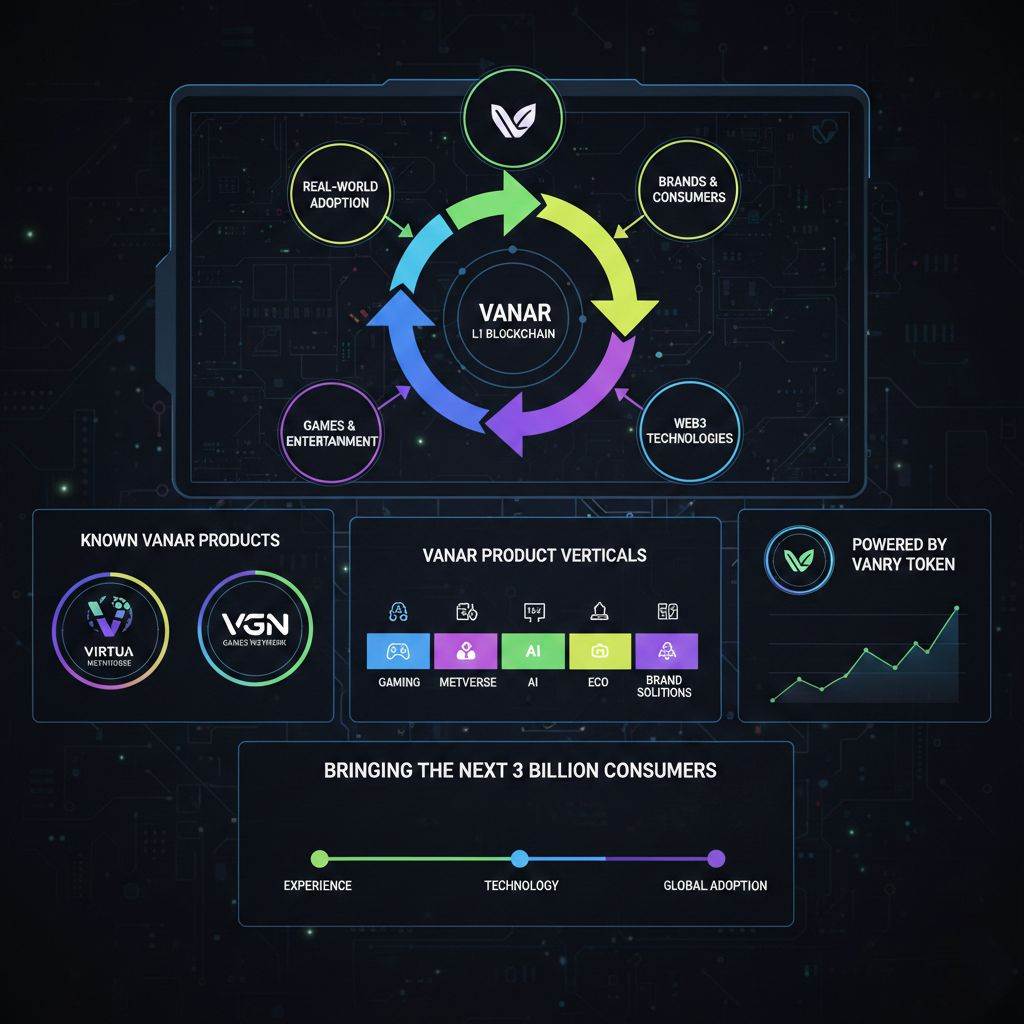

In the evolving landscape of Layer-1 blockchains, technical capability is no longer the decisive variable it once was. Speed, scalability, and modular infrastructure are increasingly assumed rather than exceptional. What now separates enduring networks from fleeting experiments is something less visible but more consequential: the architecture of ownership. In the case of Vanar, a chain positioned for real-world adoption through gaming, entertainment, artificial intelligence, and brand integration, the central design challenge is not merely throughput or developer tooling. It is the structure and distribution of its native token, VANRY.

Token distribution is product design.

This assertion may sound abstract, but for a blockchain that intends to support financial markets and consumer ecosystems simultaneously, it is foundational. Ownership determines incentives. Incentives determine behavior. And behavior determines whether a network stabilizes into infrastructure or dissolves into volatility. A token that circulates primarily as an instrument of early liquidity will behave differently from one that diffuses gradually into the hands of users, builders, validators, and long-term participants.

Vanar’s broader vision is anchored in mainstream-facing verticals. Its ecosystem includes platforms such as Virtua Metaverse and the VGN Games Network, both designed to bridge digital ownership with entertainment and brand engagement. These are not purely financial environments; they are experiential economies where stability matters. Gaming economies depend on predictable value references. Metaverse marketplaces require confidence that in-platform assets will not be undermined by structural token emissions. Brands evaluating Web3 integrations seek reliability over spectacle.

If a Layer-1 token experiences continuous sell pressure due to concentrated allocations or aggressive unlock schedules, the instability propagates beyond price charts. It reaches the product layer. Developers hesitate to denominate in-game economies in a volatile asset. Users grow wary of holding balances. Liquidity becomes reactive rather than constructive. In such an environment, even strong technology struggles to anchor sustainable activity.

This is not a moral critique of early investors or team allocations. Capital and talent require compensation. The question is calibration. A blockchain intended to serve as financial infrastructure must align its token distribution with its growth curve. If large tranches of supply enter circulation before organic demand matures, the imbalance creates a structural overhang. Markets interpret that overhang as future selling pressure, and expectations alone can dampen participation.

For Vanar, whose ambition extends to onboarding new users from gaming and entertainment sectors, the token must function less as a speculative instrument and more as a coordination layer. It must reward participation without encouraging extraction. It must decentralize gradually without destabilizing early. It must give developers reason to build enduring systems rather than short-term incentive farms.

The phrase “bringing the next three billion consumers to Web3” carries strategic implications. Consumer markets are sensitive to trust signals. Unlike crypto-native traders, mainstream users do not evaluate vesting schedules or tokenomics spreadsheets in detail, but they experience the consequences indirectly. If a platform’s underlying token trends persistently downward due to predictable emissions, user confidence erodes. That erosion is subtle at first, then structural.

Token distribution also shapes governance. If ownership remains concentrated among early stakeholders, governance decisions may prioritize capital preservation over user experience. Conversely, excessively fragmented distribution without responsible stewardship can produce incoherent direction. The challenge lies in designing a distribution arc that evolves alongside network maturity, progressively transferring influence to participants who generate real utility.

Vanar’s cross-sector orientation gaming, metaverse, AI, and brand solutions means that its token must perform across multiple economic contexts. In gaming, it may underpin digital asset ownership and marketplace liquidity. In brand integrations, it may facilitate engagement rewards or digital identity. In AI-driven applications, it could support data or compute marketplaces. Across all these use cases, predictable supply dynamics are more valuable than short-term speculative surges.

A blockchain cannot function properly as a financial substrate if its token ownership structure produces constant structural sell pressure. Financial markets require confidence in settlement assets. Even decentralized systems depend on some degree of economic predictability. When participants anticipate recurring unlock-driven liquidity waves, they adjust behavior defensively. Defensive markets are thin markets. Thin markets discourage builders.

In this sense, token distribution is not a secondary economic detail but the invisible scaffolding of the entire ecosystem. It determines whether value accrues internally or exits continuously. It shapes whether staking participation deepens security or remains opportunistic. It influences whether ecosystem grants translate into enduring products or temporary traffic.

Vanar’s long-term relevance will therefore depend less on the breadth of its vertical ambitions and more on the quiet mathematics of how VANRY ownership evolves. A sustainable Layer-1 is not defined solely by TPS metrics or partnership announcements. It is defined by whether its token economy encourages accumulation through contribution rather than distribution through exit.

Ownership, when carefully structured, becomes architecture. It channels incentives toward stability, development, and trust. When misaligned, it silently undermines even the most compelling narrative. For Vanar, the decisive test will not be whether it can build platforms across gaming and metaverse domains, but whether its token design transforms those platforms into durable economic systems rather than transient experiments.