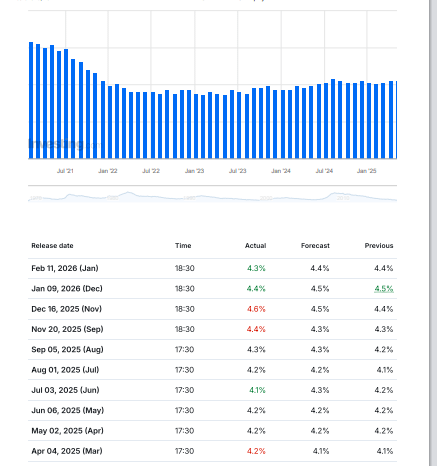

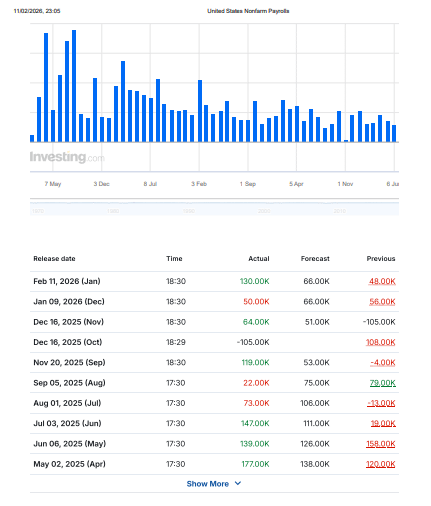

The U.S. unemployment rate and Non-Farm Payrolls (NFP) dropped today —

and markets reacted instantly

Not because of hype

But because macro direction just got clearer

📊 What the Jobs Data Really Signals

Jobs data isn’t just about employment

It’s about pressure on policy

When unemployment trends higher and payroll growth cools:

• Growth expectations soften

• Rate-cut odds rise

• Liquidity assumptions change

📌 That’s why every major asset reacts — differently $BERA

🟡 Impact on Gold

Gold moved first — as it usually does

• Softer jobs data = economic uncertainty

• Uncertainty = demand for protection

• Protection = Gold bids

Gold doesn’t chase growth

It prices stress and policy shifts

This move wasn’t emotional — it was macro-driven $STG

📉📈 Impact on Stocks

Stocks showed mixed reactions

Why?

• Weak data hurts earnings outlooks

• But helps rate-cut expectations

📌 That creates volatility not clarity

Markets are now balancing

➡️ Slower growth

➡️ Potentially easier policy

Stocks need confirmation — not guesses$ZRO

₿ Impact on Crypto

Crypto sits in the middle of this shift

Short term

• Volatility spikes

• Traders react emotionally

Long term:

• Softer labor = policy pressure

• Policy pressure = liquidity expectations

• Liquidity cycles = crypto cycles

Crypto doesn’t front-run headlines

It front-runs liquidity

🧠 The Bigger Picture Most Miss

This data isn’t about good or bad

It’s about transition

When jobs weaken

• Old narratives break

• New positioning begins

• Markets reset expectations

And resets are where opportunity forms

📌 Final Takeaway

Gold heard the message first

Stocks are debating it

Crypto is watching liquidity

The question now isn’t what happened today

👉 it’s what policy has to do next

And markets are already adjusting

👇 Do you think this data pushes us closer to easing — or more uncertainty?