Most discussions around new blockchains still start with performance. Faster blocks, higher throughput, more parallel execution. Speed is easy to market, and in good conditions, it feels impressive. But speed only matters when nothing goes wrong. Real financial systems are judged on something else entirely: how they behave when things break.

That’s where Plasma feels fundamentally different.

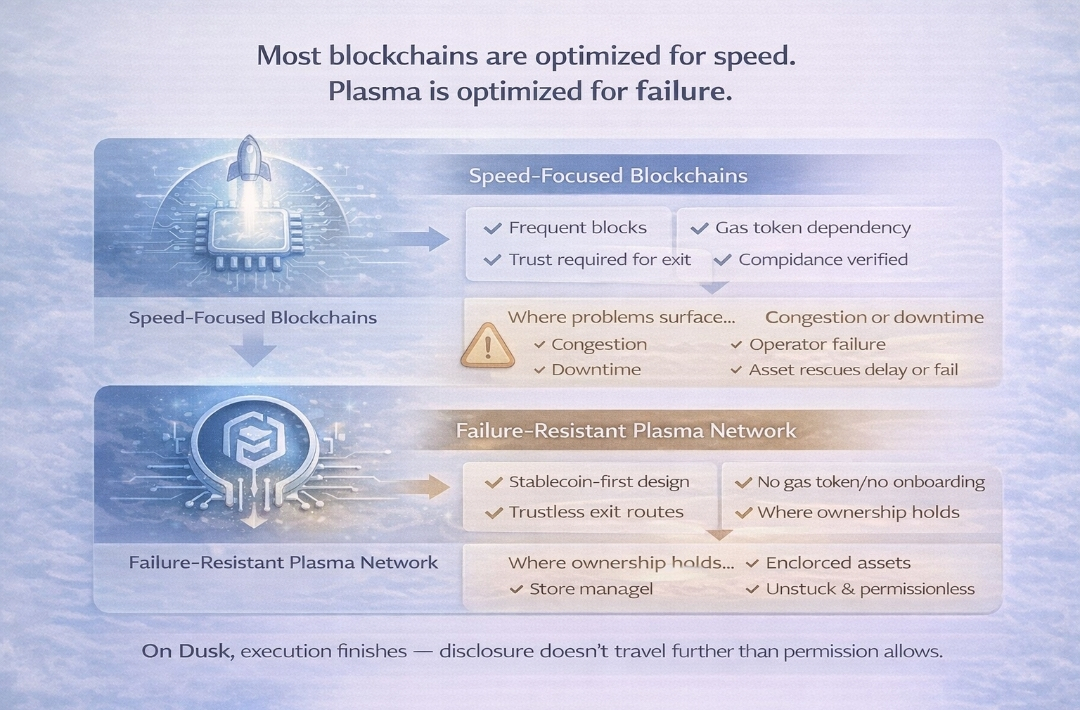

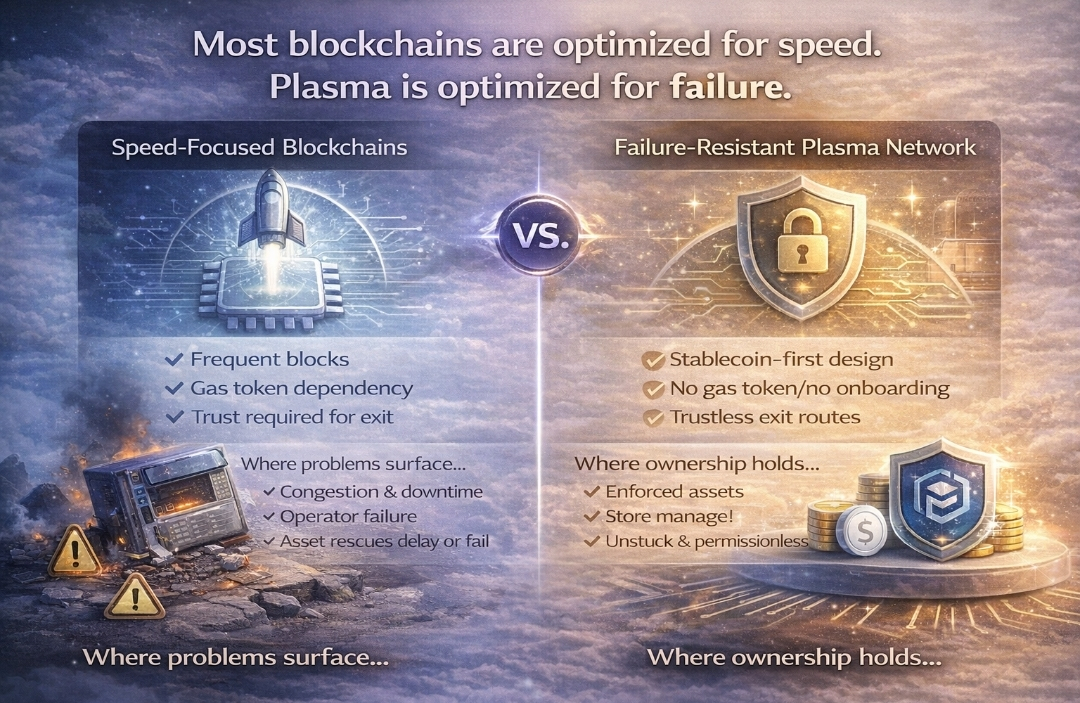

Plasma doesn’t appear to be designed for perfect conditions. It’s designed for failure. That sounds pessimistic, but in payments and settlement infrastructure, it’s actually the most honest starting point. Operators go offline. Validators fail. Networks experience congestion. Users make mistakes. The question isn’t whether these things happen, it’s whether the system still protects ownership when they do.

Plasma starts from the assumption that stablecoins are the real workload. Not speculative assets bouncing between wallets, but dollar-denominated value moving from fiat entry points into real usage. Remittances, merchant payments, treasury flows. In that context, UX matters, but predictability matters more. People don’t want to manage gas tokens or time transactions. They want money to move and remain usable.

That’s why Plasma strips away a lot of the usual friction. Stablecoin-first design, gas abstraction, and fast settlement are not presented as features, but as baseline requirements. If a payment rail demands constant attention from the user, it’s already failed its job.

Where Plasma really differentiates itself is in how it treats guarantees. Many chains work well until an edge case appears. Then users discover that finality was conditional, exits were social, or recovery depended on trusted intermediaries. Plasma builds exits and recovery into the system itself. Assets are meant to remain anchored and permissionless even under stress, without relying on goodwill or emergency governance.

This matters because stablecoins are increasingly being treated like money. And money systems are not judged by how exciting they are when markets are calm, but by how they behave during disruptions. When something goes wrong, who still owns what? Can value be reclaimed? Does settlement hold?

Plasma seems to be answering those questions directly, rather than hoping they never come up.

There’s a quiet confidence in that approach. It doesn’t try to compete for every use case. It doesn’t promise infinite composability or endless narratives. It focuses on one thing: making stablecoin value movement boring, predictable, and resilient.

If stablecoins really are becoming the connective tissue between crypto and the real economy, then infrastructure that optimizes for failure rather than perfection starts to look less conservative and more necessary.

Plasma isn’t trying to win attention in good times. It’s trying to hold up when conditions aren’t ideal. And for payment-grade systems, that’s the only moment that truly matters.