LET'S TALK ABOUT DUSK

If you have ever watched how people behave when money becomes public, you already understand why Dusk exists. The moment balances and transfers become a public performance, the whole experience changes. People get anxious. Businesses get defensive. Strategies get copied. Competitors start watching. Bad actors start hunting. Even honest users start feeling like they are being followed. Dusk is built for the opposite feeling. It is built to let finance move with privacy by default when it needs to, while still giving regulated systems a way to prove they are following rules when it truly matters. That is the emotional core of Dusk. It is not trying to make everything invisible for fun. It is trying to make financial infrastructure feel safe, normal, and usable for real institutions and real people.

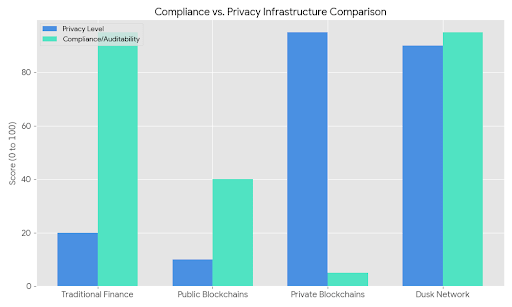

Dusk is a layer 1 blockchain founded in 2018 with a very focused mission: create a base network for regulated and privacy focused financial applications, compliant DeFi, and tokenized real world assets, where privacy and auditability are built in by design. The chain is designed around an idea that sounds simple but changes everything in practice. Privacy should not mean you cannot prove anything, and compliance should not mean you must reveal everything. Dusk’s documentation describes this as privacy by design, transparent when needed, meaning you can keep sensitive information confidential while still supporting controlled disclosure to authorized parties when required. If that sounds like a small detail, it is not. That is the difference between a system people can actually build regulated markets on, and a system that always stays stuck in experiments.

How it works is easier to understand when you picture Dusk as a strong base layer with modular layers on top. The base is called DuskDS, and it is described as the settlement, consensus, and data availability layer that everything else anchors to. This base layer is responsible for finality, security, and keeping the network honest. On top of it, Dusk supports execution environments where applications run, including an EVM style environment called DuskEVM and a WASM environment called DuskVM. The reason this modular approach matters is emotional as much as technical. Finance hates uncertainty. Developers hate building on shifting ground. With Dusk, the goal is that the settlement truth stays solid while app execution can expand, evolve, and scale without breaking the base rules that protect value.

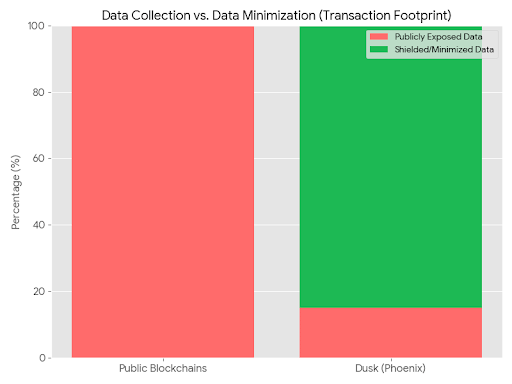

The privacy model is where Dusk starts to feel personal. DuskDS supports two transaction models: Moonlight and Phoenix. Moonlight is the transparent style for flows where public visibility is acceptable or required. Phoenix is the shielded style for confidential balances and transfers. What matters is the choice. If this happens where a user needs privacy because revealing a transfer could expose strategy, counterparties, or personal safety, Phoenix exists for that. If this happens where an institution needs transparent reporting for a specific flow, Moonlight exists for that. Dusk’s own overview frames this as dual transaction models that let users choose between public and shielded transactions, with the ability to reveal information to authorized parties when required. That design is aimed at the real world, where not every transaction should be public, and not every transaction can be fully hidden either.

Under the hood, Dusk ties privacy and verification together using zero knowledge proofs. I will keep this simple because the feeling is more important than the math. Instead of publishing your private data, you publish proof that you followed the rules. The network checks the proof, not your secrets. That is how Dusk tries to protect users from being exposed while still keeping the system trustworthy. If you care about regulated finance, this is a big deal, because the biggest fear institutions have is building on a system that cannot be audited, and the biggest fear users have is living on a chain where everything they do becomes permanent public history. Dusk is built to calm both fears at the same time.

Dusk’s network design is also built around reliability, because privacy and compliance do not matter if the chain feels fragile. The core node implementation is called Rusk, and Dusk describes it as the heart of the protocol. It combines the core contracts, networking components, and the protocol logic required to run the chain. DuskDS is powered by a proof of stake based consensus approach referred to as Succinct Attestation, and it uses a network layer called Kadcast to optimize message exchange between nodes. The docs describe Kadcast as a structured overlay that reduces bandwidth and makes latency more predictable compared to traditional gossip approaches. That predictability matters when you want finance to feel calm instead of chaotic. When markets move, nobody wants to wonder whether the network is going to lag, stall, or behave unpredictably.

DuskEVM is one of the clearest adoption moves Dusk has made, because it lowers the fear barrier for developers. DuskEVM is described as EVM equivalent, meaning it executes transactions using the same rules as Ethereum clients, so standard tooling can work without special rewrites. It is built on the OP Stack and is designed to inherit security and settlement guarantees from DuskDS. In human terms, this is Dusk saying: I want builders to feel at home, but I also want them to have a settlement layer that was built for regulated assets and privacy aware workflows. If this happens where teams want to build familiar smart contracts but need a foundation that is built for finance, DuskEVM is meant to be that bridge.

Now let’s talk about the DUSK token, because this is where the network stops being an idea and becomes an economy with real incentives. DUSK is used for staking, rewards, and network fees. If you want to participate in securing the network, you stake DUSK. If you want to use the network, you pay fees in DUSK. The tokenomics documentation states a maximum supply of 1,000,000,000 DUSK, combining an initial 500 million supply with another 500 million emitted over time as staking rewards over a long schedule. It also explains that users can migrate older token representations to native DUSK via a burner contract now that mainnet is live. The point here is long term security. A serious financial base layer needs incentives that do not disappear after the first wave of attention.

Fees are kept understandable in a practical way. Dusk uses gas to measure work, and the tokenomics page explains that gas is priced using a small unit called LUX, where 1 LUX equals 10 to the minus 9 DUSK. I know that sounds tiny, but that is the point. It allows fees to be expressed smoothly for different transaction sizes without forcing awkward decimals everywhere. If this happens where activity grows and more applications run, fees remain a consistent mechanism that ties real usage to token demand.

Staking is also designed around participation and responsibility. The consensus process uses roles and committees, and rewards go to the participants who actually help produce and finalize blocks. The same tokenomics documentation also describes soft slashing, where repeated faults can penalize or suspend a stake from being selected and earning, without automatically burning the stake. That creates a strong incentive to stay reliable. If this happens where operators get careless, the system pushes them out of the critical path until they fix their behavior. For regulated infrastructure, that kind of discipline matters, because reliability is not a nice to have, it is the entire product.

Adoption in regulated finance is not about hype. It is about trust, operational maturity, and proof that the network keeps running when real pressure shows up. Dusk’s mainnet went live on January 7, 2025, and their own announcement frames it as the beginning of a longer roadmap focused on on chain finance and participation through staking and running nodes. That date matters because it is the point where Dusk became a live settlement network, not just a whitepaper concept.

Operational honesty matters even more than perfect marketing, especially when money is involved. On January 16, 2026, Dusk published a Bridge Services Incident Notice stating that DuskDS mainnet was not impacted and continued operating normally, while bridge services were paused during a broader hardening pass. I bring this up because this is what real infrastructure looks like. Problems happen around the edges, and what matters is containment, transparency, and a clear focus on protecting users and the network. If this happens again in the future, the emotional question people will ask is simple: do I trust this team to handle risk like adults. These kinds of notices are one of the few real signals that answer that question.

When I zoom out, Dusk feels like it is built for the moment Web3 stops being loud and starts being useful. It is built to let people move value without feeling watched, while still making room for the accountability regulated systems cannot escape. It is built so developers can build without fear, institutions can participate without reputational suicide, and users can keep dignity intact while still living in a system that can prove it is fair. If Web3 is going to carry real assets, real markets, and real financial lives, privacy plus auditability is not optional. It is the missing foundation. And that is why Dusk matters. It is not chasing attention. It is chasing the future where on chain finance feels safe enough for the world to actually use.