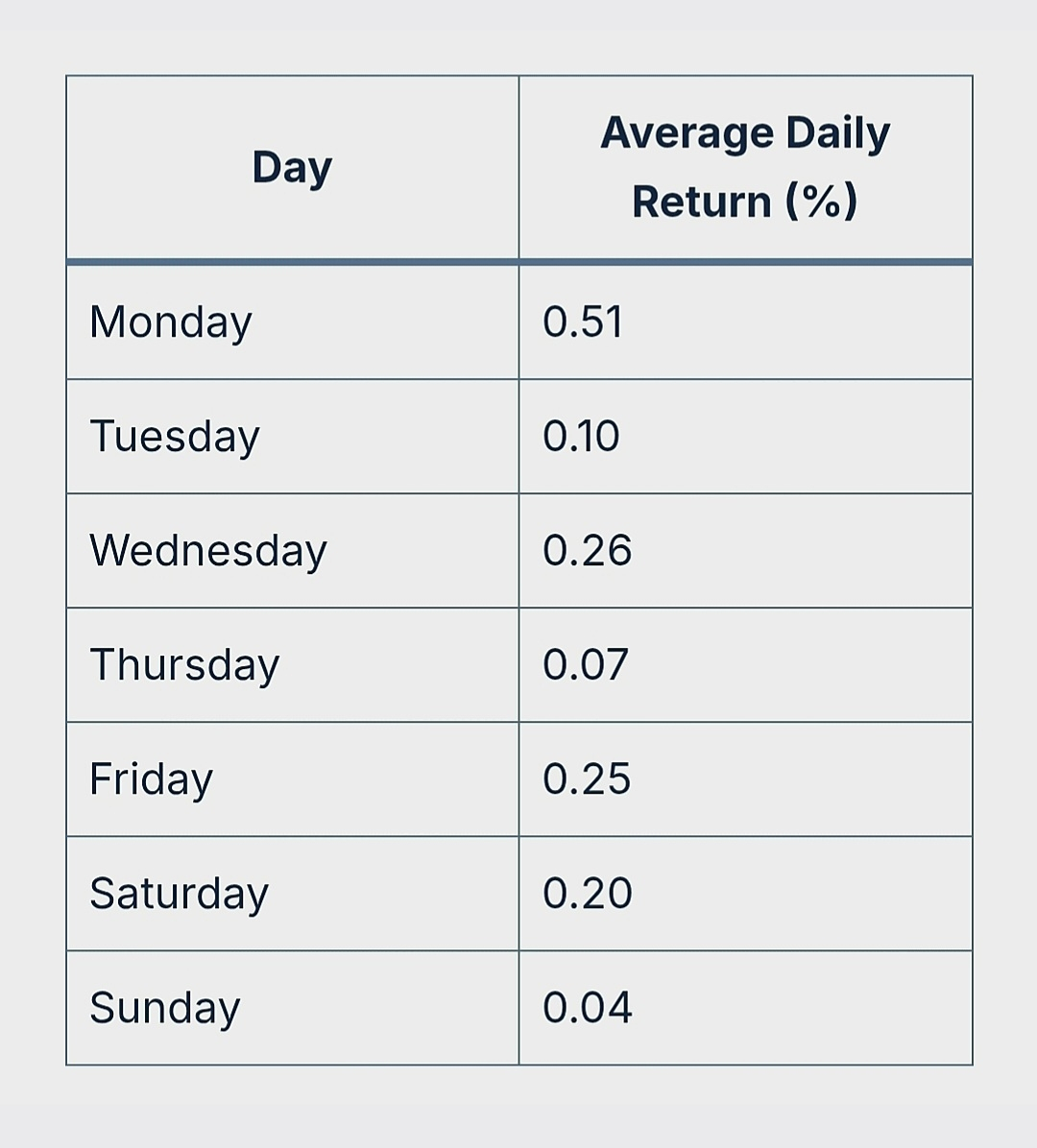

⬆️ As shown above, Monday stands out as the clear winner with an average daily return of 0.51%

This means that buying Bitcoin at the close on Sunday and holding it until the close on Monday has historically been the most profitable 24-hour period

Here is the average return per day of the week ⬇️

⬆️ This anomaly has often been referred to as part of the “Weekend Effect” — a well-documented phenomenon in both stock and crypto markets

The theory is that traders digest news and events over the weekend, and by Monday, market reactions are triggered, pushing prices upward.

Several potential reasons support this:

Lower liquidity on weekends:

Crypto markets operate 24/7, but fewer traders participate during weekends, leading to sluggish or erratic price action

Institutional activity resumes on Monday: When professional investors return on Monday, their buying may drive up prices

Retail psychology: Many retail traders and investors tend to act after the weekend when they have more time to analyze the market.

While the exact cause is hard to pinpoint, the pattern has been consistent for over a decade

Discover why Monday stands out as the most profitable day to buy Bitcoin—based on 11 years of historical performance ⬇️

How to Use This Data in Practice

Knowing the best day of the week to buy Bitcoin isn’t just an interesting statistic — it can inform actual trading and investment strategies

Here are three key takeaways:

Timing matters: Even in a long-term investment like Bitcoin, short-term timing can influence your returns

Buy Sunday evening (UTC time): Since the daily return is measured from close to close, entering the market late Sunday aligns you with Monday’s historically strong gains

Avoid Thursday entries: Historically, Thursday has shown the weakest performance, averaging only 0.07% — barely positive

This kind of Bitcoin day-of-week analysis is often used by algorithmic traders to build rules-based strategies

Are Some Days Better Than Others for Holding Bitcoin?

Beyond buying, some days offer better performance just for holding

While Monday leads in returns, Wednesdays and Fridays also show relatively strong average returns ⬇️

⬆️ Wednesday: +0.26%

⬆️ Friday: +0.25%

These may be ideal days to hold — or avoid selling — if you’re planning short-term exits

Conversely, if you’re looking to rebalance your crypto portfolio, doing so mid-week might yield better outcomes than early or late week

What About Saturdays and Sundays?

Despite crypto trading 24/7, weekend returns are surprisingly weak

Sunday in particular offers just +0.04%, making it the least favorable day for gains

Interestingly, this contrasts with some other asset classes where weekend gaps or closures affect behavior

Bitcoin’s price, though fluid, may reflect lower trading volume and investor interest during off-hours, causing weaker trends

Surprising Twist : Bitcoin Performs Better Early in the Week

What may surprise many is that early-week returns consistently outperform the rest of the week. In fact, if you simply divide the week in two:

Monday–Wednesday: +0.87% combined

Thursday–Sunday: +0.56% combined

This pattern isn’t just noise — it highlights a potential psychological or behavioral pattern across market participants

If you’re dollar-cost averaging into Bitcoin, consider skewing your purchases earlier in the week

Can This Pattern Change Over Time?

Yes ,Just like any market anomaly, the best day of the week to buy Bitcoin may evolve as more traders recognize and act on the pattern

Crypto markets are young and heavily influenced by narratives, sentiment, and macroeconomic factors

What’s worked historically doesn’t guarantee future performance — but it’s still a statistically sound edge worth knowing

A good rule of thumb: track your own entries and see how they align with these findings over time

🚸 Warning 🚸 I do not provide financial advice 🔞The intent of this content is for you to be aware of market conditions before starting to invest 👌Thank you for reading 👌

#WhenWillBTCRebound #BitcoinGoogleSearchesSurge #JPMorganSaysBTCOverGold #bitcoin