🚨 Is Silver the Most Mispriced Asset Right Now?

For months, I’ve been watching silver closely.

The numbers are starting to look too attractive to ignore.

Not hype. Not emotion.

Just data.

And one thing stands out clearly:

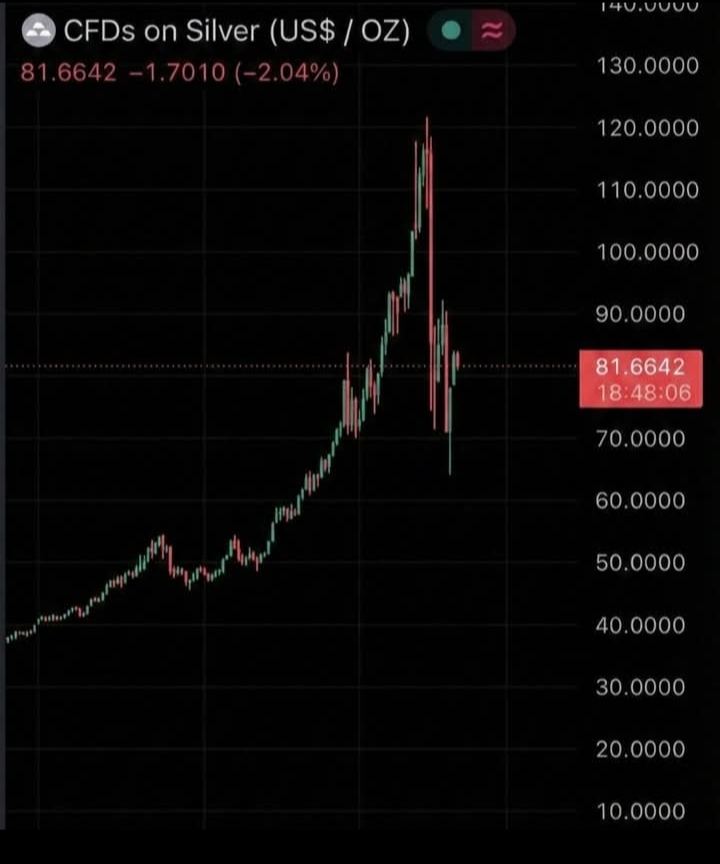

The gap between paper silver and physical silver has reached extreme levels.

Something is building under the surface.

⚔️ The Hidden East vs West Battle

Most retail investors think China wants silver to explode higher.

That’s not necessarily true.

China is the world’s manufacturing powerhouse.

Solar panels, EVs, electronics — they all require physical silver.

If silver jumps sharply above $50, Chinese industrial margins shrink fast.

So from a strategic perspective, keeping silver cheap benefits their production engine.

Meanwhile, reports suggest a major Chinese fund is heavily short silver — while being long physical gold.

That’s a spread trade.

Gold up. Silver capped.

But spreads don’t stay stretched forever.

🇺🇸 The U.S. Angle: A Different Incentive

Silver has now been labeled a critical mineral in the United States.

Here’s the problem:

If silver remains too cheap, U.S. domestic production can’t compete with lower overseas costs.

That creates a policy conflict.

Cheap silver helps importers.

Expensive silver helps domestic production.

That tension matters long term.

🌍 The Bigger Picture: Gold Revaluation

Globally, sovereign debt is exploding.

BRICS nations are rotating into hard assets.

Europe needs stronger central bank balance sheets.

The U.S. is sitting on massive debt levels.

Historically, gold revaluation has been used as a monetary reset mechanism.

If gold is repriced higher to strengthen balance sheets, silver historically follows — often violently.

📦 The Supply Question

Shanghai silver inventories are reportedly at multi-year lows.

Physical demand continues.

Paper markets can suppress price temporarily.

But when delivery pressure rises, short positions get squeezed.

Markets eventually reconcile paper and physical reality.

🔄 Gold/Silver Ratio Setup

If gold rises sharply and silver stays artificially suppressed, the ratio stretches.

Extreme ratios rarely last.

Either gold falls…

Or silver snaps higher.

History shows silver tends to move later — but faster.

🏦 Final Thought

Metals are not a “get rich tomorrow” trade.

They’re generational stores of value.

And if you believe in holding hard assets during monetary shifts, physical ownership matters more than paper exposure.

Because in real systemic stress:

If you don’t hold it, you don’t truly own it.