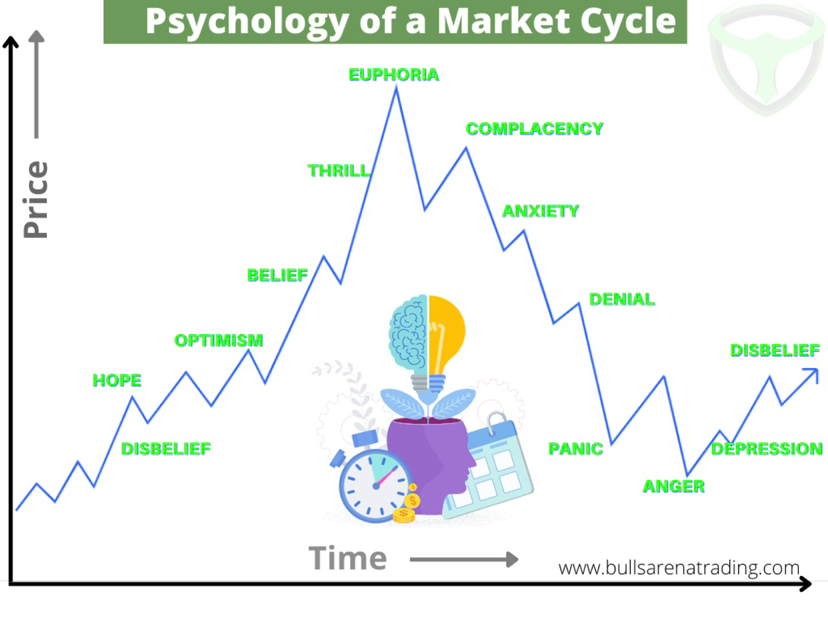

Every market crash creates the same human reflex. People stop asking what is happening and start asking one thing only. Where is the bottom. It sounds logical. It feels smart. It gives emotional comfort. If you know the bottom you feel safe. But markets have never respected this need for comfort.

The dangerous part is not guessing wrong. The dangerous part is thinking that a single number can save you. Markets do not form bottoms because people agree on them. Markets form bottoms when most people are emotionally exhausted and mentally broken.

Every cycle shows this clearly. When everyone starts saying the same price that price becomes fragile. Not because it is wrong. But because too many traders are positioned around it. The market does not like crowded ideas. Crowded ideas become liquidity.

Right now the obsession with the bottom is louder than the discussion about structure. People are quoting moving averages. Past cycle highs. Old support zones. Everyone has logic. Everyone sounds confident. That is exactly what makes this phase dangerous.

A real bottom is rarely loud. It does not come with viral tweets or confident threads. It arrives quietly when nobody wants to talk anymore. When traders stop sharing charts. When timelines become empty. When hope disappears slowly not in one big candle.

Another mistake people make is mixing price with damage. The biggest damage in drops like this is not the percentage. It is the behavior change. Traders become impatient. They overtrade. They revenge trade. They force setups that are not there. That internal damage lasts much longer than the price move itself.

Markets punish emotional urgency. The need to act. The fear of missing the bottom. This fear pushes people to size up too early. To buy weakness without confirmation. To ignore time as a factor. Time is what creates real bottoms not price alone.

This is why calling bottoms kills portfolios slowly. You anchor your mind to a number. When price breaks it you panic. When price bounces you feel smart. When price ranges you bleed through bad decisions. The market does not trend just to respect your conviction.

Strong traders do something boring here. They observe. They reduce activity. They wait for clarity in structure not in opinions. They accept uncertainty instead of fighting it. This is uncomfortable. Most people cannot do this. That is why few survive these phases with capital and confidence intact.

There is no hero move in markets like this. No single buy candle. No perfect tweet. The real edge is not losing your discipline while others lose theirs. The market always rewards patience after it finishes punishing impatience.

If you feel frustrated confused or tired right now that is normal. That feeling is part of the process. Just remember. Markets do not care where you think the bottom is. They care how you behave while searching for it.

That difference decides who survives and who slowly disappears.

#BullMarketJourney #BearMarketAnalysis #crypto #BTC走势分析 #btc70k