Spending time on Dusk’s mainnet forces a kind of uncomfortable pause. Not because something is broken, but because it feels fundamentally different from most chains people casually group under the RWA narrative. While the market chases velocity, hype cycles, and short-term catalysts, Dusk is quietly built around a single constraint that traditional finance never negotiates with: certainty.

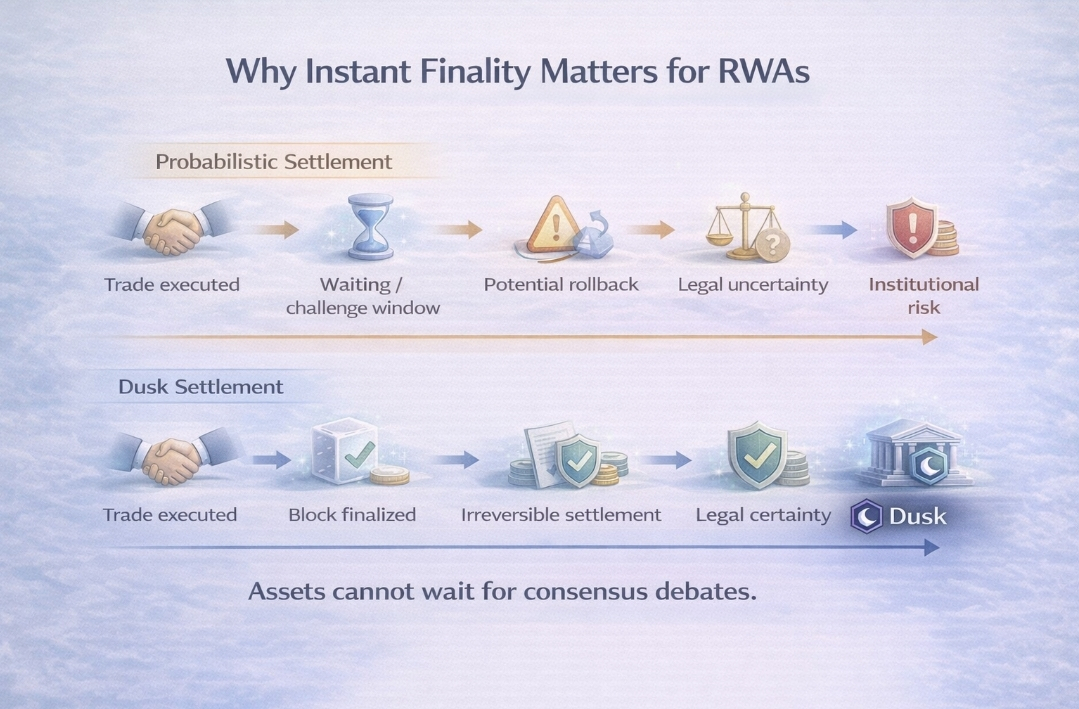

Instant finality is easy to dismiss if your reference point is retail trading. For most users, waiting a few minutes—or even hours—rarely feels existential. But in regulated finance, delayed or probabilistic settlement is not just inconvenient, it is legally dangerous. This is where Dusk separates itself from Ethereum Layer 2s. Fraud-proof windows, challenge periods, and rollback assumptions might work for DeFi arbitrage, but they collapse under real asset delivery. A seven-day withdrawal delay is not a UX problem; it is a compliance failure.

Dusk’s consensus design makes a clear trade. Once a block is finalized, it is done. No reorgs, no social recovery, no second guessing. That rigidity can look unfriendly from a decentralization purity lens, especially when node requirements are higher than what hobbyists expect. But from an institutional perspective, this rigidity is the product. Settlement that cannot be reversed is not a feature, it is the minimum requirement.

Privacy is where Dusk’s thinking becomes more nuanced. Many regulated chains solve compliance by building walls: permissioned access, closed validator sets, and heavy gatekeeping. Others swing to the opposite extreme and expose everything, hoping transparency will satisfy regulators by default. Dusk attempts a narrower path. With protocols like Citadel, compliance is proven without disclosing raw data. Identity checks resolve locally, zero-knowledge proofs attest correctness on-chain, and sensitive information never becomes a shared artifact. This aligns far better with real-world regulations like GDPR, where data minimization matters as much as auditability.

That said, the weaknesses are impossible to ignore. Ecosystem activity is thin. Developer tooling still feels early, sometimes frustratingly so. Dusk can seem empty in comparison to chains like Solana, where trying new things is rewarded with instant liquidity and attention.. Although $DUSK pays for execution and safeguards the network, emissions feel high in the absence of consistent transaction volume. Eventually, institutional usage must absorb that pressure for the argument to hold.. Until then, price action reflects uncertainty rather than conviction.

There is also a larger bet embedded here: that regulators will ultimately accept mathematical proof as legally meaningful. If that assumption fails, much of Dusk’s design loses its advantage overnight.

Still, in a market obsessed with noise, Dusk’s seriousness stands out. It feels less like a growth hack and more like a defensive infrastructure play. Not exciting, not fast-moving—but honest. And sometimes, that’s exactly what long-term systems are built on.