#Plasma $XPL When I first looked at XPL, it wasn’t the price chart that held my attention. It was how quiet everything felt around it. No constant shouting on timelines. No daily countdowns. Just a token sitting there, moving a little faster than the market on some days, lagging badly on others, waiting for context to catch up.

That’s usually where the real work starts.

A bullish XPL scenario only makes sense if adoption does something specific, not abstract. On the surface, adoption just looks like more wallets and higher volume. Underneath, it’s about whether people return. A wallet that touches a chain once doesn’t matter much. One that comes back three or four times a month does. Right now, most mid-cap utility tokens live in that uncomfortable zone where monthly active users sit in the low tens of thousands. If XPL can push sustained activity beyond that, say from 20,000 active users to 60,000, that’s not just growth. That’s a different texture of demand, because it changes how fees, staking, and liquidity behave day to day.

That user growth only sticks if utility earns it. XPL doesn’t benefit from speculation alone for long. What matters is whether its core use cases save time, reduce cost, or remove friction somewhere specific. A 30 percent reduction in transaction cost compared to a dominant L1 sounds modest until you realize developers feel that difference immediately. Over a year, a project spending $100,000 on execution suddenly spends $70,000. That gap funds hiring, audits, or marketing. That’s how chains slowly become sticky.

Liquidity then becomes the amplifier. When daily on-chain volume rises from $2 million to $8 million, which is a range many emerging ecosystems flirt with, price doesn’t just move because of demand. It moves because slippage drops. Trades hurt less. Market makers stay longer. That creates steadier candles, which ironically attracts more traders looking for less chaos. Price appreciation starts to look earned rather than forced.

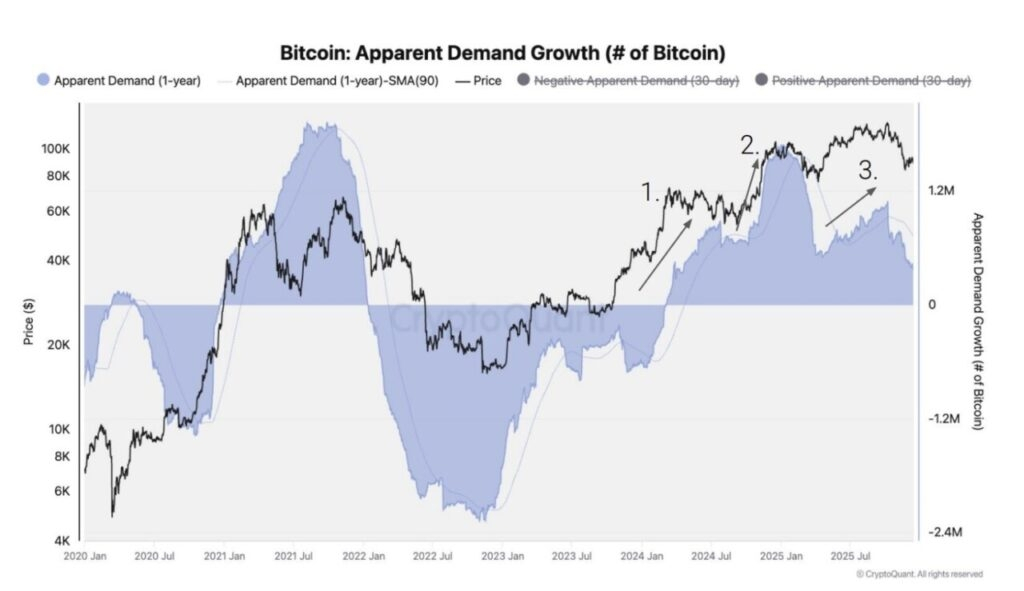

Macro conditions quietly decide how far that bullish case can run. If global liquidity continues to loosen, and risk assets behave like they did in late 2023, altcoins don’t need perfection. They need survivability. When Bitcoin dominance sits near 52 percent, as it has recently, capital is selective but not closed off. In that environment, a utility token that shows real usage can outperform even without narrative hype. If XPL rides that window while interest rates stabilize and ETF-driven inflows keep crypto visible, the upside isn’t explosive. It’s steady. A 2x over a cycle in that context would already be meaningful because it would be supported by activity, not leverage.

But the bearish scenario deserves equal weight, because it’s easier to trigger than people admit. Adoption can stall quietly. If active users flatten at 25,000 and never reaccelerate, price action eventually reflects that boredom. Tokens don’t bleed instantly anymore. They decay. Volume drops from $5 million a day to $1.5 million, spreads widen, and suddenly even small sell orders feel heavy. That’s when long-term holders get tested.

Utility risk sits underneath that. If XPL’s core use cases remain too niche, or worse, become replaceable, then efficiency stops being a moat. Layer-2s and modular chains are cutting costs aggressively. A competitor shaving fees another 20 percent can erase XPL’s advantage overnight. What looks like innovation on the surface becomes maintenance underneath, and maintenance rarely excites capital.

Macro pressure compounds this. If rates stay higher for longer and liquidity tightens again, speculative appetite fades fast. In 2022, we saw what happens when that switch flips. Tokens with real products still fell 70 percent because they were priced for growth that couldn’t happen under those conditions. If Bitcoin dominance pushes back toward 60 percent, which has happened before during risk-off phases, capital drains from utility plays first. XPL wouldn’t be singled out. It would just be part of the math.

There’s also the supply question people don’t like to sit with. If staking yields hover around 8 percent while real demand grows slower than supply emissions, pressure builds silently. Those rewards have to go somewhere. If they hit the market faster than new users arrive, price weakens even as fundamentals look “fine.” This is where many good projects get stuck in long ranges that exhaust believers.

Understanding that helps explain why bullish and bearish paths for XPL aren’t about one headline event. They’re about whether small signals line up at the same time. User growth that holds. Volume that deepens rather than spikes. Fees that feel cheap but not disposable. Macro conditions that don’t actively fight risk-taking.

What struck me most, watching similar tokens over the past year, is how rarely price leads fundamentals now. In 2021, charts ran ahead and everything else chased. Today, it’s reversed. Activity moves first. Price notices later, if at all. That’s healthier, but it tests patience.

If XPL leans into that reality, the bullish case isn’t flashy. It’s a gradual repricing as the foundation thickens underneath. If it doesn’t, the bearish case isn’t dramatic either. It’s long stretches of silence punctuated by brief hope.

And that might be the real signal to watch. In this market, the projects that survive aren’t the loudest. They’re the ones that stay busy when no one’s watching.@Plasma