There’s a quiet crisis happening in the blockchain world that most people don’t talk about. We’ve been promised digital ownership, permanent records, and immutable assets, but the truth is more fragile than anyone wants to admit. When you buy an NFT or store data on most blockchains today, you’re not actually storing much on the blockchain itself. What you’re getting is a pointer, a reference that leads somewhere else entirely. That reference might be an IPFS hash pointing to a file on a distributed network, or it could be an AWS link that depends on centralized servers staying online. If those external systems fail, your supposedly permanent asset becomes little more than a broken link.

Vanar Chain emerged with a different vision. They’re not just building another fast blockchain or another scalable Layer 1. They’re solving something fundamental that’s been overlooked in the rush toward higher transaction speeds and lower fees. They’re asking a question that should have been asked years ago: what if the blockchain could actually store and understand the data it claims to protect? What if intelligence wasn’t bolted onto blockchain as an afterthought, but woven into its very foundation?

The Hidden Dependency That Undermines Digital Ownership

Traditional blockchains face a severe constraint that most developers have learned to accept as inevitable. Block sizes are limited, typically around sixty-five kilobytes per block. That’s barely enough space for a few low-resolution images, let alone videos, documents, or complex datasets. The standard solution has been to store data externally and just keep the reference on-chain. It’s practical, it’s widely adopted, and it’s fundamentally flawed.

When major cloud providers experience outages, the fragility of this system becomes impossible to ignore. In April of 2025, Amazon Web Services went down, taking with it access to major exchanges like Coinbase and Robinhood. Users couldn’t access their funds, traders couldn’t execute orders, and the entire promise of decentralized finance looked more centralized than anyone wanted to acknowledge. The blockchain itself kept running, but without access to the external infrastructure it depended on, the system couldn’t function. This isn’t a theoretical problem anymore. It’s happened repeatedly, and each time it exposes the same uncomfortable truth.

IPFS offers a more distributed alternative, spreading files across multiple nodes rather than relying on a single company’s servers. But IPFS comes with its own challenges. Content can disappear if enough nodes stop hosting it. Links can break over time, a phenomenon known as link rot. The system requires ongoing maintenance and active participants to keep data available. For assets meant to last decades or centuries, depending on the goodwill of unknown node operators doesn’t inspire confidence.

Vanar Chain’s CEO, Jawad Ashraf, put it bluntly when he described the current state of digital ownership as an illusion. You think you own something because you have a blockchain record, but what you actually own is a reference to something that might not exist tomorrow. The blockchain certifies the ownership of that reference, not the underlying asset itself. If the file disappears from external storage, your certified ownership becomes meaningless. You own a receipt for something that’s gone.

Compression That Thinks

Neutron, Vanar’s on-chain storage layer, tackles this problem with an approach that sounds almost impossible until you see it working. They’re compressing entire files, not by a few percentage points but by ratios as high as five hundred to one. A twenty-five megabyte video becomes a forty-seven character string called a Neutron Seed, and that seed gets stored directly on the blockchain itself. No external links, no IPFS hashes, no dependencies on anyone else’s infrastructure. The file lives inside the block, part of the immutable record.

The compression works through a four-stage pipeline that combines AI-driven reconfiguration, quantum-aware encoding, chain-native indexing, and deterministic recovery. The first stage analyzes the file’s structure and content, identifying patterns and redundancies that can be compressed more efficiently than traditional algorithms would manage. This isn’t just making files smaller; it’s transforming them into a format that’s optimized for blockchain storage while maintaining the ability to perfectly reconstruct the original.

What makes this particularly interesting is that Neutron Seeds aren’t dead data. They’re queryable and AI-readable, meaning smart contracts and applications can interact with the content without having to decompress everything first. If you store a legal document as a Neutron Seed, smart contracts can verify compliance, check for specific clauses, or validate signatures without pulling the entire file off-chain and processing it externally. The intelligence needed to understand the data is built into how the data is stored.

This capability was demonstrated live at the Vanar Vision conference in Dubai at the Theatre of Digital Art. More than a hundred venture capitalists, payment technology leaders, and journalists watched as a high-definition video was compressed into a Seed, embedded in a mainnet transaction, and then recovered and replayed in under thirty seconds. It wasn’t a controlled demo environment or a carefully staged proof of concept. It was happening live on the production network, processing real transactions while proving that full on-chain storage isn’t just theoretically possible but practically viable.

The quantum-aware encoding layer adds another dimension that most blockchains haven’t even started thinking about yet. Quantum computers threaten to break the cryptographic foundations that blockchain security depends on. By the time quantum computing becomes widespread, most existing blockchains will need complete overhauls of their encryption schemes. Vanar’s encoding layer was designed with this future in mind, building in protections against quantum attacks from the start. They’re not retrofitting security after the fact; they’re anticipating the threats that are coming.

Intelligence as Infrastructure

Kayon takes what Neutron starts and adds reasoning capabilities that transform static storage into active intelligence. While Neutron handles compression and storage, Kayon functions as the brain that can read, understand, and act on the data stored in those Seeds. This isn’t about calling external AI services or integrating with off-chain models. Kayon is a decentralized inference engine that operates directly on the blockchain itself.

Smart contracts traditionally execute predetermined logic based on fixed conditions. If a certain event happens, trigger a certain action. They’re powerful for automation but limited in their ability to handle nuance, interpret context, or make decisions based on complex datasets. Kayon changes this by allowing contracts to query data, understand relationships between different pieces of information, and apply reasoning to make more sophisticated decisions.

Consider compliance checking for tokenized financial assets. Traditional smart contracts can verify whether a transaction meets predetermined rules, checking things like account balances or transaction amounts. But real compliance often requires understanding context that’s stored in documents, legal agreements, and regulatory frameworks. With Kayon, a smart contract can query relevant legal documents stored as Neutron Seeds, interpret the compliance requirements in those documents, and determine whether a transaction meets those requirements without human intervention.

This creates possibilities for applications that have been theoretically interesting but practically impossible to build on traditional blockchains. AI agents that maintain persistent memory across sessions become feasible because their context can be stored on-chain in a format that’s both compact and queryable. Financial applications can implement sophisticated compliance checks that understand regulatory nuance rather than just following rigid rules. Gaming applications can create truly intelligent NPCs whose behaviors and memories persist as part of the blockchain state rather than being maintained in centralized game servers.

The integration between Neutron and Kayon represents something fundamentally different from how most blockchains approach AI. Many projects talk about AI integration, but what they typically mean is connecting blockchain applications to external AI services through oracles or APIs. That maintains the same external dependencies that plague current storage solutions. Vanar embeds the intelligence directly into the Layer 1 infrastructure, making it available to every application built on the chain without requiring additional integrations or dependencies.

Real Applications in Real Markets

Gaming has been one of the first sectors to demonstrate what Vanar’s infrastructure enables. World of Dypians, a fully on-chain game with more than thirty thousand active players, runs entirely on Vanar’s network. Every game asset, every player action, every piece of game state exists on the blockchain itself. There are no centralized game servers maintaining the true state of the world while the blockchain just handles token transactions. The blockchain is the game world, and it continues existing regardless of whether any particular company keeps running servers.

This matters more than it might initially seem. Traditional games, even those that incorporate blockchain elements, remain fundamentally dependent on the companies that created them. If the company shuts down its servers, the game dies. Players might retain ownership of some tokenized assets, but those assets become unusable artifacts from a game that no longer exists. Fully on-chain games break this dependency. As long as the blockchain exists, the game exists. Communities can fork the game, modify it, build new clients to interact with it, all without needing permission from or payment to the original creators.

The payment finance sector, often called PayFi, represents another significant application area. Tokenized real-world assets require sophisticated compliance mechanisms to meet regulatory requirements. These aren’t simple yes-or-no checks. They involve understanding legal frameworks, interpreting contractual obligations, and maintaining audit trails that regulators can review. Storing the necessary documentation off-chain creates regulatory risk because there’s no guarantee those documents will remain accessible and unmodified. Storing them on-chain in traditional ways would be prohibitively expensive and inefficient.

Neutron’s compression makes it economically viable to store complete legal documents, proof of reserves, audit reports, and compliance certifications directly on-chain. Kayon makes those documents actionable, allowing smart contracts to verify compliance in real-time without human intervention. This combination creates infrastructure for regulated financial products that can operate with blockchain’s efficiency while meeting traditional finance’s compliance standards.

Vanar has also attracted significant partnerships that suggest mainstream adoption isn’t just theoretical. Their infrastructure collaboration with NVIDIA brings access to CUDA-accelerated computing, Tensor cores for AI operations, and Omniverse for metaverse development. These aren’t marketing partnerships where companies exchange logos and press releases. They’re technical integrations that give developers building on Vanar access to industrial-grade AI infrastructure.

Google Cloud’s carbon-neutral data centers host Vanar’s core infrastructure, addressing the environmental concerns that have plagued blockchain adoption. Companies facing emissions regulations and ESG requirements can build on Vanar without the carbon footprint concerns that make other blockchains problematic for corporate adoption. The platform provides granular tracking of carbon usage, enabling companies to report their blockchain-related emissions accurately and potentially participate in carbon credit markets.

The partnership with Movement Labs addresses a different but equally important challenge. Many blockchain projects struggle after their initial launch because they lack the ongoing support needed to build sustainable applications. Builders report feeling disconnected from their host chains, left to figure out technical challenges and business development on their own. Vanar and Movement Labs created a support framework that provides technical guidance, ecosystem resources, and connections to investors and strategic partners. They’re treating application developers as partners in building the ecosystem rather than customers who pay gas fees.

When Reality Validated the Vision

The AWS outage in October 2025 provided an unexpected but powerful validation of Vanar’s approach. While major exchanges went dark and users panicked about accessing their funds, Vanar’s infrastructure kept operating without interruption. The advantage wasn’t just theoretical anymore. It was visible in real-time as centralized systems failed and truly decentralized alternatives proved their resilience.

Ashraf emphasized during the crisis that with Vanar, nothing points outside the chain. Every component needed for operation exists on the blockchain itself. There are no API calls to external services that might go down, no cloud storage that might become unreachable, no dependencies on infrastructure controlled by other companies. This isn’t about redundancy or backup systems. It’s about fundamental architectural differences that eliminate entire categories of failure modes.

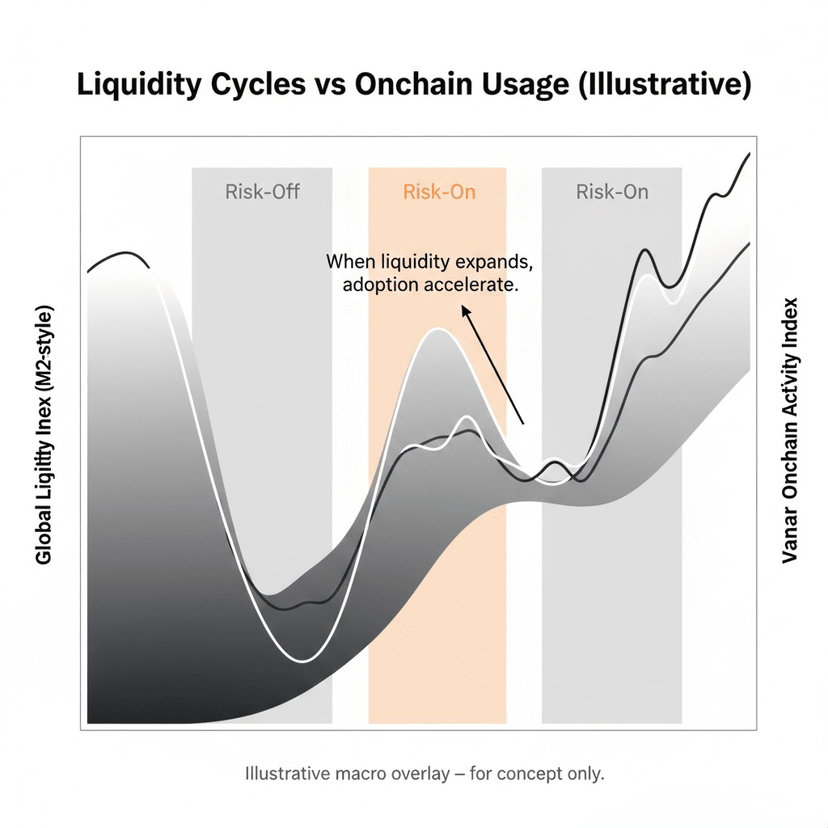

The market responded. Trading volume for VANRY, Vanar’s native token, spiked as traders recognized the practical implications of truly decentralized infrastructure. Projects that had been evaluating different blockchains for deployment started asking questions about Vanar’s architecture. Enterprise clients concerned about reliability and regulatory compliance took a closer look at what full on-chain operation actually meant for their risk profiles.

It’s not that other blockchains are poorly designed or that their developers don’t understand the importance of decentralization. It’s that the practical constraints of blockchain storage have pushed the entire industry toward compromises that sacrifice genuine decentralization for practical functionality. Vanar’s compression technology removes those constraints, making it possible to build truly decentralized applications without the compromises that have become so normalized that people forgot they were compromises at all.

The Token That Powers Intelligence

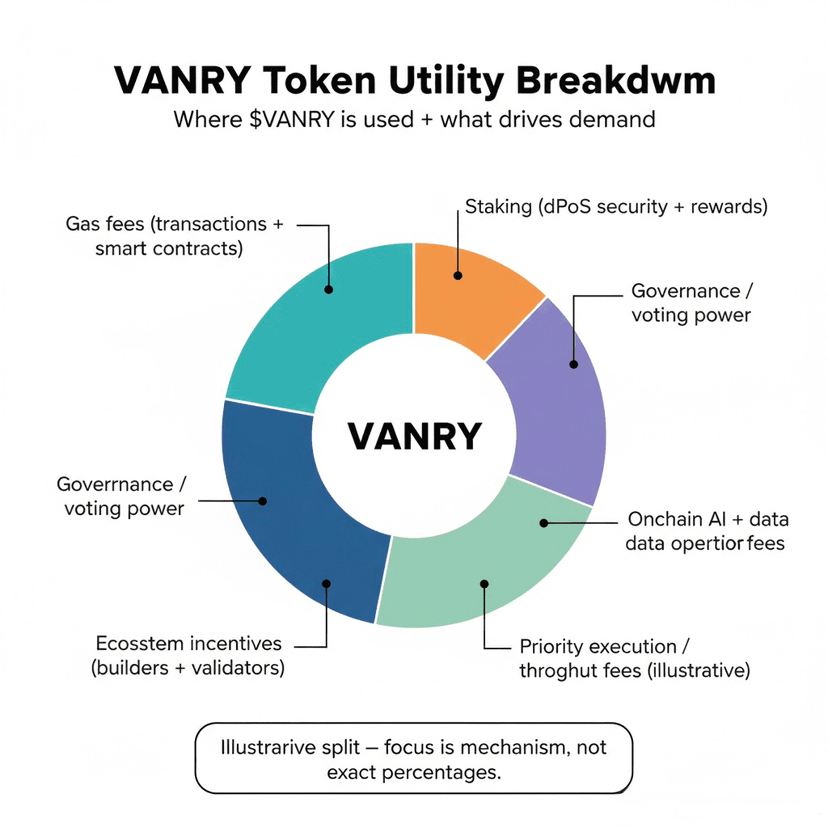

VANRY functions as more than just a transaction token in Vanar’s ecosystem. It’s gas for network operations, maintaining the ultra-low fixed costs around half a cent that make high-frequency applications viable. But it’s also the access token for Vanar’s AI infrastructure. Starting in the first quarter of 2026, advanced AI tool subscriptions require payment in VANRY. Developers accessing Neutron’s compression capabilities, enterprises querying data through Kayon, applications building on Vanar’s intelligence layer all need VANRY to operate.

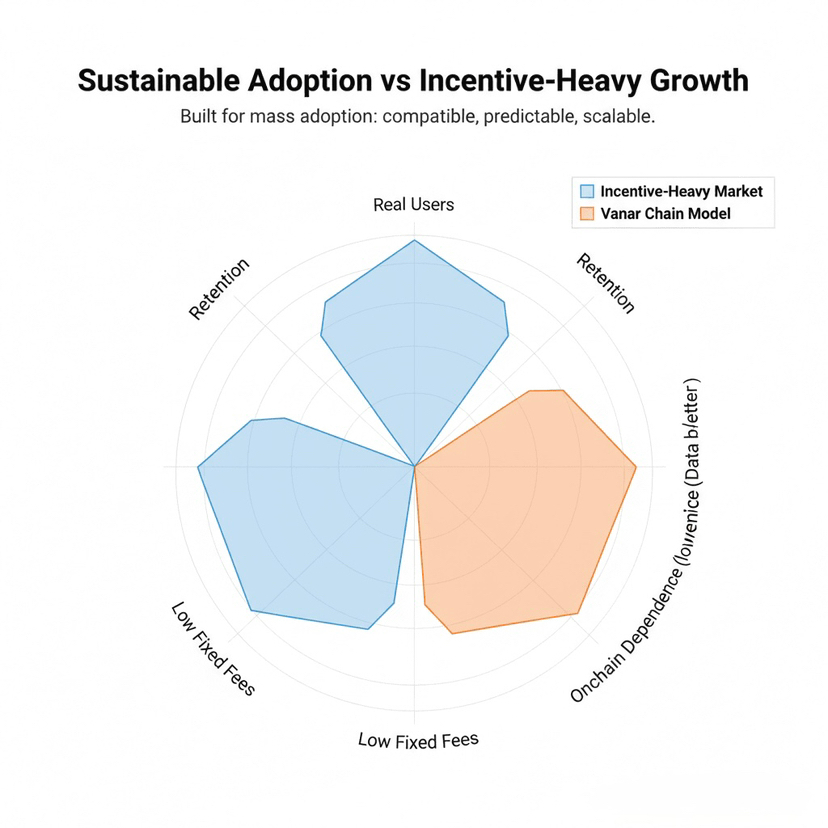

This creates a different economic model than most blockchain tokens follow. Many tokens primarily derive value from speculation and exchange trading. VANRY has genuine utility demand from the infrastructure itself. As more applications build on Vanar and use its AI capabilities, organic demand for the token grows independent of market sentiment. Developers need it to build, enterprises need it to operate, and users need it to interact with AI-powered applications.

The staking mechanism encourages long-term holding while securing the network. Stakers receive returns from transaction fees and AI service subscriptions, aligning their incentives with network growth. Higher activity means higher rewards, creating a feedback loop where network success benefits those who commit to supporting it. Governance rights attached to VANRY give holders influence over protocol upgrades and ecosystem development, transforming the token into a representation of influence over blockchain’s intelligence infrastructure.

From a market positioning perspective, VANRY sits at the intersection of two major narratives driving blockchain development. AI and blockchain have been converging for years, but most projects treat them as separate domains that need integration bridges. Vanar makes AI native to the blockchain itself, giving VANRY exposure to growth in both artificial intelligence and Layer 1 infrastructure simultaneously. This dual positioning creates unique value dynamics compared to projects focused on only one sector.

The Question of What Comes Next

We’re seeing early signs of what intelligence-native blockchain infrastructure enables, but the implications extend beyond current applications. When data storage becomes practical and affordable on-chain, entire categories of applications that weren’t previously viable become possible. When smart contracts can reason about the data they interact with rather than just executing fixed logic, the boundary between application and infrastructure starts to blur.

Digital identity systems could store not just identifiers but complete verified credential documents, enabling privacy-preserving authentication without central authorities. Supply chain tracking could maintain full documentation of each step in a product’s journey, making it possible to verify claims about sourcing, manufacturing, and handling without trusting the company’s word. Legal contracts could become smart contracts not through simplification but through sophisticated enough reasoning to handle real contractual complexity.

The gaming applications we’re seeing today might be just the beginning. Imagine entire virtual economies that persist independently of any company, where the economy’s rules can evolve through collective governance and new game mechanics can be added by anyone who wants to build them. Imagine educational credentials stored with complete supporting documentation, making them verifiable decades later regardless of whether the issuing institution still exists. Imagine financial instruments that can automatically verify their compliance with regulations across multiple jurisdictions, adapting to regulatory changes without manual updates.

The quantum-resistant encryption Vanar is building in from the start might prove prescient sooner than expected. If quantum computing breakthroughs happen faster than anticipated, blockchains without quantum resistance will face existential challenges. Migrating existing systems to quantum-safe cryptography while maintaining backwards compatibility and not disrupting operations represents a coordination challenge that might prove insurmountable for some networks. Vanar won’t need to migrate. They’re already there.

Whether Vanar becomes the dominant infrastructure for AI-powered blockchain applications or simply proves the concept that others follow, what they’re building challenges fundamental assumptions about what blockchains can do and how they should work. They’re demonstrating that true digital ownership doesn’t require compromises with centralized storage. They’re showing that intelligence can be native to blockchain rather than integrated through external services. They’re proving that quantum resistance and efficient operation aren’t mutually exclusive.

The test isn’t whether the technology works. The Dubai demonstration and the World of Dypians game prove it works. The test is whether enough developers, enterprises, and users recognize the advantages of this approach to drive adoption at scale. Technology that solves real problems still needs people to choose it over familiar alternatives. Vanar has built infrastructure that addresses legitimate weaknesses in how blockchain currently operates. Now we’ll discover whether the market values those solutions enough to embrace a fundamentally different architectural approach.

If blockchain is going to fulfill its promise of genuinely decentralized, permanent, and verifiable digital ownership, it needs to actually store and understand what it claims to own. Vanar built the infrastructure to make that possible. Whether that becomes the new standard or remains an interesting alternative will shape not just one project’s trajectory but the entire evolution of blockchain technology.