I was standing in line at the local vegetable market last week, watching notes and coins pass from customer to vendor to the next stall in a steady, almost invisible current. No one was hoarding the rupees; they moved because tomatoes needed buying, wages needed paying, and the whole small economy kept breathing. The contrast hit when I got home and opened a drawer full of old foreign coins I’d saved “for a rainy day.” They sat there, perfectly still, accruing nothing but tarnish.

The same quiet observation carried over when I logged into CreatorPad later that evening. The campaign tasks loaded in their usual clean list, and one title sat there without decoration: Token Velocity vs Long-Term Value Accrual in $VANRY . I tapped the card. The screen changed to the submission view, the full title anchored at the top of the empty response box like a challenge. That single “vs” between the two phrases, staring back while the cursor blinked in the blank field, stopped me cold. It was in that precise moment—facing the unadorned opposition on the CreatorPad editor—that an assumption I had carried for years quietly fractured.

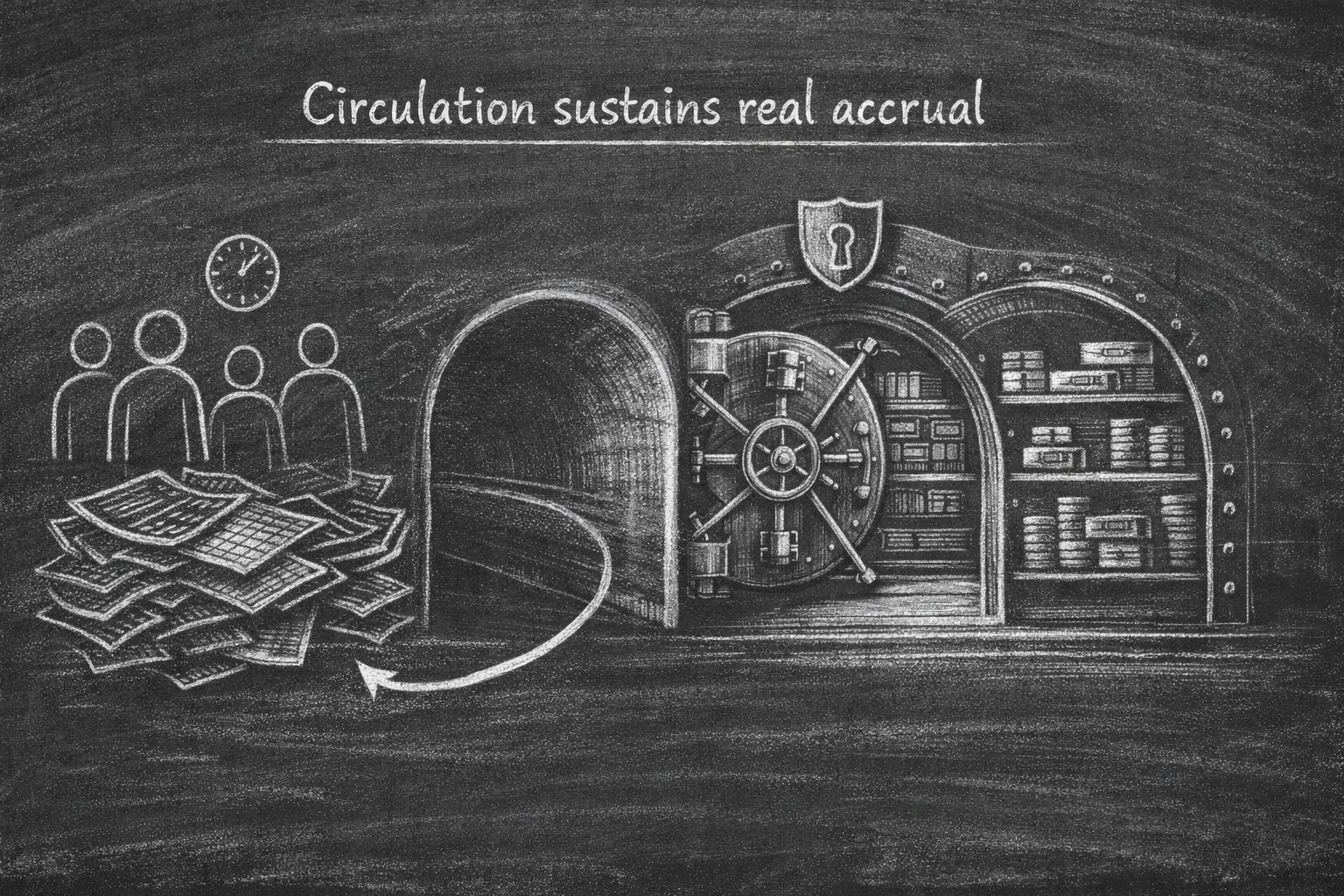

We have been taught that token velocity and long-term value accrual are locked in conflict, that the only way for a token to gain lasting worth is to slow its movement to a crawl. Stake it, lock it, burn it, reward holders for doing nothing. The lower the velocity, the higher the “accrual.” It sounds disciplined. It feels protective. But the task’s blunt framing forced the opposite thought: what if this supposed opposition is mostly a comforting fiction?

Traditional economies do not treat circulation as the enemy. Money that refuses to move signals caution or decline, not strength. Shops empty, suppliers stall, wages freeze. Crypto has inverted the lesson with almost religious conviction. Projects design elaborate mechanics to suppress velocity, then celebrate the resulting charts as proof of seriousness. The result is familiar: communities of passive holders, on-chain activity that barely registers, and tokens whose value feels borrowed from speculation rather than earned through use. The more we engineer against movement, the more the token becomes a speculative trophy instead of a working part of any system.

This habit runs deeper than any single whitepaper. It trains teams to prioritize incentive layers over product layers. It trains users to treat tokens as lottery tickets rather than tools. Over repeated cycles we have seen the pattern: heavy staking rewards, low daily transactions, then the slow drift toward irrelevance once the carrots run out. The criticism feels risky because it questions the dominant playbook—yet the playbook keeps producing the same quiet failures.

Vanar Chain and its $VANRY token sit squarely inside this tension. The token exists to move through the chain’s specific interactions; its design does not appear built around artificial scarcity or prolonged locking. The CreatorPad task made the example impossible to ignore. Here was a project where velocity is not a bug to be fixed but a feature the infrastructure requires. The contrast with the usual accrual-first approach was suddenly stark, and the discomfort was that the usual approach might be the one doing the damage.

None of this dismisses the need for some form of value capture. Pure velocity without any mechanism to reward participants who secure or improve the network would collapse under its own weight. But the extreme we have normalized—treating circulation itself as the threat—has produced far more stagnant ledgers than thriving ones. We keep rewarding immobility and then wonder why the ecosystems feel lifeless.

The question that stays with me is simple and unresolved: how many more projects will we watch quietly fade because we designed their tokens to sit still rather than to work?