When I first started hearing about Fogo Network, the conversation sounded familiar. People kept repeating the same phrases about speed, throughput, and low latency. I have seen that script many times in crypto. Fast chains are easy to describe and very hard to actually operate well.

What pulled my attention in a different direction was a more practical question. What does Fogo Network look like when no one is marketing it and it is simply running as infrastructure? I am not thinking about slogans. I am thinking about how leadership rotates, how zones are managed, how validators are maintained, how developers access stable endpoints, and how the network behaves when pressure builds.

From that angle, I do not see Fogo Network as just another crypto project. I see it as a real time systems project that happens to use a blockchain structure.

Time Discipline Instead Of Pure Speed

I do not think the most expensive problems in trading come from being a little slower. In my experience, the real damage comes from inconsistency. It is unpredictable timing, temporary failures, and systems that behave perfectly in testing but differently under stress.

The core design choices inside Fogo Network feel centered around what I would call time discipline. Block production follows a defined rhythm. Leadership rotation is structured. Latency is managed deliberately. Performance is treated as something controlled rather than left to chance in a fully open environment.

Even in testnet documentation, I noticed that Fogo Network defined concrete timing goals. Blocks were targeted around forty milliseconds, and leadership rotated after a fixed number of blocks, roughly translating into short and measurable windows of control.

That may look like a small implementation detail. To me, it signals something more serious. It says the team wants timing that people can plan around rather than timing that simply looks good in an average metric.

Geographic Zones As A Performance Tool

There is something traditional finance rarely advertises openly. The best execution environments often rely on physical proximity. Systems are placed near each other to reduce latency and remove unpredictable delay.

Fogo Network openly acknowledges this reality. The architecture introduces a zone model where validators operate close to one another to reduce consensus latency. The aim is to keep the critical path of agreement geographically tight instead of stretching it across continents at all times.

I find that approach honest. Many networks begin with a global decentralization narrative and later struggle with performance gaps. Fogo Network starts by accepting that performance sensitive markets benefit from proximity, then designs a rotation model to redistribute that advantage across regions over time.

Testnet material explains that consensus can shift between regions such as Asia Pacific, Europe, and North America. I do not see that as centralization. I see it as acknowledging a tradeoff and managing it deliberately rather than pretending it does not exist.

Rotating Zones As Operational Rhythm

In testnet conditions, epochs last around ninety thousand blocks, which comes out to roughly an hour. After that period, consensus rotates to a different zone.

An hour is meaningful in trading terms. It is long enough to observe consistent behavior and short enough to demonstrate that no single region permanently controls the process.

When I look at that structure, I see more than a technical detail. I see an operational rhythm. It feels like the network is proving it can run in one region, then repeat the same performance elsewhere, on schedule.

That type of reliability testing is often overlooked in early stage crypto projects. Yet it is exactly the kind of pattern institutional participants look for when evaluating infrastructure.

Developer Access And Endpoint Stability

Another area I pay attention to is developer access. A chain can advertise high performance, but if its RPC endpoints are unreliable, most users will experience frustration rather than speed.

I noticed that ecosystem contributors such as xLabs discussed running multiple RPC nodes across different regions during testnet. These nodes were not part of consensus. They were dedicated to improving developer access and stability.

To me, that is a practical sign of maturity. It shows awareness that usability depends on redundancy, geographic distribution, and consistent response times. Real systems break because of failed endpoints more often than because of theoretical consensus flaws.

When teams focus on multi region RPC support and redundancy, I see an ecosystem thinking about production rather than only about ideology.

Validator Discipline And Economic Structure

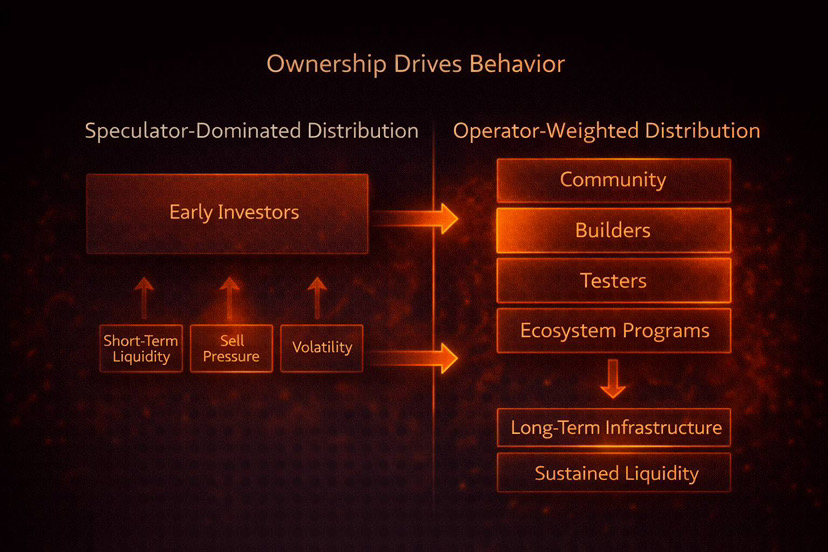

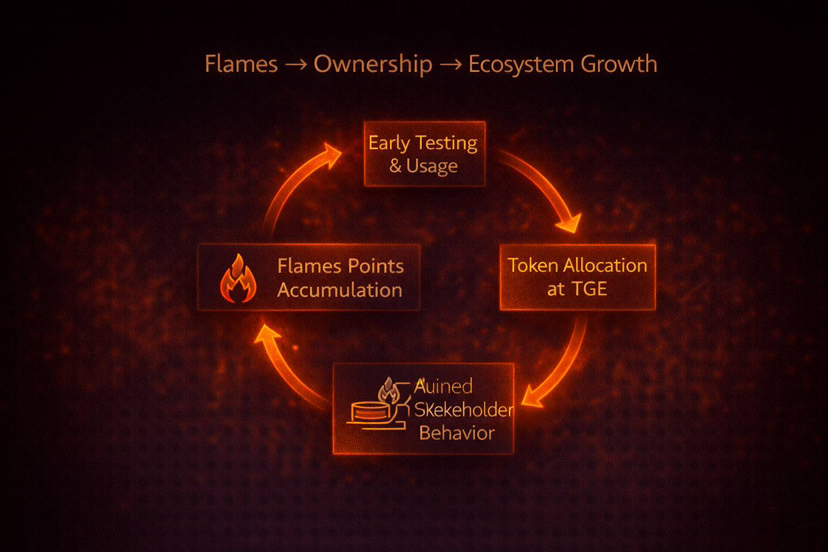

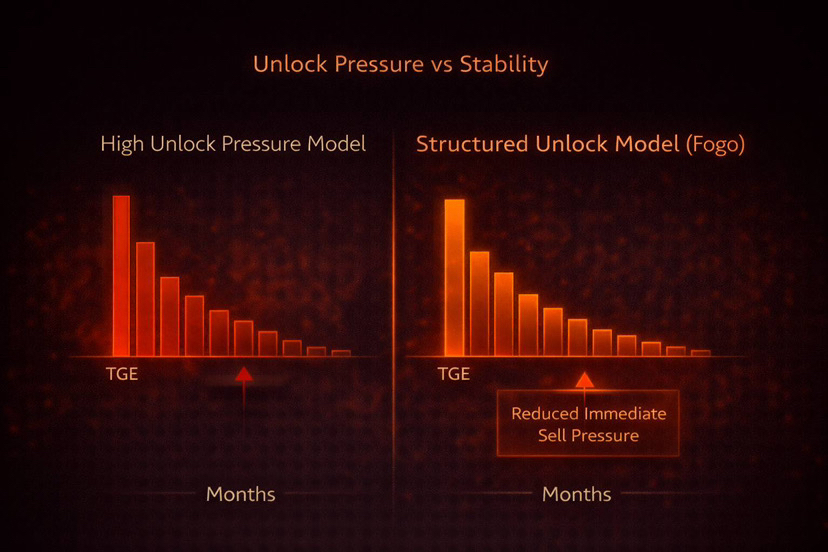

The token structure inside Fogo Network also reflects operational thinking. Validators must stake to participate and secure the network, and delegators can support them through staking. Transaction fees require the native token.

I am not interested in repeating generic token utility explanations. What matters to me is the operational implication.

If a network depends on zone coordination and structured timing, validators cannot behave casually. They must meet performance expectations. Staking, incentives, and governance mechanisms are some of the few tools available to enforce discipline in an open system.

The documentation also frames the token in formal regulatory language, categorizing it as a utility token required for access to the protocol. Whether or not someone follows European regulatory frameworks closely, this signals that the project is thinking in structured system terms rather than only in crypto native storytelling.

Designing For Stress Not For Demos

Anyone can demonstrate speed in a quiet environment. The real question is what happens when nodes fail, regions switch, traffic surges, or developers push the system hard.

The combination of zone based consensus, deterministic leadership rotation, short leadership windows, and scheduled epoch transitions suggests an attempt to make a public blockchain behave more like exchange infrastructure.

I do not interpret this as chasing perfection. I interpret it as trying to limit the sources of chaos.

If Fogo Network can maintain consistent execution across zone transitions and under load, then it has a realistic chance of supporting meaningful trading activity. If it cannot, it may still be fast on paper but unreliable in practice.

Performance As A Service Level

In my view, many people misunderstand what performance means in blockchain systems. They treat it as a badge of honor shown through benchmarks and screenshots.

Long term value comes from treating performance as a service level commitment. That means predictable timing, predictable access, stable behavior during stress, and clearly defined operational parameters.

The way Fogo Network presents its testnet documentation feels aligned with that philosophy. It reads more like something designed to be measured and audited than something written to be admired.

The fact that independent infrastructure teams talk openly about multi region RPC deployments and validator testing reinforces that mindset.

A Shift From Narrative To Systems Thinking

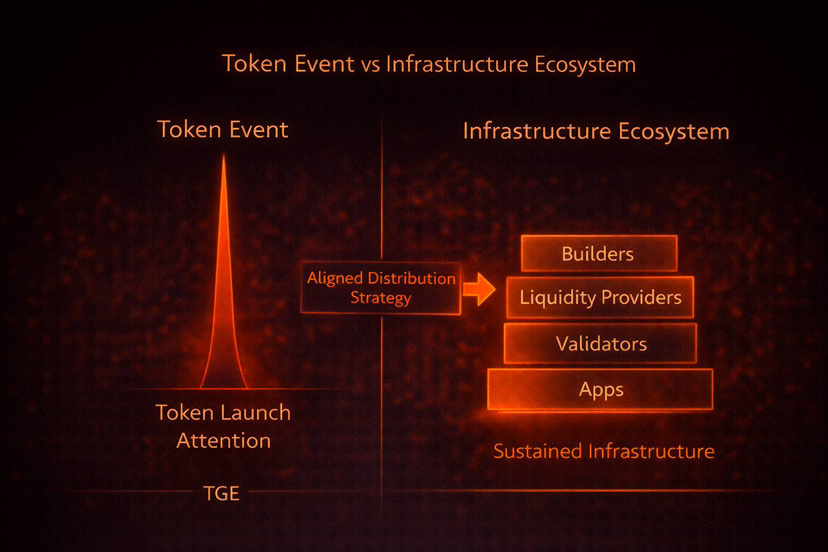

What I see in Fogo Network is an attempt to move the conversation from storytelling to system design.

It openly acknowledges that real time markets require proximity, controlled latency, predictable leadership, and infrastructure that scales with load. It tries to design around those requirements while still rotating geography, using staking incentives, and remaining compatible with the Solana Virtual Machine environment.

This path is not flashy. It does not generate viral charts as easily as raw throughput claims.

But if it succeeds, Fogo Network will not be remembered simply as another fast chain. It will be remembered as one of the early networks that treated market performance as an operational discipline, something to be run, monitored, rotated, tested, and continuously improved rather than merely advertised.

That, to me, is a far more ambitious goal than trying to beat Solana on a benchmark.