A second White House–brokered meeting between cryptocurrency industry leaders and banking representatives aimed at advancing U.S. crypto market structure legislation ended without a final agreement, as divisions over stablecoin provisions persist.

The closed-door discussion focused on resolving disagreements around stablecoin-related language in the proposed market structure bill. While participants described the talks as constructive, no compromise has yet been reached.

“Productive session at the White House today — compromise is in the air,” said Stuart Alderoty, who attended the meeting, in a post on X. “Clear, bipartisan momentum remains behind sensible crypto market structure legislation. We should move now — while the window is still open.”

Stablecoin yield remains key sticking point

U.S. lawmakers are seeking to pass comprehensive legislation clarifying how regulators oversee digital assets and assigning jurisdictional boundaries. The House passed the CLARITY Act in July, but progress has stalled in the Senate, where bipartisan support remains insufficient.

Momentum slowed further last month after Coinbase withdrew its support, citing concerns over provisions that would ban all yield payments tied to stablecoins. Banking groups argue that allowing stablecoin yields—particularly when offered through third-party platforms such as exchanges—could threaten bank deposits and undermine financial stability.

Tuesday’s meeting marked the second White House–hosted session in two weeks bringing together banks and crypto firms. The first, held on Feb. 2, was described as “constructive” and “fact-based” by Patrick Witt.

Banks, crypto industry call for further talks

Dan Spuller said the latest meeting was a “smaller, more focused session” centered on problem-solving, with stablecoin rewards emerging as the main point of contention.

“Banks did not come to negotiate from the bill text, instead arriving with broad prohibitive principles,” Spuller said, calling that approach a key obstacle to progress.

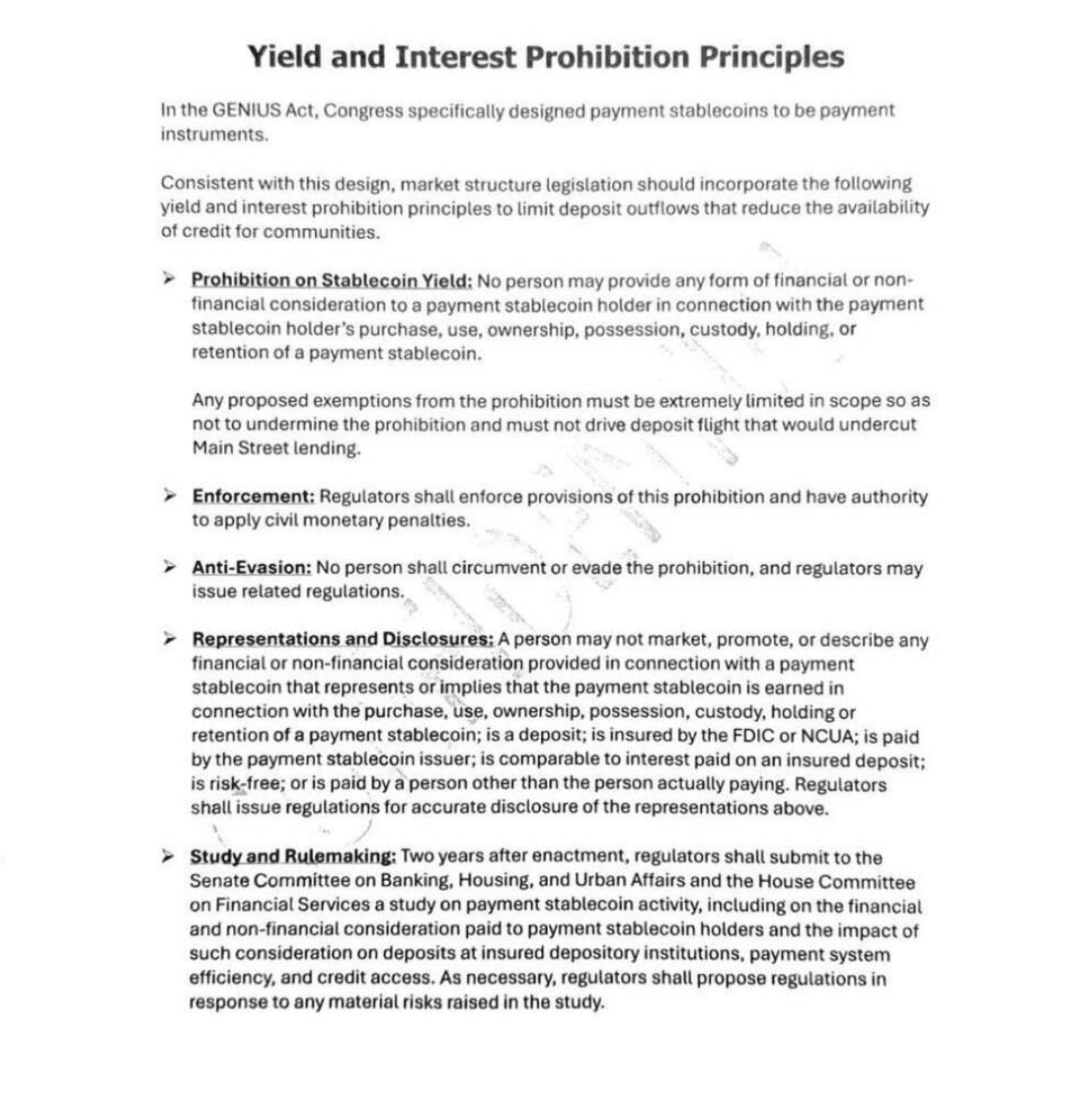

According to reports, banking representatives circulated a handout advocating “yield and interest prohibition principles” to be incorporated into the Senate’s version of the bill, reinforcing their push for a blanket ban on stablecoin yield.

Three major banking trade groups—the American Bankers Association, the Bank Policy Institute, and the Independent Community Bankers of America—said in a joint statement that “ongoing discussions” are needed to move the legislation forward. They emphasized that any framework should support innovation without compromising financial safety or bank deposits.

Calls to separate market structure from stablecoin yield

Some crypto executives urged lawmakers to decouple the stablecoin yield debate from broader market structure reforms. Mike Belshe said both sides should stop revisiting the GENIUS Act, which already restricts stablecoin issuers from paying yield directly.

“That battle was fought,” Belshe said. “Market structure has nothing to do with yield on stablecoins and must not be delayed further.”

While the talks signal continued engagement between regulators, banks, and the crypto industry, the lack of agreement underscores the challenges lawmakers face in finalizing stablecoin rules within a broader crypto market structure bill.