I clicked refresh on the Vanar dashboard at 11:47 PM last Tuesday because the grant tracking section still showed "Pending Review" for a project I'd been watching since early December. The little progress bar had been stuck at 62% for four days straight. My coffee had gone cold in the mug beside the keyboard, and I felt that familiar low-level irritation when you know something should have moved by now but hasn't. I wasn't even the applicant—just tracking it out of habit because I'd delegated some $VANRY to a validator who seemed active in voting on these things. The number caught my eye: ecosystem allocation requests sitting at 187 open, with only 14 resolved in the past week. It wasn't dramatic. It was just slow.

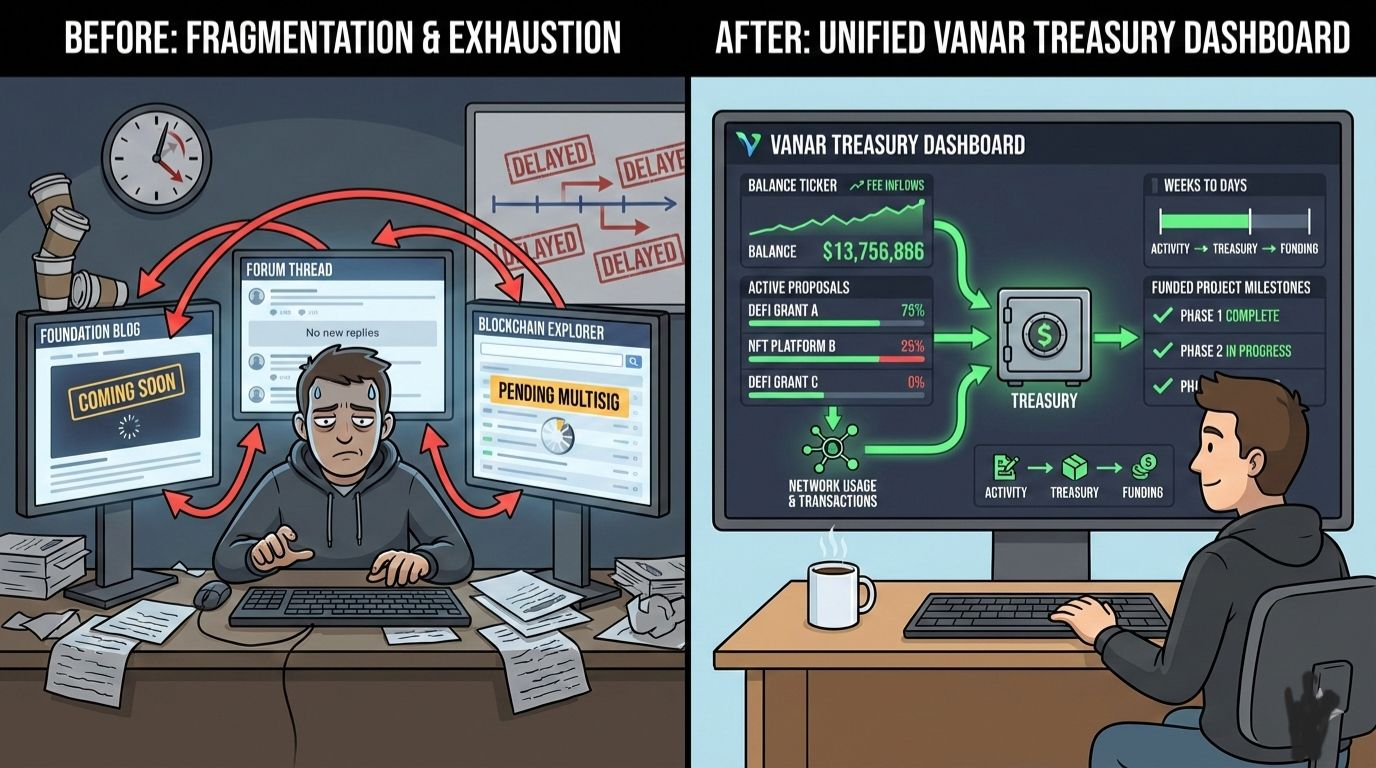

That slowness is the friction. Most chains talk about funding builders, but in practice you end up chasing scattered signals. You check the foundation blog for announcements, then scan governance forums for proposals, then look at on-chain treasury outflows to see if anything actually shipped. Half the time the numbers don't line up because transfers happen in batches or through multisig wallets with delayed confirmations. The people who feel it most are the smaller teams waiting on grant disbursements—they burn runway while the process drags. Validators and larger holders absorb less pain because they can influence votes directly, but even they complain privately about how opaque the outflow timing remains. Everyone tolerates it because the alternative is worse: no funding at all means even fewer projects survive long enough to build something useful.

That's when Vanar Chain became relevant. It functions like a shared company expense account that everyone can see and vote on, but with receipts enforced on-chain. Instead of waiting for centralized foundation announcements that may or may not match reality, it routes a predictable portion of network activity directly into a community treasury that funds ongoing development. The difference is subtle but operationally meaningful: you don't hunt for updates across five places; you watch one dashboard where inflows from fees and burns feed the pot, and outflows tie to approved proposals.

The mechanism starts when transaction fees hit the network. A portion—currently around a structured percentage that adjusts based on usage—gets diverted automatically to the community treasury instead of just burning or rewarding validators. This isn't manual; it's coded into the protocol so every block that processes real activity adds to the pot without needing a separate vote. The Vanar Foundation oversees initial allocation and maintenance, but once funds enter the treasury, disbursements require governance votes from $VANRY stakers. You see the treasury balance update in near real-time on the official explorer-linked dashboard, usually within seconds of block finality. Grant requests appear as proposals with clear milestones, budgets, and timelines. When approved, funds release in tranches tied to verifiable on-chain proofs of progress, like contract deployments or user metrics.

What changed for me was the predictability. Before, I'd see a grant announced but then wait months with no visibility into whether it was funded or stalled. Now the treasury page shows exact inflows from recent high-volume periods—like when a new AI tool integration spiked gas usage—and you can trace outflows to specific proposal IDs. Confirmation times for treasury movements average under 10 seconds on good days, and the dashboard labels each line item with the proposal title and recipient wallet. The metric that shifted most is mental overhead: instead of refreshing three different sites, I check one screen and know roughly how much runway the ecosystem has left for the quarter.

This matters because it aligns activity with sustainability. High usage directly fattens the treasury, which in turn funds more tools, integrations, and grants that attract more usage. That’s where $VANRY enters: it is used for staking to participate in governance votes that control treasury outflows. Stakers lock $VANRY to weigh proposals, including which projects get funded and how much. Over time, this creates a mechanical dynamic where active participation in securing the network also gives you say over how ecosystem funds are spent, tying long-term holders to practical decisions rather than passive holding.

That said, the system still depends heavily on validator turnout for timely votes. If participation drops below a certain threshold—say during low market periods—proposals can sit unvoted for weeks, delaying disbursements and frustrating builders who need quick turnaround. It's not a fatal flaw, but it's a real bottleneck I've seen firsthand when a simple tooling grant lingered for 18 days because only 41% of staked supply bothered to vote.

I've tracked Vanar Chain's treasury flows for about five months now. The mechanism is measurable in reduced guesswork and faster feedback loops on what actually gets built. I hold a small position. I'm observing, not predicting. Personal observation only. Not investment advice.