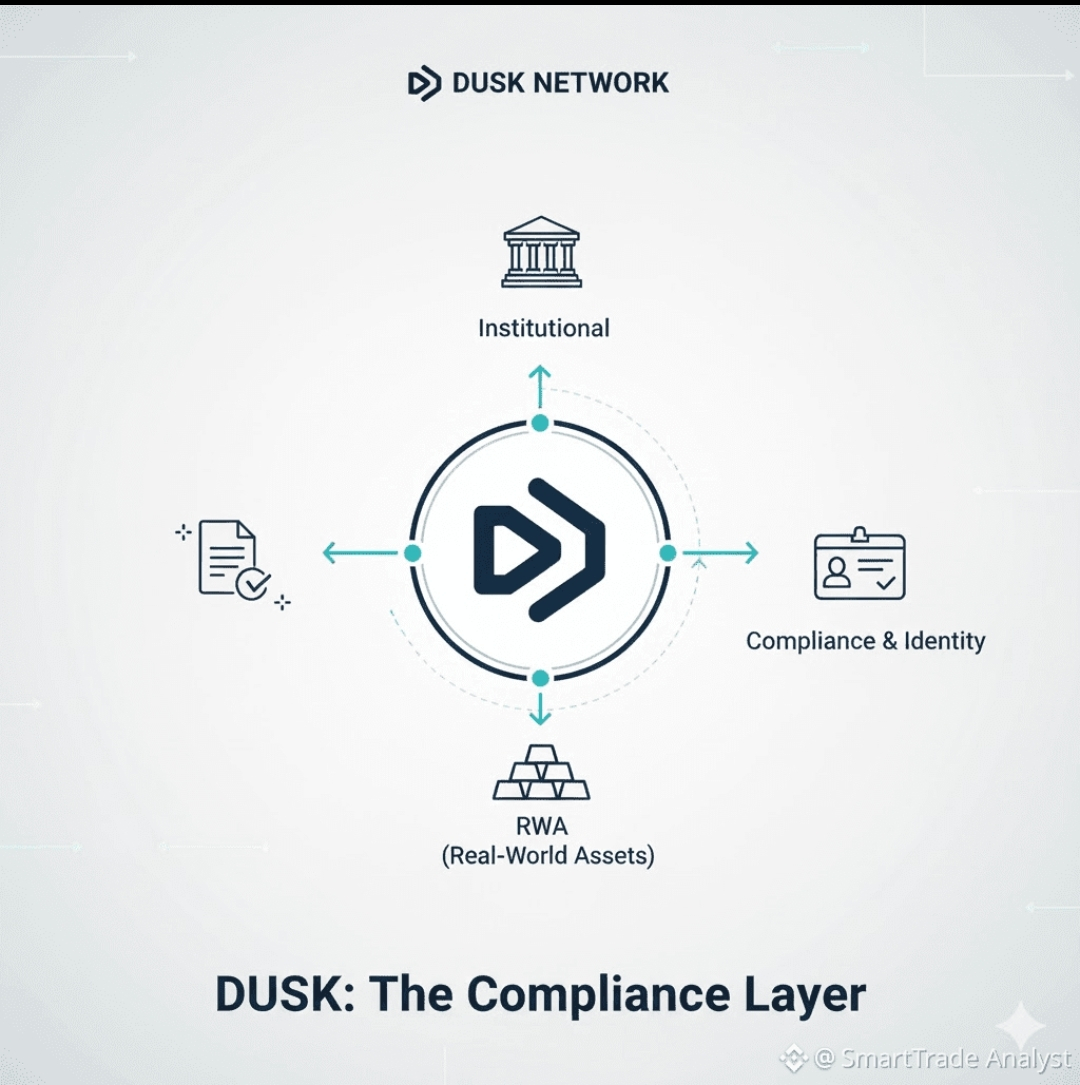

There’s a quiet kind of anxiety that sits underneath modern finance. Not the dramatic kind people talk about on TV, but the everyday tension institutions live with: “We need transparency to earn trust—yet if we reveal everything, we expose ourselves.” A fund doesn’t want the market watching its positions in real time. A bank doesn’t want counterparties mapped like a public social graph. A tokenized bond shouldn’t leak who holds it, at what size, and when they move it. And still—regulators, auditors, and compliance teams must be able to prove the system is fair, rules are enforced, and misconduct can be investigated. This is the emotional knot Dusk tries to untangle: the fear of exposure and the need for accountability, at the same time, without pretending one can simply be sacrificed for the other.

#

Dusk, founded in 2018, positions itself as a layer-1 blockchain built specifically for regulated and privacy-focused financial infrastructure. In plain terms, it’s not trying to be everything for everyone; it’s trying to be the place where finance can actually breathe on-chain—where sensitive activity isn’t automatically broadcast to the world, and where “compliance” isn’t an afterthought taped onto a product at the last minute. That focus gives it a different personality than most chains. The ambition is not just faster swaps or cheaper transactions; it’s to recreate the conditions that real markets require to function: confidentiality, enforceable policy, and credible audit trails.

To appreciate why this matters, imagine the difference between walking into a bank and walking into a glass house. In most public blockchains, you’re in the glass house. Addresses, balances, transfers, and flows can be traced, clustered, and analyzed endlessly. Even when identities aren’t directly named, patterns form quickly—especially for institutional actors with distinct transaction behavior. That’s not just a “privacy concern”; it’s a structural risk. It invites front-running, strategy copying, predatory surveillance, reputational exposure, and in some cases regulatory complications when sensitive data becomes effectively public. Institutions don’t hesitate because they’re old-fashioned; they hesitate because they understand what it means to conduct finance with the curtains permanently pulled open.

Dusk’s design responds to this by making privacy a native capability, but not in a naïve “hide everything forever” way. A crucial psychological barrier for regulated finance is the fear that privacy equals lawlessness. Many privacy-first systems struggle here because they can’t easily support controlled visibility. Dusk pushes a more balanced idea: privacy for the crowd, but auditable truth when it matters. That’s the difference between a dark room and a room with secure blinds—private by default, but not beyond oversight. The chain’s transaction design supports both transparent transfers (useful when visibility is intended or required) and shielded transfers (useful when confidentiality is essential). The strategic benefit is flexibility: different asset classes, jurisdictions, and institutional workflows can choose the right confidentiality level without leaving the same settlement layer.

This duality isn’t just “features”; it’s a statement about how money behaves in the real world. Some things must be public proof of reserves, public disclosures, certain reporting flows. Other things must remain private positions, counterparties, and the timing of strategic movements. Markets aren’t built on radical transparency; they’re built on selective transparency. Dusk’s core bet is that the only way regulated on-chain finance becomes more than a marketing phrase is if selective transparency is baked into the foundation rather than outsourced to off-chain agreements and manual processes.

The modular architecture reinforces this intent. Institutional finance doesn’t tolerate vague settlement guarantees. Post-trade realities are unforgiving: a trade settles or it doesn’t; ownership changes or it doesn’t; obligations are discharged or they aren’t. Dusk emphasizes the idea of a settlement layer that anchors truth finality, security, and consistent state while enabling execution environments above it to host application logic. That division matters emotionally for risk teams, too. Risk committees don’t want “innovative code” to be the same thing as the thing that guarantees settlement. They want a stable base that can be reasoned about, monitored, and defended, while application layers evolve with market needs.

Under the hood, privacy at this level depends on cryptography that can carry the weight of real throughput. It’s one thing to prove something privately in a lab; it’s another to do it at scale, repeatedly, with predictable cost and verification performance. Dusk’s approach leans on zero-knowledge proof systems and ZK-friendly primitives so that confidential transactions can be verified efficiently. That detail is more than technical: it’s what determines whether privacy becomes normal behavior or remains a novelty that only a few users can afford. If private transfers are slow or expensive, traders won’t use them; if they won’t use them, institutions won’t trust the chain’s “privacy” claims; if institutions don’t trust it, the entire regulated finance narrative collapses. Performance here is not vanityit’s credibility.

And credibility is the real currency Dusk is chasing. “Compliant DeFi” isn’t simply DeFi with a checkbox; it’s DeFi that can enforce eligibility, restrictions, disclosures, and audit processes without destroying composability. In today’s ecosystem, compliance often fragments liquidity because each application invents its own identity gate, its own permission model, and its own reporting logic. That creates a maze where integrations are brittle and onboarding becomes a repeated ordeal. Dusk’s philosophy suggests that if compliance primitives and selective disclosure are standardized at the infrastructure level, institutions can move with less fear: fewer bespoke integrations, fewer one-off legal interpretations, fewer manual reconciliations. When you’re an institution, fear isn’t abstract it’s measured in operational risk, reputational risk, and regulatory risk. Anything that reduces that fear while keeping the benefits of programmability becomes genuinely attractive.

This is especially true for tokenized real-world assets. RWAs aren’t memes; they are legal obligations, ownership records, restrictions on transfer, corporate actions, and reporting requirements. Tokenizing them isn’t just “putting them on a chain,” it’s reproducing the guarantees that make them meaningful. Without privacy, holders might be unwilling to participate. Without auditability, regulators and auditors won’t allow it. Without enforceable rules, issuers can’t manage distribution responsibly. Dusk’s positioning speaks to this full lifecycle: not only “issue a token,” but “run an asset in a way that survives real scrutiny.”

Even the economics of the network reflect a long, institutional timeline. Dusk designs staking incentives and emissions to support network security over many years, which signals it expects adoption to grow gradually rather than explode overnight. That can be comforting to serious builders it suggests a project planning for durability rather than a short-term spike but it also creates a non-negotiable pressure: the network must earn genuine demand. Long-term emissions can weigh on a token if usage, fees, and real utility don’t expand to match the security budget. The chain’s future, therefore, is not only about cryptography; it’s about proving that regulated finance truly wants what Dusk is selling.

And that brings us back to the human sidebecause even in institutions, decisions aren’t made by cold algorithms. They’re made by people who have to sign off, who have to answer questions, who have to defend choices when something goes wrong. In finance, a single operational failure can destroy trust that took years to build. That’s why incident handling, operational security, and transparency during disruptions matter as much as protocol design. Institutions don’t just evaluate tech; they evaluate maturity. They ask: does this team respond like infrastructure people or like hobbyists? Do they communicate clearly? Do they contain risk quickly? Do they prioritize user protection? Dusk’s public communications around operational issues underscore how seriously that dimension must be taken if the goal is regulated adoption.

So the most honest analytical way to describe Dusk is this: it’s building a bridge between two worlds that rarely agree with each other. On one side is the crypto-native ideal of open networks and composable code. On the other is the reality of regulated markets that demand confidentiality, policy enforcement, and auditable truth. Dusk is trying to make that bridge feel safe enough to cross not just technically, but emotionally, for the people responsible for compliance, risk, and reputation. If it succeeds, it won’t be because it shouted the loudest; it will be because it reduced the fear that keeps serious capital and serious assets off-chain. And if it struggles, it will likely be because this is the hardest arena in crypto: you’re not only building a chain you’re trying to earn the kind of trust that finance gives slowly, and takes back instantly.