Bitcoin just crashed from $112K → $104K in 24 hours, liquidating $406 MILLION worth of positions.

Retail traders? Absolutely destroyed.

But here’s what they won’t tell you on Crypto Twitter.

━━━━━━━━━━━━━━━━━━━

THE CARNAGE (Real Numbers, Zero Sugar-Coating)

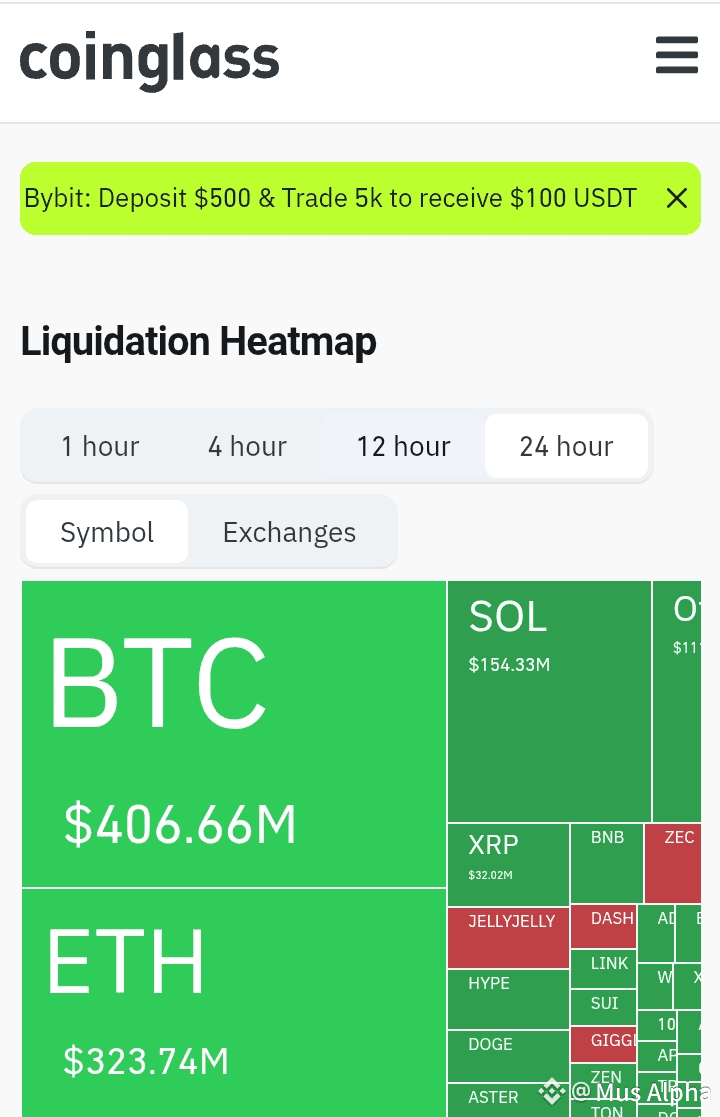

Liquidation breakdown:

• Total wiped: $406.6M

• Long liquidations: $386M (≈95% of total)

• Short liquidations: $20.6M (barely a scratch)

• Biggest single victim: $33.9M BTC-USDT long on HTX

Translation: Retail went all-in long at $110K+, got liquidated on the way down. Classic.

Hyperliquid led the massacre with ~$374M in forced closures. Binance and Bybit cleaned up the rest.

━━━━━━━━━━━━━━━━━━━

WHAT WHALE WALLETS ARE ACTUALLY DOING (While You Panic)

Everyone’s screaming “Bitcoin’s dead!”

But on-chain data tells a different story:

Whale activity (last 48 hours):

• Net inflow to exchanges = short-term bearish (whales repositioning)

• Ancient dormant wallets waking up — 6,000 BTC ($644M) moved from Bitfinex → unknown wallet

• Miners dumped $172M BTC (largest outflow in 6 weeks)

The nuance nobody mentions:

These aren’t panic sells. These are strategic repositioning moves.

OG holders taking profit after holding since $500.

Smart money doesn’t panic — they execute.

━━━━━━━━━━━━━━━━━━━

TECHNICAL REALITY CHECK

Support levels destroyed:

• $108K support? Gone.

• $106K trendline from June? Broken.

• Now testing $104K (4th retest = danger zone)

Next support if $104K fails:

→ $100K–$103K (psychological + previous consolidation)

→ Below that? $96K, then $90K

Resistance if we bounce:

→ $106K–$108K (now resistance)

→ $110K–$112K

→ $115K (max pain for Nov options expiry)

━━━━━━━━━━━━━━━━━━━

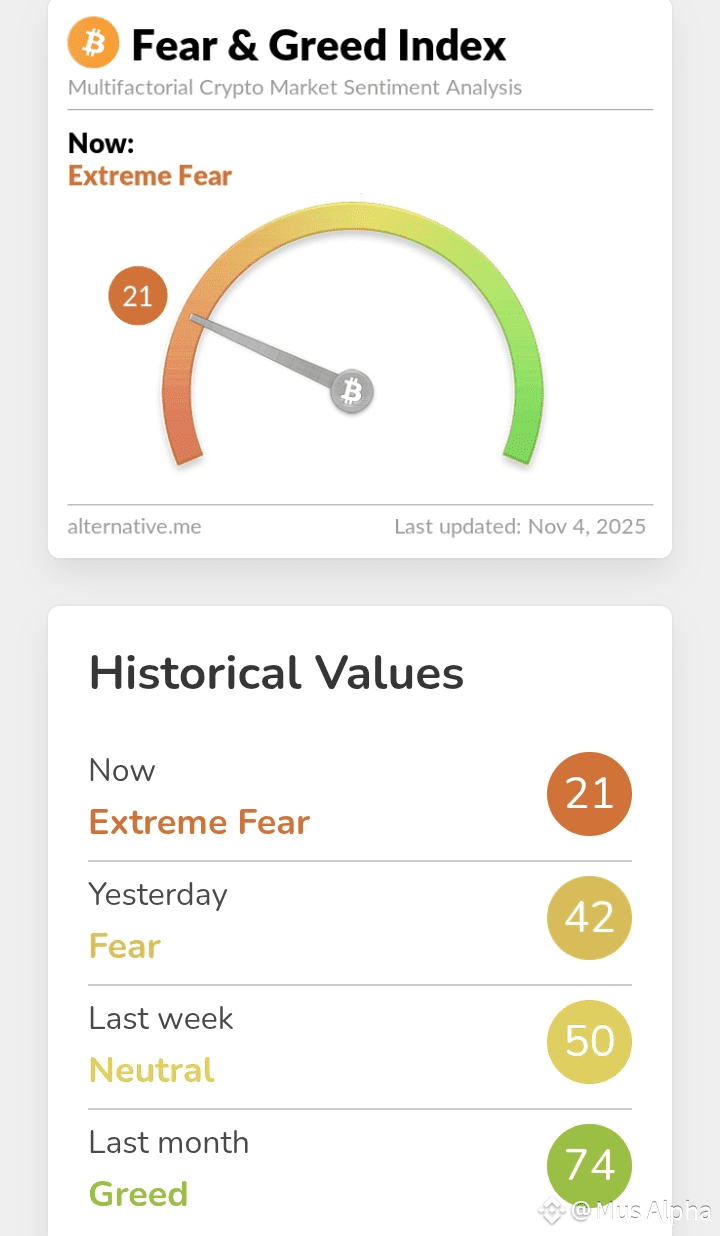

THE FEAR & GREED INDEX DOESN’T LIE

Current reading: 21 (EXTREME FEAR)

Yesterday: 42 (FEAR)

Last week: 50 (NEUTRAL)

Last month: 74 (GREED)

Change: –21 points in ONE DAY

Last time we saw this level?

→ April 9, 2025 (index hit 18 during geopolitical chaos)

Historical pattern:

When Fear Index drops below 25, Bitcoin typically enters an accumulation phase within 7–30 days.

Not guaranteed, but historically probable.

Contrarian signal:

When retail capitulates (Fear Index 21), smart money accumulates.

━━━━━━━━━━━━━━━━━━━

WHY THIS HAPPENED (The Macro Backdrop)

Fed cut rates 0.25% on Oct 29 (second cut in 2025) BUT:

• Powell signaled “no more easy cuts.”

• Compared policy to “driving in fog” (translation: we’re guessing).

• Dollar Index rose → risk-off sentiment.

• Stock market: mixed signals, volatility spillover into crypto.

No major regulatory FUD.

This is pure technical correction + profit-taking + overleveraged retail getting wrecked.

━━━━━━━━━━━━━━━━━━━

MY TAKE (Unpopular Opinion Incoming)

This is a healthy correction, not the apocalypse.

Why:

✅ Liquidations flush out overleveraged longs (good for market health)

✅ Fear Index 21 = historically bullish reversal zone

✅ Whale activity = repositioning, not exodus

✅ No external black swan (just Fed caution + profit-taking)

BUT:

⚠️ If $104K breaks with volume → next stop $100K

⚠️ Miner selling ($172M) adds sell pressure

⚠️ Risk-off macro sentiment could persist

The play:

If you’re long-term bullish → $104K–$100K is your DCA zone.

If you’re trading → wait for $104K to hold or break before entering.

━━━━━━━━━━━━━━━━━━━

WHAT TO WATCH NEXT 24–48 HOURS

🔍 $104K support hold or break (critical level)

🔍 Whale exchange netflow (inflow continues = more downside)

🔍 Fear Index recovery (bounce from 21 = capitulation bottom signal)

🔍 Miner selling slows down ($172M dump right now)

🔍 Options expiry Nov 29 ($115K max pain = magnet effect?)

━━━━━━━━━━━━━━━━━━━

THE UNCOMFORTABLE TRUTH

Retail panic-sold at $104K.

OG holders repositioned at $104K.

Who do you think wins long-term?

Market doesn’t reward emotional decisions.

It rewards patience and data.

Question for you:

Are you panic-selling into Fear Index 21, or are you buying what panicking retail is dumping?

Drop your play in comments.

No judgment — just curious who’s thinking contrarian right now.

━━━━━━━━━━━━━━━━━━━$BTC $ETH $BNB

#Bitcoin❗ #Liquidations #marketcrash

#fearandgreed #CryptoNewss