$BTC price breaks the psychological $69,000 level as bearish sentiment spreads across the market.

The market woke up this morning (16/02/2026) under a blanket of red. Bitcoin has officially lost the psychological support level of $69,000, currently trading around $68,287. With the Fear & Greed Index plunging to 12 (Extreme Fear), the biggest question right now is: Are we facing a genuine market breakdown, or is this merely a “cheap accumulation” trick by whales?

1. The Big Picture: When the 69K “Sanctuary” Collapses

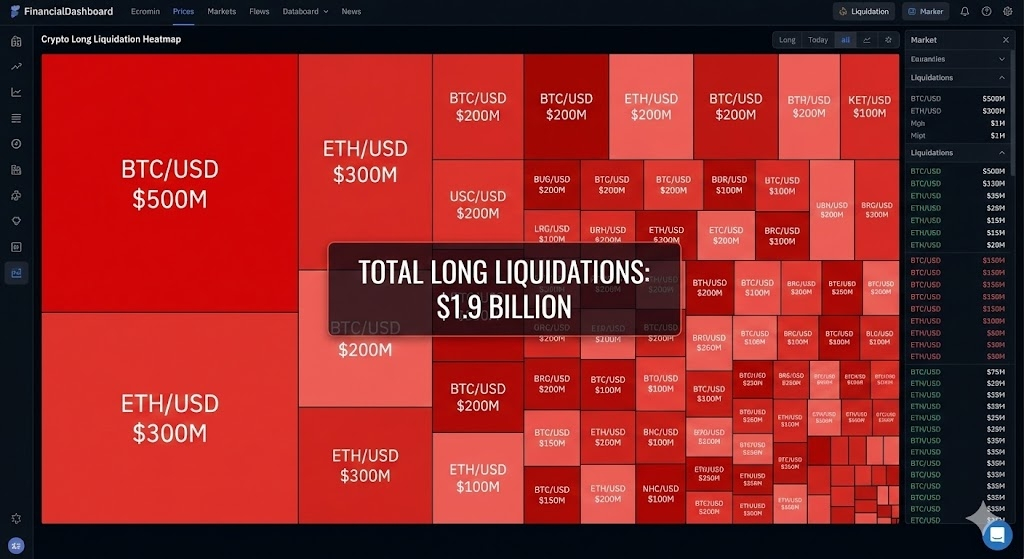

Over $1.9B in long positions wiped out, triggering a cascade of forced selling.

Twice this week, $BTC failed to hold the $69,000–$70,000 zone. This area was previously seen as a “steel wall” following the recovery from the $60k low earlier this month.

But let’s look deeper at the numbers behind the price action:

Leverage liquidation: More than $1.9 billion in Long positions has been wiped out over the past week. This is the primary reason for the sharp slide—a classic domino effect.

ETF flows: Continued mild net outflows, indicating institutions are temporarily in “defensive mode.”

Institutional outflows and bearish crowd expectations highlight growing pessimism.

Crowd prediction: On Polymarket, 65% of participants are betting that BTC will hit $60k before revisiting $80k.

Pessimism is everywhere—but is the crowd always right?

2. The Fear Paradox: Low Volume & Retail Still Buying

Extreme Fear (Index at 12) historically appears near local market bottoms.

This is where we must separate emotion from data. Despite the price drop, there’s a curious signal experienced traders are whispering about: volume has not exploded.

Price falling without panic-level volume suggests repositioning rather than mass capitulation.

24h trading volume stands at $37.64 billion—large, but not enough to qualify as a true panic sell-off.

Retail investors: According to data from Coinbase, quiet accumulation by retail buyers is still taking place.

Market structure: Analysts on X point out that if this were a true trend reversal, selling volume should spike dramatically. So far, this looks more like repositioning than a mass exodus.

Expert take:

“Price is falling, fear is extreme (Index at 12), yet no one is panic-selling aggressively? This is often a sign of shaking out weak hands before the train moves on.”

3. Survival Scenarios: 66.4K Is the “Final Line”

The 66.4K–67K zone is the critical battlefield for short-term trend direction.

We don’t guess—we trade with a plan. Based on current charts and on-chain data, here’s the actionable roadmap:

🚨 Bearish scenario (High risk)

If BTC fails to hold the $66,400–$67,000 hard support zone:

The floodgates could open, pushing price straight to $64,000, or worse, a retest of $60,000.

Action: Absolute stop-loss if 66k breaks. Don’t try to hold losses in an Extreme Fear market.

🚀 Bullish scenario (Hope)

If BTC holds above 67k and buying volume returns:

Short-term target is a retest of the $70,000–$72,000 liquidity zone.

Action: Only consider Long positions when price decisively closes a 4H candle above $69,500 with strong volume.

4. Advice for Traders Right Now

Strict position sizing (1–2% risk per trade) is essential in high-volatility conditions.

This is the most sensitive phase since BTC topped at ATH 126k. Don’t let emotions control your trigger finger.

Capital management is king: Use only 1–2% of your account per scalp trade. The risk of being “wicked out” is extremely high.

Don’t catch a falling knife: If you’re risk-averse, wait. Better to buy slightly higher (above 70k) with confirmation than cheaper (68k) without knowing where the bottom is.

DCA strategy: For those who believe in the long-term return of the “King of Crypto,” prices below 69k with a Fear Index at 12 are gifts for accumulation—not for selling.

5. Conclusion

The market splits between long-term holders and cautious traders waiting for deeper levels.

Bitcoin is wounded—but not dead. This drop is a brutal psychological test for anyone still dreaming of quick riches after the fall from 126k.

Remember: “Be greedy when others are fearful”—but be greedy with knowledge.

The 66.4k zone will be the decisive battlefield over the next 48 hours.

👉 WHICH SIDE ARE YOU ON?

🔥 Team Diamond Hands: Holding strong—Fear Index 12 is the time to buy more!

❄️ Team Exit: Already cut losses, waiting for 60k before reassessing.

💬 Drop your view in the comments and don’t forget to share this article so fellow traders can keep a steady hand!

If you want a detailed chart update tomorrow, just leave a dot (.) below!

#BTC #BTCFellBelow$69,000Again