$RIVER 📊 Market & Price Action🔹 What Helium (HNT) is today

Helium (HNT) is the native cryptocurrency of the Helium Network, a decentralized wireless infrastructure project built to power Internet of Things (IoT) connectivity and community-owned network coverage. Instead of traditional telecom towers, users deploy small “hotspots” that provide wireless coverage and earn HNT rewards for doing so. The network uses blockchain tech and a proof-of-coverage system to validate and incentivize network participation.

📈 Recent developments

• HNT continues to be actively traded and has seen price movements, with recent data showing increased trading activity and growth in network participation.

• The project underwent a technical upgrade called the Helium Mainnet Upgrade on January 11, 2026, aimed at improving performance and privacy features on its underlying infrastructure (via partners like COTI).

💡 Why it matters

Helium isn’t just a typical crypto token — it’s tied to a real-world Decentralized Public Infrastructure Network (DePIN) that aims to make wireless connectivity more affordable and community-driven. As the network grows and more IoT devices connect through it, demand for and use of the HNT token can evolve.

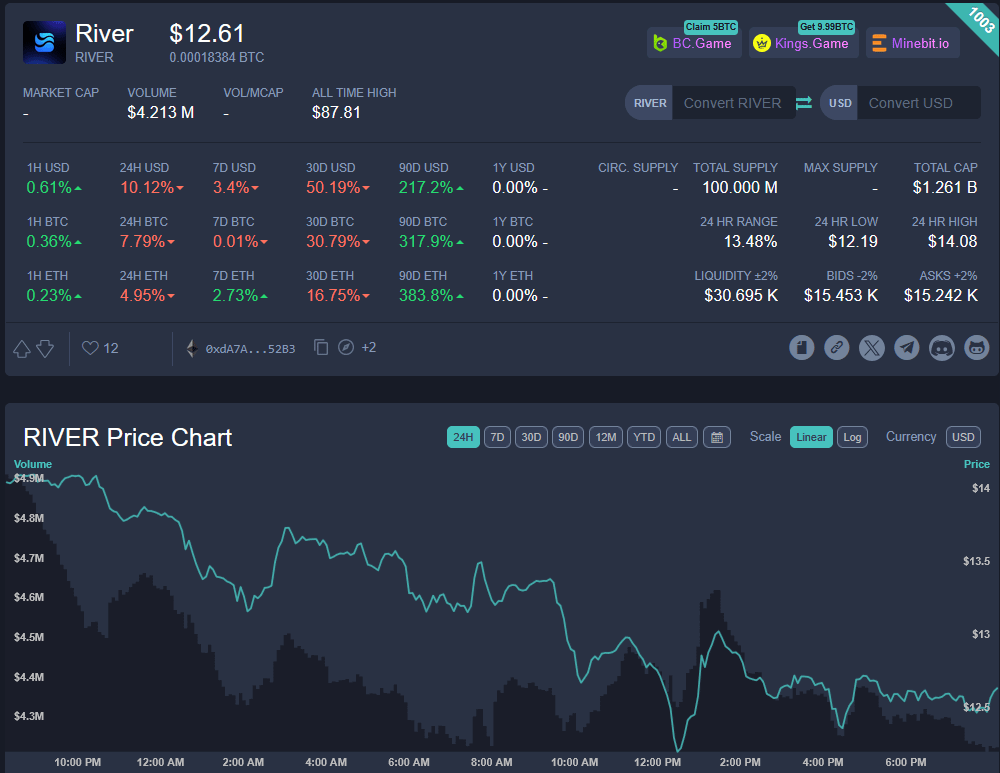

RIVER has seen strong price moves in 2026, with notable rallies earlier in the year — including surges of hundreds of percent — though it remains highly volatile and has corrected from recent highs.

Recent trading data shows the token still attracting attention and experiencing short-term rallies, for example a ~27% jump following a cross-chain bridge launch and new exchange listing.

🔗 Project Developments

River’s core idea is building a chain-abstraction stablecoin ecosystem that lets users mint and use stablecoins across blockchains without traditional bridges, which is a key part of its DeFi narrative.

Expansion efforts include integrations with other networks (like Sui) and ecosystem growth via technical enhancements and community engagement features.

💰 Backing & Risk

The token has received institutional backing from known crypto investors/funds, which has helped market interest.

However, analysts and traders continue to highlight volatility and supply concentration risks, meaning caution is advised for speculative holders.