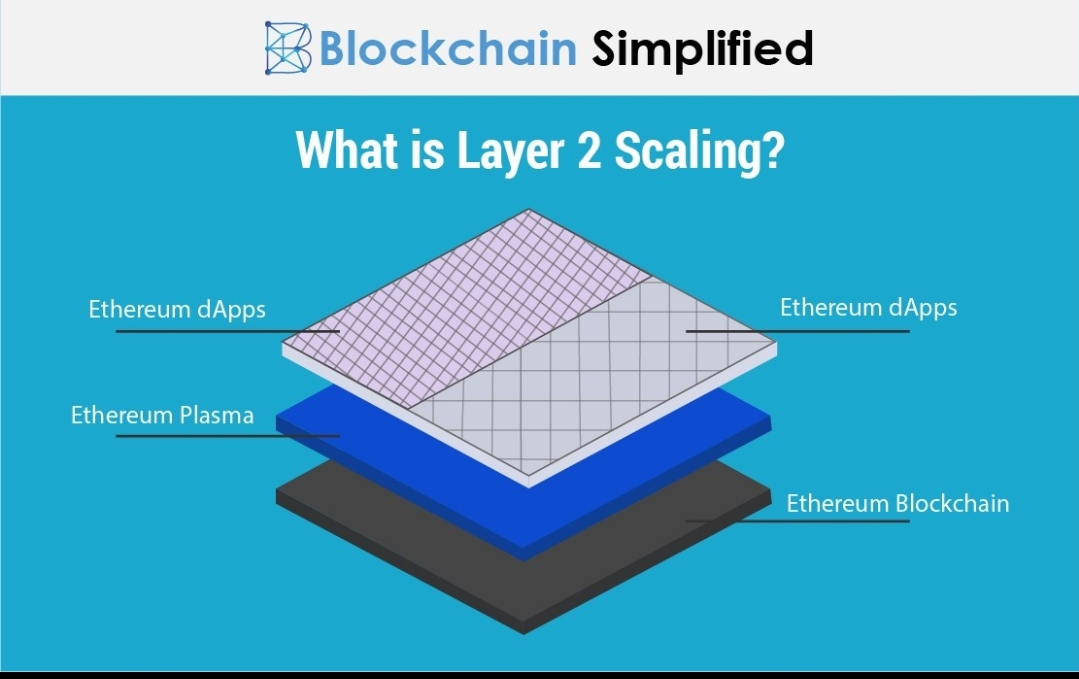

Plasma isn’t exciting in the way newer scaling ideas are. It doesn’t come with constant announcements or dramatic performance charts. But it was born from a very grounded realization: if the main blockchain has to do everything, it will eventually fail at being usable. Instead of forcing every small action onto a crowded base layer, Plasma lets most activity happen elsewhere, while still anchoring everything to the security of the main chain.

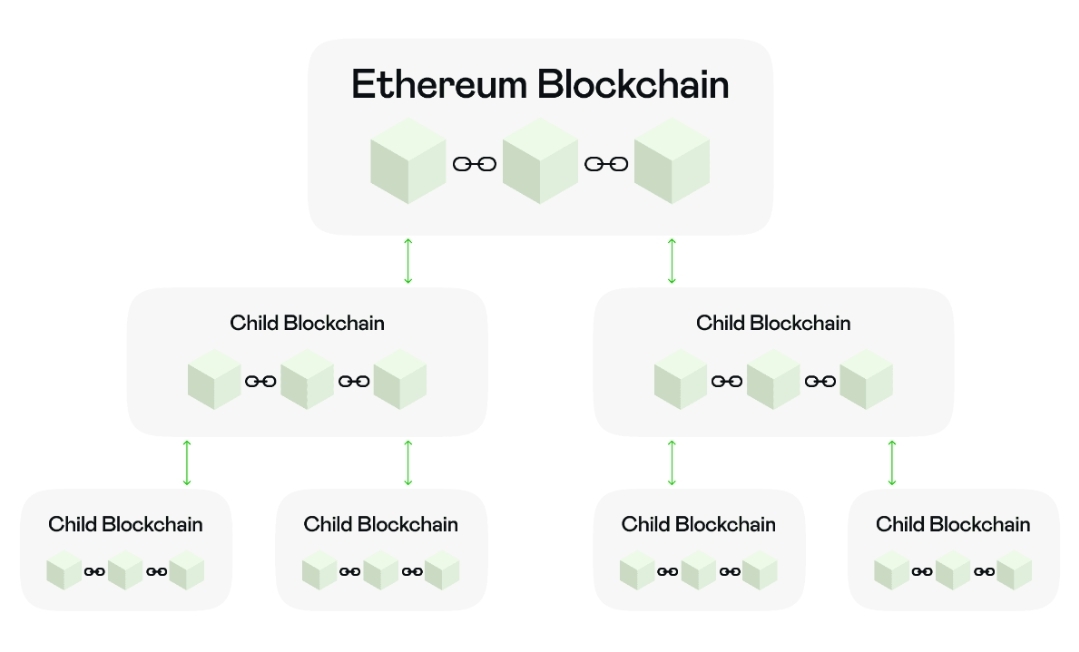

When I explain Plasma to friends who aren’t technical, I don’t talk about proofs or commitments. I explain it like this: imagine a city where every single errand requires permission from city hall. Buying groceries, paying rent, lending a book. It would collapse under its own weight. Plasma creates neighborhood-level systems where daily life happens freely, while city hall exists only to keep things fair and step in if there’s a dispute. That’s really the heart of it.

What makes Plasma interesting even today is not what it promises, but what it avoids promising. It doesn’t try to be the perfect solution for every use case. It doesn’t pretend that all activity needs to be equally complex. It accepts that most blockchain usage, if adoption ever becomes real, will be repetitive, small-scale, and frankly boring. Payments, transfers, simple interactions. The kind of things people do without thinking.

In my experience watching stablecoin usage in the US, especially among people sending money to family, this pattern is obvious. Transfers are frequent and relatively small. When fees spike unpredictably, people don’t complain on social media. They quietly stop using the tool. Plasma-style systems align naturally with this behavior because they reduce how often users need to touch the congested base layer. You don’t feel the friction every time you move value.

The same logic becomes even clearer in countries dealing with inflation. People there aren’t experimenting with advanced financial tools. They’re protecting purchasing power. They move funds often, sometimes daily, because holding still feels risky. In that environment, low and predictable costs matter more than flexibility or composability. Plasma doesn’t solve every problem, but it solves this one well.

One aspect of Plasma that I’ve always respected is how it handles failure. It assumes that systems can break, operators can misbehave, and things can go wrong. Instead of denying that reality, it builds an escape hatch. Users can exit back to the main chain if they need to. That idea sounds technical, but psychologically it’s huge. Knowing you’re not trapped changes how comfortable you feel using a system. After watching centralized platforms collapse over the years, that design choice feels quietly wise.

Of course, Plasma isn’t flawless. It can be confusing. Exit mechanisms aren’t always intuitive, especially for users who don’t want to think about security assumptions. If the interface isn’t designed well, people may not even realize what options they have. Plasma also isn’t ideal for applications that rely on lots of smart contracts constantly interacting with each other. It favors efficiency and simplicity over complexity, and that trade-off is real.

But over time, I’ve stopped seeing that as a weakness. Not everything needs to do everything.

Earlier in my crypto journey, I was obsessed with finding the “best” solution. The fastest chain. The most decentralized architecture. The most advanced design. Years later, my thinking has shifted. Now I care more about fit. What problem is this system actually trying to solve, and who is it for?

Plasma feels like it was built for people who just want things to work. No drama. No surprises. No sudden fee spikes that make you rethink a simple action. It’s not trying to win arguments on technical forums. It’s trying to reduce friction in everyday use.

I don’t think Plasma will ever dominate conversations again, and honestly, that’s probably a good thing. The future of blockchain infrastructure doesn’t look like one solution replacing all others. It looks like layers and tools, each doing a specific job well. Some systems will handle complex financial interactions. Some will focus on experimentation. Others will quietly move value from one place to another without anyone noticing.

Plasma belongs in that quieter category. Not as a headline-grabber, but as a reminder that scaling isn’t about numbers on a dashboard. It’s about how people feel when they use a system. Whether they hesitate before clicking send. Whether they trust that they can leave if something feels wrong. Whether the tool fades into the background instead of demanding constant attention.