Plasma makes sense to me in the same way “tap to pay” made sense the first time you used it: you don’t want to learn the plumbing—you just want the payment to move, instantly, and to feel like it was always supposed to work that way.

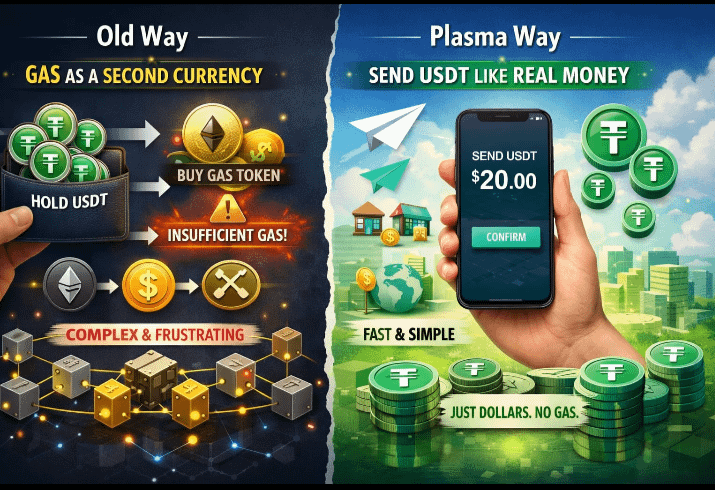

Stablecoins are already the closest thing crypto has to a real consumer product. People don’t wake up wanting “exposure to volatility.” They want digital dollars they can send to family, pay suppliers with, move between apps, or settle invoices in—especially in markets where USD stablecoins are basically a parallel financial system. And yet, most blockchains still force a weird ritual: before you can move your dollars, you must also own and manage a second currency just to pay fees. That’s the part that breaks the spell. It’s not “mass adoption friction” as a buzzword—it’s the exact moment a normal user realizes the system wasn’t designed for them.

Plasma’s core idea is to remove that moment.

Not by pretending fees don’t exist, and not by hand-waving with “our gas is cheaper,” but by designing the chain around the reality that stablecoin settlement is the main event. The stablecoin is the product. The chain is the rail. Everything else—execution, consensus, token economics—exists to make that single experience feel dependable.

Why the “gas as a second currency” problem is bigger than it looks

If you’re crypto-native, gas feels normal. If you’re running payments, it feels absurd.

Think about what a merchant actually wants: “I received $20 in USDT—can I forward $20 to my distributor right now?” Not “Do I also have enough of the chain’s native token? Is it on the right network? Did fees spike? Did the wallet estimate correctly? Will the transfer fail?” That’s the kind of friction that doesn’t show up in a TPS chart but absolutely shows up in churn.

This is why Plasma isn’t pitching itself as a generic “EVM L1 with fast blocks.” It’s pitching itself as a stablecoin settlement chain that happens to be EVM-compatible, because programmability is useful—but settlement reliability is the thesis.

The design choice that changes the user experience: gasless USDT transfers

Plasma is building around USDT as the default “money object.” That matters because USDT isn’t theoretical. It’s the stablecoin most people already use day-to-day in high-adoption markets, and it’s the one that businesses, OTC desks, and cross-border operators have standardized around.

The chain introduces a mechanism where basic USDT transfers can be gasless for the user. Not “gasless” in the fairy-tale sense where nobody pays. Someone always pays. The key point is who pays and when that payment becomes the user’s problem.

Plasma is effectively saying: for the simplest, most common action—sending USDT from A to B—the user shouldn’t have to hold a separate volatile token just to make the transfer happen. If that sounds small, it’s because we’re used to broken UX. In payments, removing one mandatory extra step can be the difference between “this works” and “this is too annoying to bother.”

And Plasma doesn’t stop at the “gasless transfer” headline. It leans further into a stablecoin-first model where fees can be paid using approved tokens (including stablecoins) rather than always forcing XPL as the gas asset. That’s important because real applications aren’t just one-off sends. They’re recurring flows: payroll, merchant settlements, subscriptions, remittances, agent networks. The more you can keep the experience in a single unit of account, the more it behaves like actual money.

Under the hood: familiar execution, payments-grade finality

Plasma pairs two decisions that, together, tell you exactly who they’re building for:

1. Full EVM compatibility using Reth (Rust Ethereum client).

This is a practical choice. If you want developers and payment companies to build quickly, you don’t ask them to learn a new VM, new language, or new set of tooling assumptions. You give them the Ethereum surface area they already know. That’s not laziness—it’s go-to-market realism.

2. Sub-second finality with PlasmaBFT.

Payments need determinism. When someone pays at checkout, “final in 20 seconds” is already a compromise. “Final maybe later if congestion spikes” is a deal-breaker. Plasma’s BFT approach is essentially trying to deliver the kind of predictable finality you’d expect from systems that handle high-frequency value movement.

Now, the grown-up part: fast finality and EVM compatibility are not rare claims. The difference is whether a chain is engineered to keep finality stable under pressure, not just in demo conditions. Plasma’s architecture suggests they understand that the real enemy is variance. In finance, “usually fast” doesn’t count. Consistent is the feature.

The Bitcoin angle: borrowing neutrality instead of inventing it

Here’s where Plasma gets more interesting than “stablecoin chain.”

Plasma’s security narrative includes Bitcoin anchoring: the idea that Plasma’s state commitments can be anchored to Bitcoin over time, using Bitcoin as a neutral reference point that’s notoriously difficult to rewrite. You can read that as philosophical—“Bitcoin is neutral”—but there’s also a very practical angle for institutions and infrastructure providers:

Auditability and history integrity matter. If a payment rail is going to be used for meaningful settlement, you want strong assurances that the chain’s history can’t be silently reshaped. Anchoring to Bitcoin is a way of saying: “Even if you don’t fully trust us, you can trust the external anchor we use to make manipulation harder.”

And Plasma’s “Bitcoin bridge” concept points at something strategic: they want to sit where BTC and USDT meet. That’s the liquidity gravity well of crypto. If Plasma becomes the place where USDT moves frictionlessly and BTC can be brought into the same programmable environment with credible security posture, it starts to look less like “another L1” and more like “a settlement hub.”

XPL token utility: the uncomfortable truth Plasma can’t avoid

There’s a tension Plasma has to manage, and it’s worth saying plainly:

If you succeed at making stablecoin transfers feel effortless, you risk making the native token feel invisible. And if the token feels optional, you risk undermining the economic engine that secures the network.

So XPL needs a job that remains essential even when users don’t think about it.

Plasma’s positioning for XPL is straightforward: it underpins security (staking/validator incentives), and it becomes the asset around which the network’s long-term economics balance out—especially as the chain decentralizes and validator participation expands. There’s also a value-capture angle in how fees and burns are structured: if the chain burns base fees (EIP-1559-style) while emissions fund security, then usage can offset dilution over time. That kind of model is basically saying, “If the network becomes useful, the token should reflect that usefulness structurally, not just narratively.”

But the real test is policy.

If Plasma subsidizes too much for too long, it risks turning XPL into “that thing validators use” with weak demand from actual usage.

If Plasma pulls subsidies back too aggressively, it risks breaking the exact user experience it’s trying to win with.

The sweet spot is the hard part: keep the “stablecoin feels like a product” experience for the mainstream, while ensuring the security budget and incentives stay credible as activity grows.

Economics in plain terms: what matters and why

When you strip away tokenomics jargon, a settlement chain has to answer three questions:

1. Who pays for security?

Validators need predictable compensation. Whether that comes from inflation, fees, or a mix, it must be sustainable.

2. What happens when usage scales?

If demand increases, can the chain keep fees stable and finality predictable? This is where consensus and execution choices show up as user experience.

3. How does the token stay relevant without ruining UX?

A chain that hides its native token perfectly might win users but lose its economic spine. A chain that forces the native token everywhere keeps the token relevant but loses users. Plasma is trying to thread that needle with protocol-level gas abstraction and staking-led security.

That’s the meta-story: Plasma isn’t just “stablecoins on a fast chain.” It’s attempting to re-balance the relationship between UX and economics so that stablecoin users aren’t punished for not being traders.

Recent signals: what I pay attention to

With chains like this, I’m less impressed by “partnership tweets” and more interested in whether the project keeps tightening the loop between design and reality.

The things that matter are:

how they scope gasless transfers (to prevent abuse without killing usability),

how clean the developer integration remains (EVM compatibility is only valuable if it’s genuinely frictionless),

how the validator roadmap progresses (because decentralization isn’t a slogan—it’s a timeline),

how the Bitcoin anchoring/bridge posture evolves (because credibility is earned in implementation details).

In other words: the boring parts.

Payment infrastructure doesn’t become trusted because it’s exciting. It becomes trusted because it keeps working when nobody is paying attention—and still works when everyone is.

Where Plasma could genuinely carve out its own lane

A lot of L1s compete for “developers.” Plasma is competing for something more specific: being the chain that stablecoin movement prefers by default because it feels closest to real-world money behavior.

If they execute, Plasma doesn’t need to win every narrative. It only needs to become the most reliable, least annoying place to move stablecoins at scale. That alone is a massive wedge.

And the Bitcoin anchoring story, if implemented cleanly, gives Plasma a distinctive long-term posture: not just fast settlement, but settlement with an external neutrality anchor. That’s not a gimmick. That’s a way to say, “We want this to stay trustworthy even as the stakes rise.”

A clear conclusion that matters

Here’s the real insight I walk away with: Plasma is trying to make stablecoins stop feeling like “crypto assets” and start feeling like “software money.” The difference is subtle but huge.

Crypto assets are tolerated: you learn quirks, you accept friction, you adapt your behavior to the system.

Software money is adopted: it disappears into the background, it behaves predictably, and it lets people focus on life and business rather than mechanics.

If Plasma can keep sub-second determinism, keep the stablecoin-first gas experience clean, and keep XPL’s security economics credible without pulling users back into gas gymnastics, it won’t just be another Layer 1. It will be a proof that blockchains can finally treat money like a product—simple, dependable, and built for the way people actually use it.