Many new traders believe you need a large capital to see significant gains in crypto. In reality, skill often matters more than size. With disciplined risk management and the ability to read chart patterns, even a small $680 account can grow substantially over time.

Chart patterns reveal market psychology, helping you identify high-probability entries and exits, time trades accurately, and manage risk effectively.

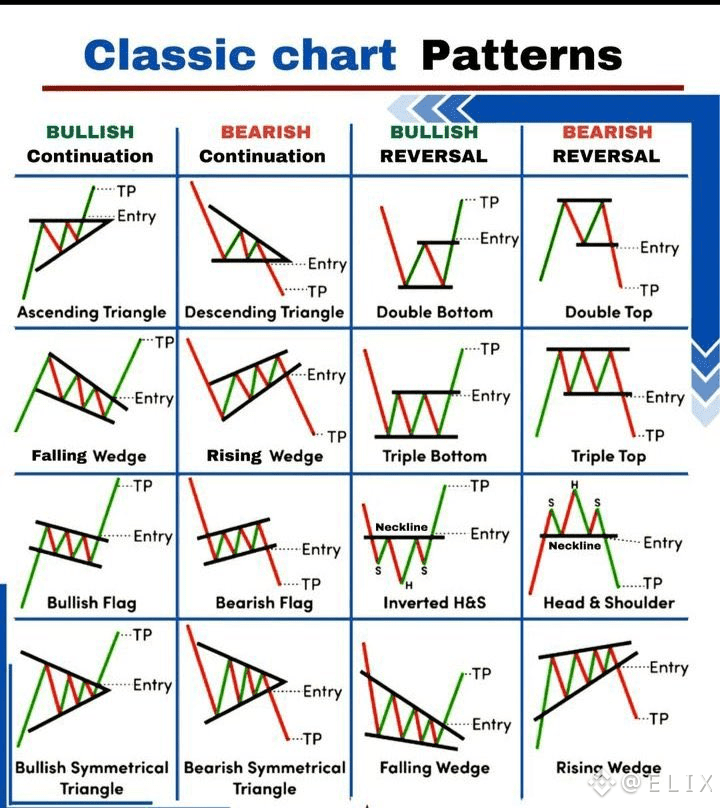

Step 1: Understand the Four Main Chart Pattern Categories

Bullish Continuation

• Examples: Ascending Triangle, Bullish Wedge, Bullish Flag, Symmetrical Triangle

• Meaning: Price pauses briefly before continuing higher. Ideal for joining an uptrend early.

Bearish Continuation

• Examples: Descending Triangle, Bearish Wedge, Bearish Flag, Symmetrical Triangle

• Meaning: Price consolidates before continuing lower. Suitable for short positions or closing long trades.

Bullish Reversal

• Examples: Double Bottom, Triple Bottom, Inverted Head & Shoulders, Falling Wedge

• Meaning: A downtrend shows signs of ending, signaling a potential shift to an uptrend. Useful for spotting bottoms.

Bearish Reversal

• Examples: Double Top, Triple Top, Head & Shoulders, Rising Wedge

• Meaning: An uptrend is weakening, signaling a possible reversal to the downside. Helps secure profits before declines.

Step 2: Build a Trading Plan Around Patterns

Capital Allocation

• Start with $680

• Risk only 2–3% per trade ($14–$20)

Leverage Use

• Moderate leverage (3–5x) for strong setups

• Avoid overleveraging to reduce risk of liquidation

Entry and Exit Rules

• Enter trades when price breaks out of the pattern with confirmation

• Place a Stop Loss just beyond the opposite side of the pattern

• Target profits based on the pattern’s measured move

Step 3: Compound Your Profits

Consistent small wins repeated over time generate real growth.

Example Scenario

• Win 3–5% per trade

• Repeat 100+ disciplined trades

• Profits snowball over time

Hypothetical Growth

• Trade 1: $680 → $714

• Trade 10: $960 → $1,008

• Trade 50: $5,200 → $5,460

• Trade 100+: Potentially $40,000+

Step 4: Prioritize Risk Management

Even the best patterns can fail. Protect your capital by:

• Always using a Stop Loss

• Avoiding emotional trades or chasing breakouts

• Trading in line with the broader market trend

Step 5: Practice Before Going Live

• Backtest patterns on historical charts

• Confirm breakouts with RSI, MACD, and volume

• Filter out false signals to improve accuracy

Final Takeaway

By spotting key chart patterns, applying discipline, and compounding profits over time, even a small $680 account can grow significantly. The keys are skill, patience, and consistent execution. Master chart patterns, manage your risk, and let your capital work effectively.

#tradingtechnique #chartpatterns #BTC90kChristmas #BTCVSGOLD #StrategyBTCPurchase