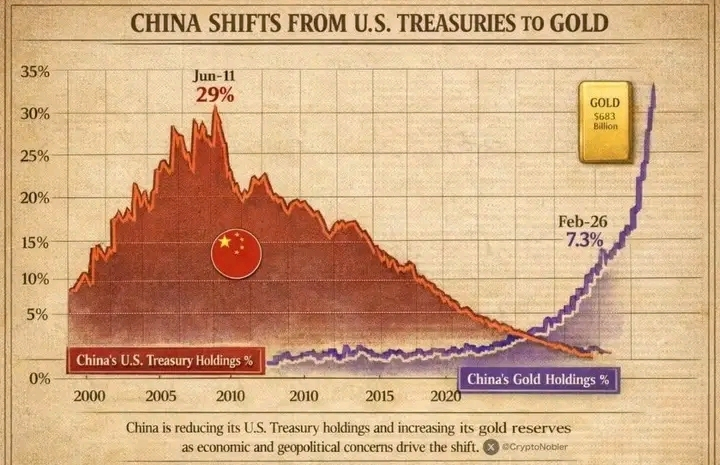

China’s Strategic Shift from U.S. Treasuries to Gold: A Macro Turning Point?

Over the past decade, China has gradually reduced its exposure to United States Department of the Treasury securities while significantly increasing its gold reserves. This transition reflects more than a simple portfolio adjustment — it signals a broader strategic recalibration in global finance.

Declining U.S. Treasury Holdings

At its peak around 2011, China’s U.S. Treasury holdings represented a substantial portion of its foreign reserves. Over time, however, that allocation has steadily declined. The reduction suggests a deliberate move to decrease reliance on dollar-denominated assets.

Several factors may explain this shift:

Rising geopolitical tensions

Concerns about long-term U.S. fiscal sustainability

The weaponization of the dollar in global sanctions

Portfolio diversification strategy

By lowering exposure to U.S. government debt, China reduces vulnerability to external political and monetary risks.

The Rise in Gold Reserves

At the same time, China has been steadily accumulating gold. Gold has historically served as:

A hedge against currency depreciation

Protection during financial crises

A neutral reserve asset outside political control

Unlike sovereign debt, gold carries no counterparty risk. In periods of uncertainty, central banks often increase gold allocations to strengthen reserve stability.

What This Means for Global Markets

This transition does not necessarily mean an immediate market crash. However, it does signal long-term structural changes:

Reduced demand for U.S. Treasuries could affect global bond yields.

A stronger push toward gold may support higher long-term gold prices.

It reflects a broader trend of reserve diversification among emerging economies.

If other major economies follow a similar path, the dominance of the U.S. dollar in global reserves could gradually weaken — though such transitions historically take years, not months.

Is a Global Market Crash Coming?

The narrative that “China will crash all markets” is an oversimplification. Financial systems are complex and interconnected. While China’s actions increase macro uncertainty, markets typically adjust over time rather than collapse instantly.

What we are witnessing is not an immediate crisis — it is a strategic repositioning.

Final Thoughts

China’s move from U.S. Treasuries toward gold represents a calculated hedge against geopolitical and economic uncertainty. Investors should not react with panic, but with awareness.

In macro investing, shifts in reserve strategy often signal where long-term risk perception is heading. And right now, that signal points toward diversification, resilience, and preparation for a more multipolar financial world. Zzz