As of February 17, 2026, the "L1 Wars" have entered a second phase. We are no longer debating if blockchains can scale; we are debating how fast they can settle. While the broader market watches the $1 trillion capital surge into safe-haven assets, the smart money is quietly rotating into a specific niche: High-Fidelity SVM infrastructure.

At the center of this rotation is @Fogo Official . After a month of mainnet stability, it’s time to move past the surface-level "speed" narrative and look at the structural shift Fogo is forcing upon the industry.

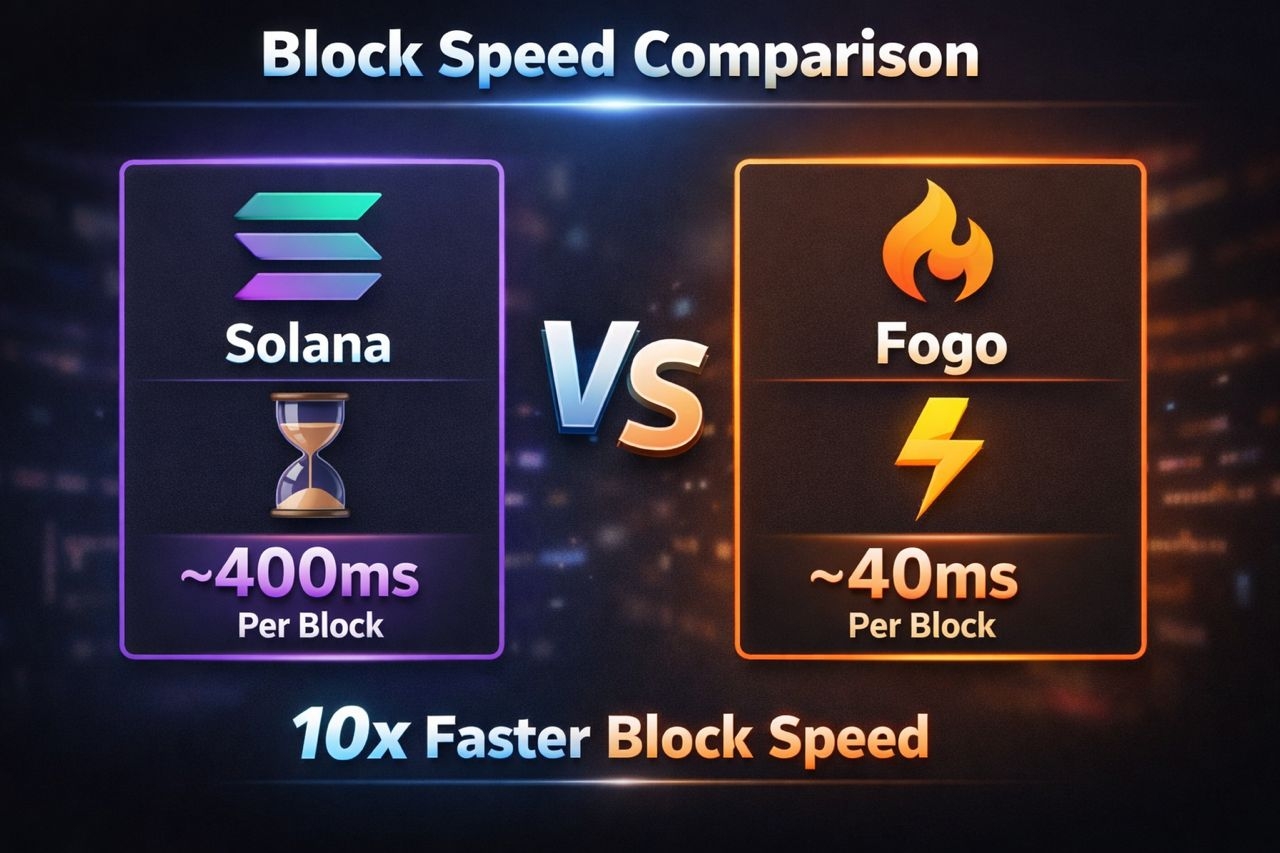

1. The Firedancer Edge: Beyond the 400ms Ceiling

Most traders understand that Fogo is fast, but few understand why. Traditional SVM chains (like Solana) are currently capped by a 400ms block production ceiling due to legacy client bottlenecks. Fogo has effectively "broken the speed limit" by standardizing a customized Firedancer validator client.

By removing the "multi-client drag" and focusing on a single, high-performance engine, Fogo achieves 40ms block times.

Why this matters for your PnL:

In the 400ms world, you are still vulnerable to "micro-lags" that MEV (Maximal Extractable Value) bots exploit to front-run your trades. In the 40ms world, that window is physically too small for most bots to operate. Fogo isn't just a faster chain; it's a Fairer Chain.

Pro Tip: This visual is essential to show readers the 10x performance gap.

2. Multi-Local Consensus: The "Tokyo Protocol" 🇯🇵

One of the most innovative (and under-discussed) features of #fogo is Multi-Local Consensus. To achieve 40ms speed, validators are co-located in high-performance zones like Tokyo.

Critics often claim this hurts decentralization. However, Fogo’s architecture uses Dynamic Zone Rotation. While the "engine room" might be in Tokyo for one epoch to maximize speed, the validator leadership rotates globally to ensure resilience. It is a "Follow-the-Sun" model for the digital age, providing CEX-like responsiveness with the transparency of a decentralized ledger.

3. Fogo Sessions: The "Invisible" Blockchain Experience

The biggest hurdle for Web3 has always been the UX Friction. signing 50 transactions a day is exhausting.

Fogo Sessions (powered by native Account Abstraction) allows you to open a secure "trading window."

• Zero Popups: Once a session is active, you can swap, stake, and provide liquidity without a single wallet confirmation.

• Gasless Onboarding: Through Paymasters, dApps can sponsor the gas for new users.

This is the "Uber Moment" for crypto where the technology disappears, and only the utility remains.

4. Technical Analysis (TA): The $0.022 Support Floor 📊

Let's look at the numbers. Since the January 15 airdrop, $FOGO has been in a classic "Price Discovery" phase.

• The Bottom is In: We’ve seen three major tests of the $0.022 support level over the last 10 days. Each time, volume has spiked, indicating strong institutional accumulation.

• The Resistance: We are currently battling the $0.025 resistance. A daily close above this level targets the $0.028–$0.030 range, which was the consolidation zone before the early February dip.

• The "Airdrop Overhang": The claim portal for the 22,300 early supporters closes on April 15, 2026. As we approach this date, the "unclaimed supply" uncertainty will vanish, likely acting as a catalyst for a macro re-rating.

Tip: Use the "Draw" tool on your exchange to highlight the $0.022 floor and the $0.025 breakout target.

5. The $33.5M War Chest & Institutional Conviction

Fogo isn't a "bootstrapped" experiment. With over $33.5 million in total funding including the strategic $7M sale on Binance the foundation has the runway to survive any market cycle.

Backing from GSR, Distributed Global, and Selini Capital confirms that professional market makers are treating Fogo as their primary home for automated on-chain strategies. They aren't here for the airdrop; they are here for the 40ms execution.

Final Verdict: The Precision Scalpel of DeFi

Fogo is the first Layer 1 that feels like a professional trading terminal. As the Binance Spring Earn Fiesta continues, keep your eyes on the Total Value Locked (TVL) in protocols like Valiant and Pyron. When the tech meets the liquidity, the "40ms revolution" will be televised.

What’s your move? Are you staking for "Flames Season 2" or trading the $0.022 bounce? Let’s talk in the comments! 👇