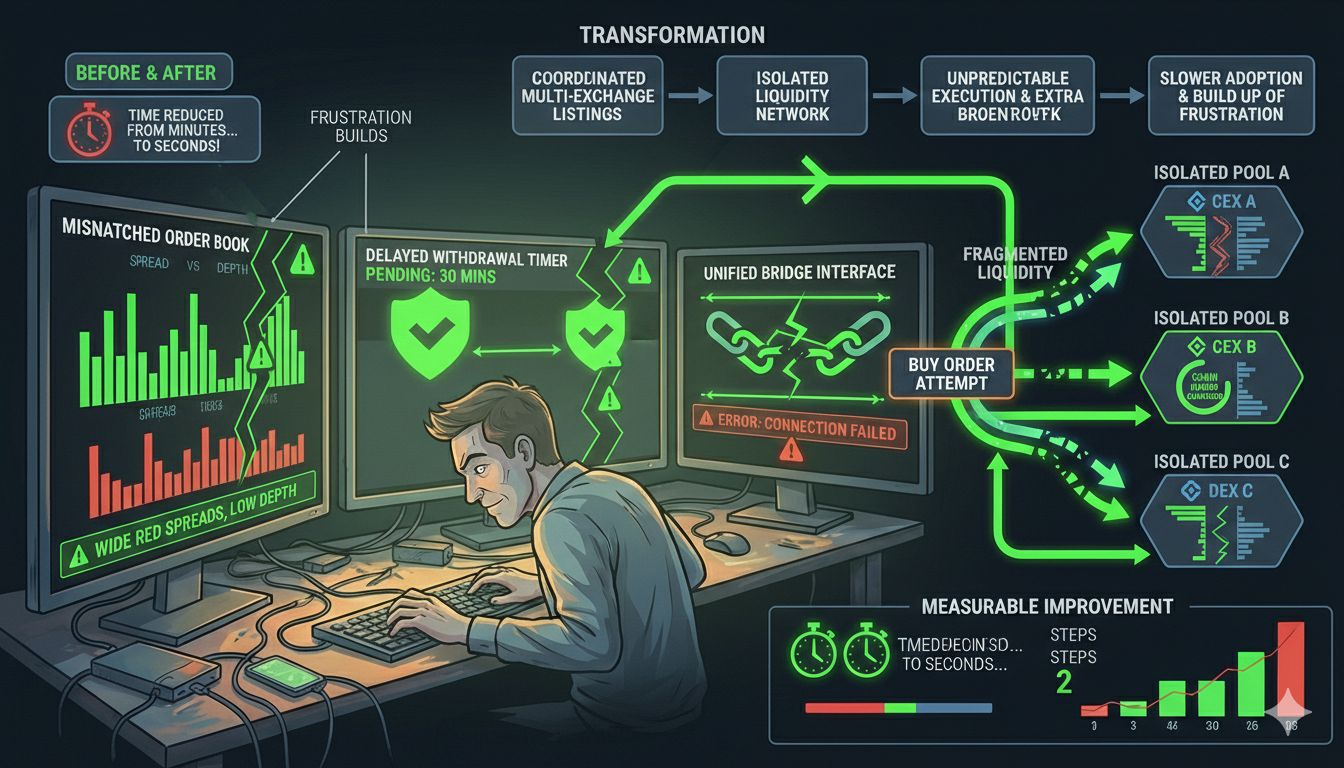

I was at my desk when the clock hit 14:02 UTC on January 15th. The new trading pair had just unlocked on Binance, and I clicked through to place a small test order. The interface showed bids stacking up in real time, but my fill came back in three separate chunks, the average price 2.1% worse than the quoted mid. I sat there, mouse still hovering, feeling that familiar tightness in my chest—the one that says the book looks deep until you actually hit it.

I opened OKX in another tab and the bridge dashboard in a third. Volumes were climbing, but the prices drifted a few cents apart between venues. A withdrawal I started from the first exchange sat pending for twenty-three minutes before it cleared to the destination chain. By then the market had already ticked down. I closed the laptop for a minute, rubbed my eyes, and reopened it. Same story.

This is the pattern I’ve watched with every fresh token launch over the past year. The announcements hit, the community cheers, and then the first trading sessions expose the gaps. Liquidity pools on one platform, thinner books on the next, and the chain itself still waiting for real inflows. You chase the momentum, but the execution never quite matches the headline numbers.

Users put up with it because it’s still the quickest route to participation. No one wants to sit on a new chain with no way to exit cleanly. Projects chase the listings because organic discovery takes forever. The cost lands on the early traders who eat the slippage and on the teams burning incentives to keep the charts from going flat. It’s not dramatic. It’s just the daily tax.

That’s when Fogo became relevant. It functions like a new coffee roaster suddenly appearing on the shelves of every major supermarket chain on the same morning. Instead of slowly building distribution through a few local stores and hoping word spreads, it lands in every aisle at once, letting customers taste it wherever they already shop. The difference is subtle but operationally meaningful.

Fogo’s rollout hit multiple major exchanges in a tight window. Binance opened first, then OKX, Gate, KuCoin, and a couple others followed within hours. I followed the pings that day, watching the pairs go live one after another. It felt different from the usual drip-feed approach.

The mechanism was simple in practice. Each listing activated the exchange’s liquidity programs—dedicated makers, reward tiers, seeding bots that kept quotes live even during quiet hours. Because the timing overlapped, volume didn’t just pile into one venue and leave the rest starving. It spread, and the books started talking to each other faster than usual.

I noticed it immediately in my own flows. By the second day, I could split a position across two exchanges and the prices stayed within a tight band. No more waiting days for a second listing to catch up and provide an exit. The Fogo explorer, when I checked it later that night, showed bridge deposits ticking up in steady waves. Wallets that had just received CEX inflows were moving assets onto the chain within the same hour.

The dashboards told the rest. Twenty-four-hour volume across the listed pairs cleared forty million dollars by the end of the first full session. On the Fogo side, active addresses climbed hard, and the transaction graph showed clear clusters right after the big CEX hours. Gas stayed under a cent even when things got busy. Confirmations landed in under fifty milliseconds. The experience stopped feeling like two separate worlds.

This matters because the exchange ecosystems compress the cold-start problem. They handle the initial capital and price discovery, which lets users cross over to the chain without the usual hesitation. That’s where $fogo enters: It is used for gas fees on every on-chain transaction and as the asset staked by validators to secure the network. Over time, this creates a mechanical dynamic where rising trading activity on the chain increases the baseline need for $fogo to pay for those fast, cheap executions, while staking rewards pull supply into longer-term alignment.

I kept watching the patterns in the weeks that followed. Late-night refreshes on the explorer would show clusters of activity—deposits from known CEX hot wallets, then quick interactions with the native order book. The liquidity wasn’t just sitting on the exchanges anymore. It was starting to flow through the chain in measurable ways. The numbers weren’t hype charts. They were the quiet evidence of users actually showing up and staying.

That said, the model still carries a real dependency. If the major exchanges dial back their liquidity support or shift focus to the next shiny launch, the on-chain side could lose momentum before native mechanisms fully mature. We’ve seen it happen. The acceleration is real, but it needs the off-chain infrastructure to keep delivering.

I’ve been on the Fogo chain daily for the past four weeks—bridging small amounts, running test trades, checking the flows at odd hours. The difference the exchange listings made in those early days is still visible in the metrics I track. The market grew faster and deeper than most new L1s I’ve followed. I hold a small position. Personal observation only. Not investment advice.