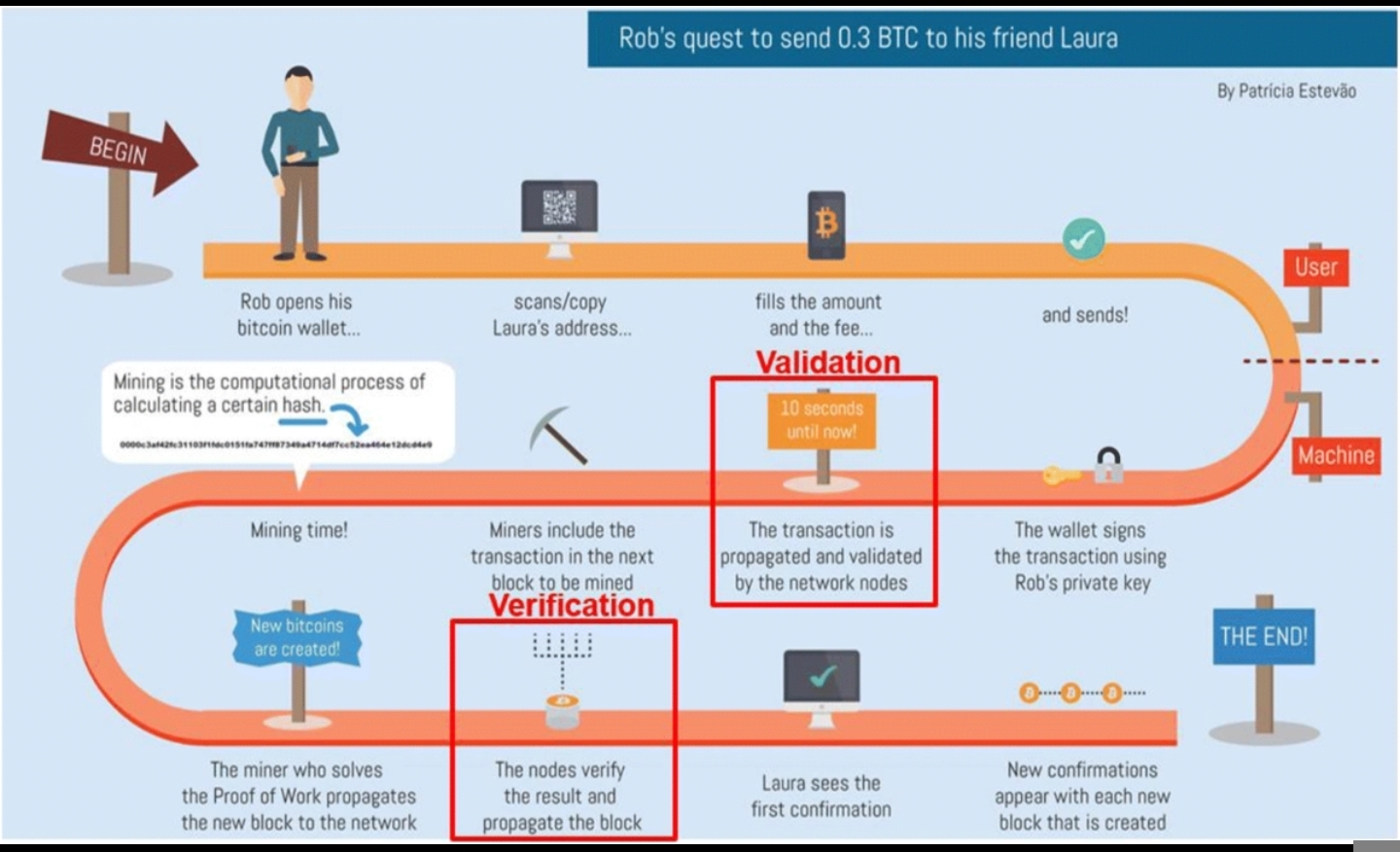

Security and decentralization

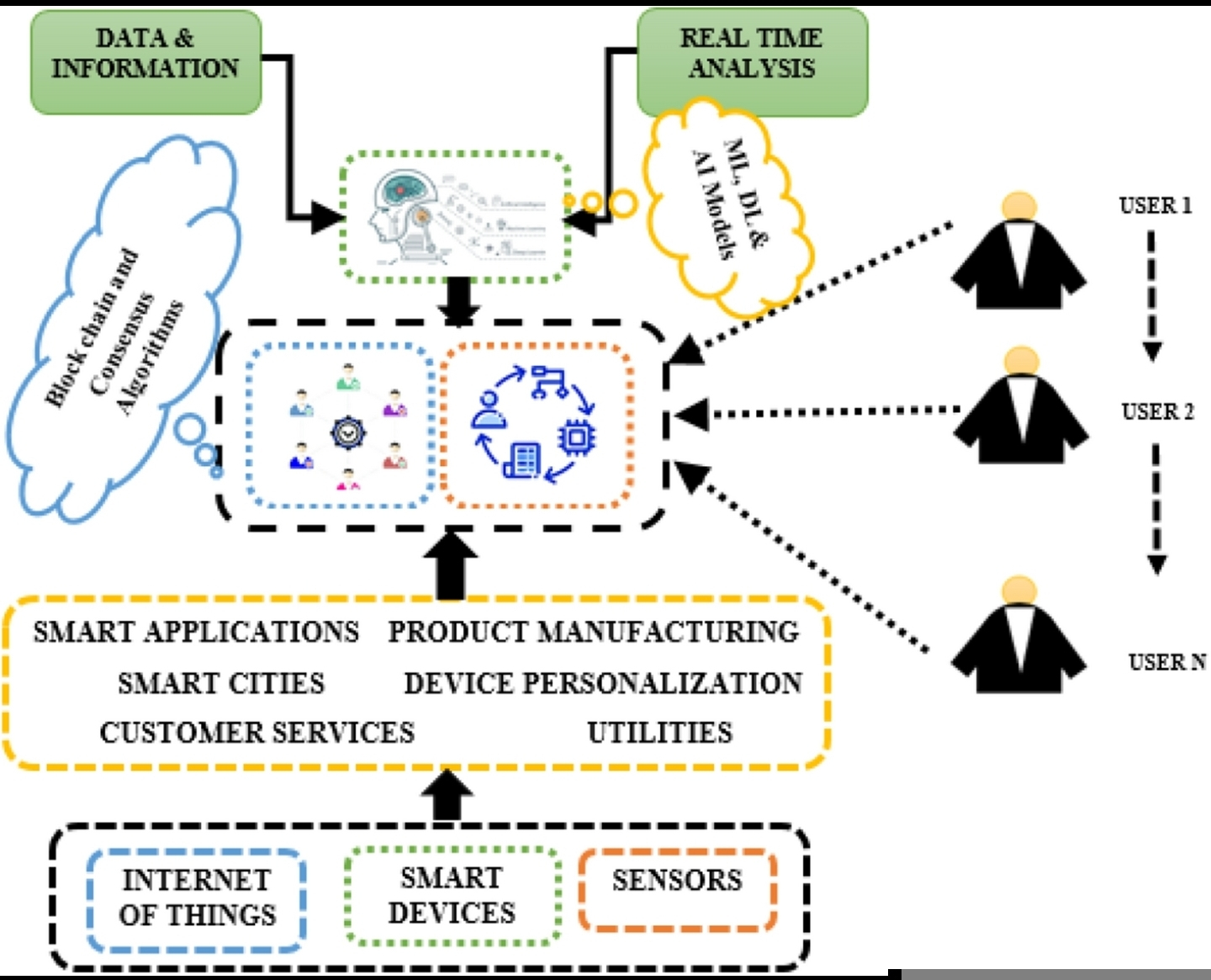

Value needs trust. Networks protect value with security systems. Bitcoin secures itself with proof of work that rewards miners for protecting the ledger. Ethereum now uses proof of stake where validators lock value to secure the network. A network with many independent nodes and strong security is harder to attack. Beginners should ask who secures the chain and how costly an attack would be. Strong security supports long term confidence

Narrative and adoption

Story and use grow together. Bitcoin has a narrative as digital gold which attracts savers and big investors. Ethereum has a narrative as a world computer which attracts developers and builders. These stories shape demand and investor interest. Adoption by wallets, exchanges, apps, and institutions shows the narrative is working. For beginners follow simple signals like growing user numbers and more apps built on the network

Conclusion

A token is worth what people believe it is worth and what the network actually delivers. Value comes from useful features, controlled supply, strong security, and a clear adoption story. Bitcoin and Ethereum show different mixes of these forces.