1. As Per Data (Merged Quantitative & Technical Overview) 📊

Spot Price & Levels 💰: $BTC is currently tradng between $68,762 - $69,694.

The chart identifies a (HVL) and Call Resistance pivot at $70,000.

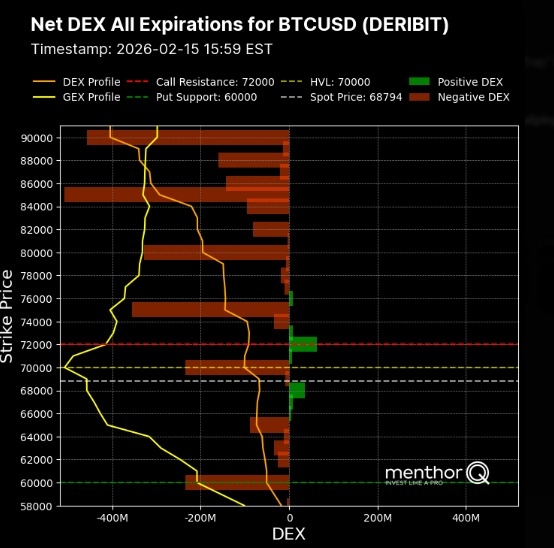

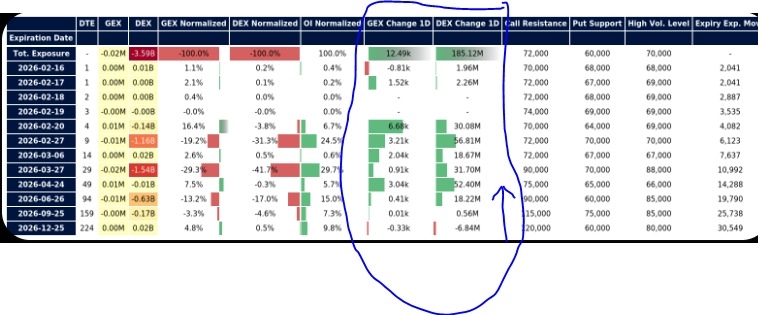

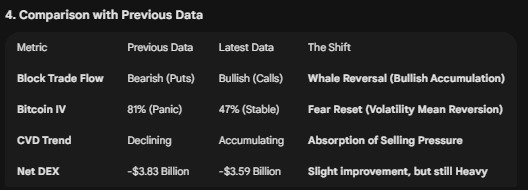

Net Exposure (DEX/GEX) ⚖️: Net DEX remains deeply negative at -$3.59 Billion, indicating a strong downward "gravity" from market makers.

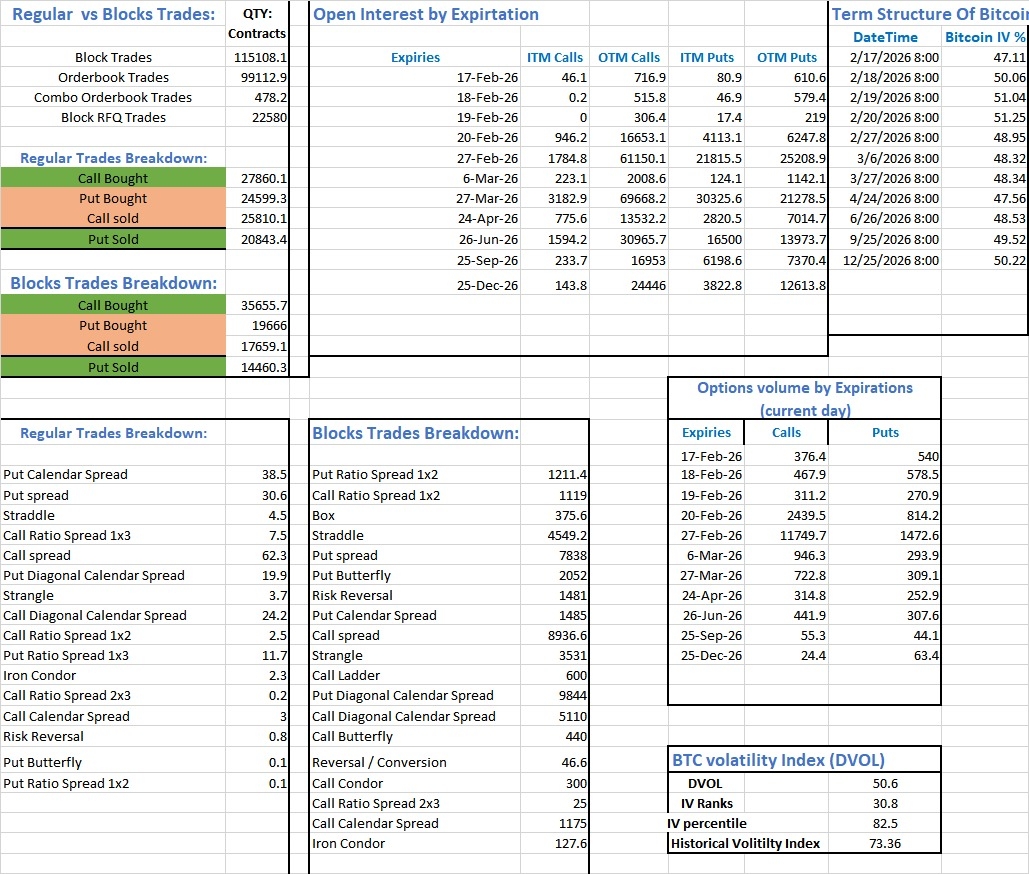

Block Trade Flow 💹: A massive influx of Call Buying (35,655 contracts) vs Put Buying (19,666 contracts). Whales are aggressively positioning for an upside move.

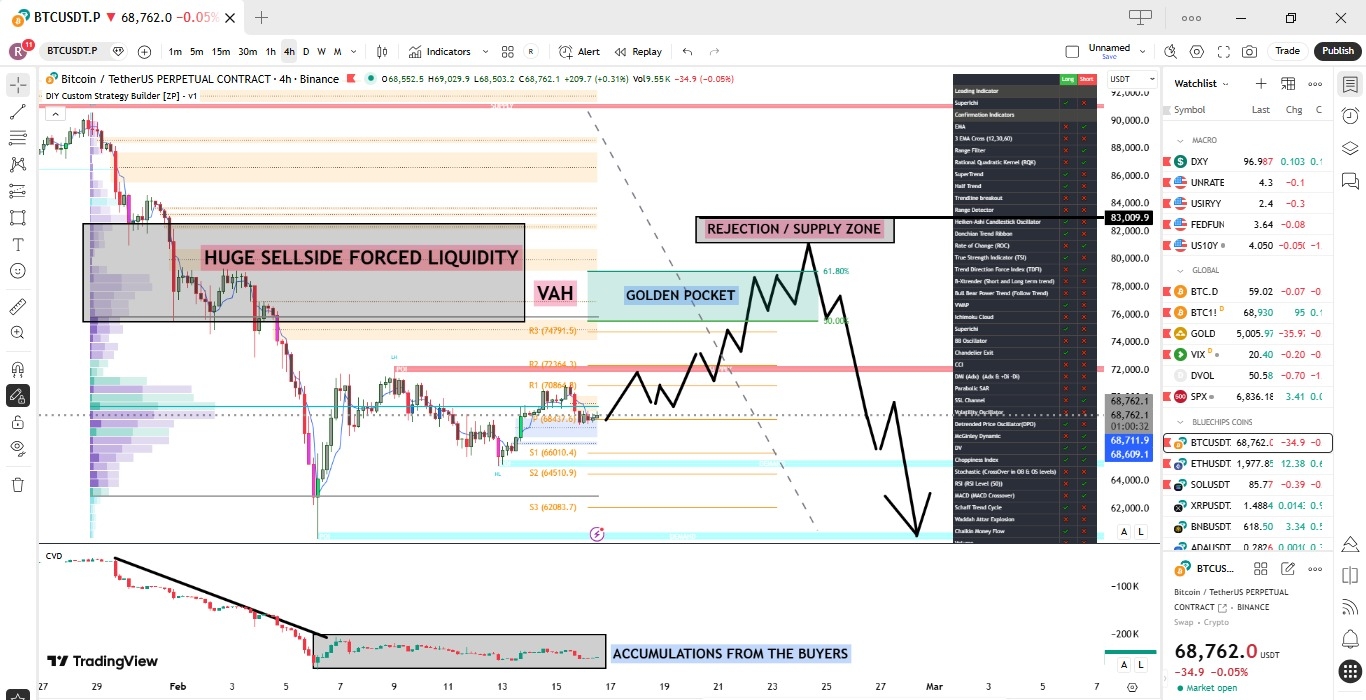

Technical CVD & Liquidity 💎: The 4H chart shows "Accumulations from the buyers" in the Cumulative Volume Delta (CVD) at the current lows, while highlighting "Huge Sellside Forced Liquidity" (stop-loss pockets) resting on the left.

Volatility Profile 🌪️: IV has stabilized at 47%, down from the 81% panic zone.IV Percentile is at 82.5%, suggesting options are still relatively expensive but the immediate "fear" has subsided.

2. Deep Analysis: The Quant-Technical Divergence 🔍

Our Quant Model reveals a high-stakes battle between institutional accumulation & dealer-driven price suppression.

The Accumulation Absorption 🛒: The technical chart shows a clear CVD accumulation at the $68k range.

Aligns perfectly with the 35k+ Call contracts bought in block trades. Whales are buying the dip.

However, Net DEX is -$3.59B, dealers are hedging these calls by selling the underlying, keeping price “stuck” despite buying pressure.

The $70,000 Gravity Flip ⚡:The HVL ($70k) is the line in the sand.As long as price is below $70,000, we are in a Negative Gamma Regime. Any bounce is likely to be sold off by dealers.

Reclaiming $70k is the only way to trigger a "Gamma Squeeze."

Upside Targets (The Golden Pocket ): If $70,000 is reclaimed, the chart points to $76,000 - $78,000 (Golden Pocket) and the Value Area High (VAH).

Heavy Call Resistance ($72k - $80k) starts to build up in the GEX profile.

3. Institutional Sentiment & Expected Moves 🏦

Strategic Outlook 📈: Large institutions are "Strategically Bullish but Tactically Cautious."

Bottom Fishing 🎯: Actively using $68k level to build long-biased spreads (Call Spreads/Call Diagonals).

They do not expect a total collapse to $60k (Major Put Support).

Anticipating a Squeeze ⏱️: High volume of calls for Feb 27 expiry suggests timing a move for late February.

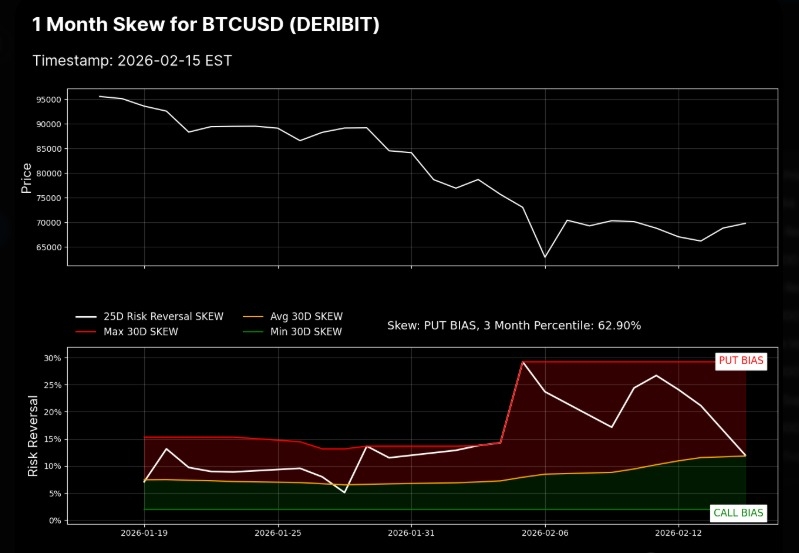

Risk Management 🛡️: Despite the buying, "Put Bias" (Skew) is still in the red zone.

They are keeping downside protection in case $68,000 (0DTE Support) fails.

4.Market Sentiment Scale (1-100) 📊

Current Score: 49/100

Verdict: Neutral-to-Short Build-up (Transitioning) ⚖️

Reasoning: The score has improved from 32 to 49. We are on the verge of a Neutral (50) flip.

Why not above 50? Because the price is still below the HVL ($70k) and Net DEX is still negative. Until the price breaks the dealer's sell-wall at $70,000, the "Short Build-up" remains the dominant mechanical force, even if Whales are trying to buy.

Our Practical Trading Strategy (The Quant Model Way) 📝:

The Short Trap ⚠️: Avoid shorting aggressively here because the CVD Accumulation and Whale Call Buying are massive.This is a potential trap for late bears.

The Confirmation ✅: Wait for a 4H close above $70,200.

Once the HVL is reclaimed, the negative DEX will turn into a tailwind (short covering), and the path to the Golden Pocket ($76k) opens up.

Stop Loss 🛑: A clean break below $68,000 invalidates the accumulation thesis and would likely trigger the "Forced Liquidity" cascade shown on your chart.

#MarketRebound #MarketSentimentToday #BTCFellBelow$69,000Again #BTC走势分析