Institutions don’t avoid public blockchains because they don’t understand them. They avoid them because they understand them too well.

Institutions don’t avoid public blockchains because they don’t understand them. They avoid them because they understand them too well.

From the outside, it looks puzzling. Blockchains offer transparency, auditability, and settlement finality exactly what regulated finance claims to want. Yet large institutions consistently hesitate to deploy meaningful workloads on fully public chains.

The reason is rarely stated plainly.

It isn’t throughput.

It isn’t compliance tooling.

It isn’t even volatility.

It’s uncontrolled information leakage.

That is the context in which Dusk Network becomes relevant.

Public blockchains leak more than transactions. They leak strategy.

On transparent chains, institutions expose:

trading intent before execution,

position sizing in real time,

liquidity management behavior,

internal risk responses during stress.

Even when funds are secure, information is not. For institutions, that is unacceptable. In traditional finance, revealing intent is equivalent to conceding value.

Public blockchains make that concession mandatory.

Transparency is not neutral at institutional scale.

Retail users often view transparency as fairness. Institutions view it as asymmetric risk:

competitors can infer strategies,

counterparties can front-run adjustments,

market makers can price against visible flows,

adversaries can map operational behavior over time.

This isn’t theoretical. It is exactly how sophisticated markets exploit disclosed information everywhere else.

Public blockchains simply automate that leakage.

Why “privacy add-ons” don’t solve the problem

Many chains attempt to patch transparency with:

mixers,

optional privacy layers,

encrypted balances but public execution,

off-chain order flow.

Institutions see through this immediately. Partial privacy still leaks metadata:

timing signals,

execution paths,

interaction graphs,

settlement correlations.

If any layer reveals strategy, the system fails institutional review.

Institutions don’t ask “is it private?” They ask “what can be inferred?”

Risk committees don’t think in terms of features. They think in terms of exposure:

Can someone reconstruct our behavior over time?

Can execution patterns be reverse-engineered?

Can validators or observers extract advantage?

Can this create reputational or regulatory risk?

On most public chains, the honest answer is yes.

That answer ends the conversation.

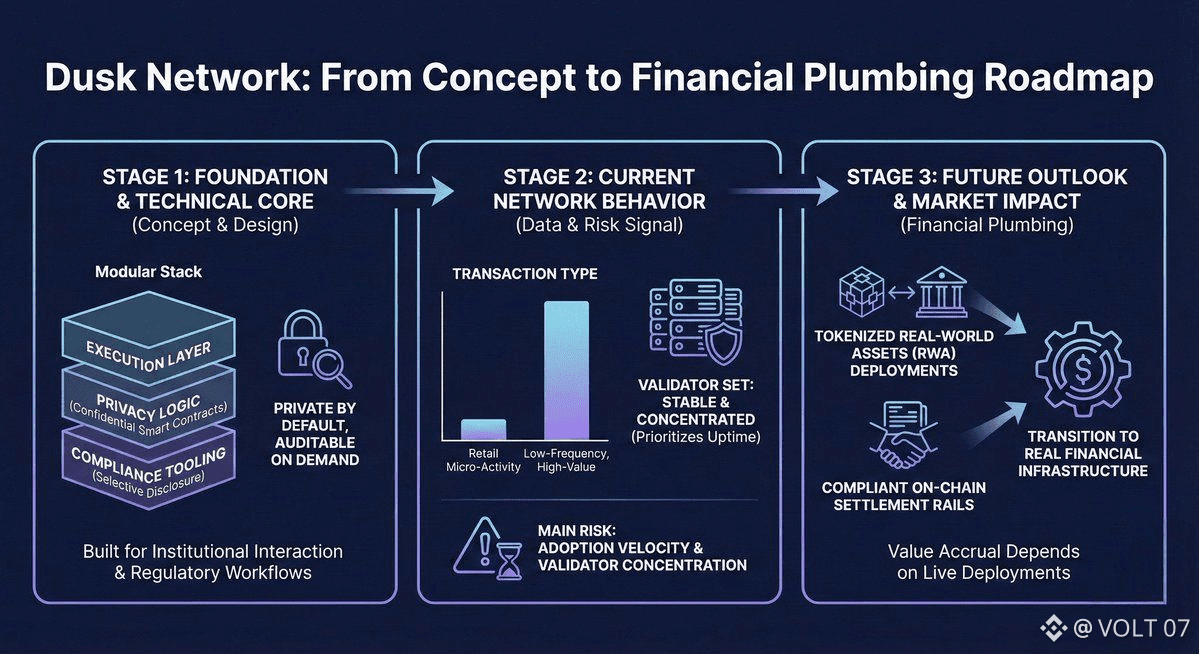

Dusk addresses the real blocker: inference, not secrecy

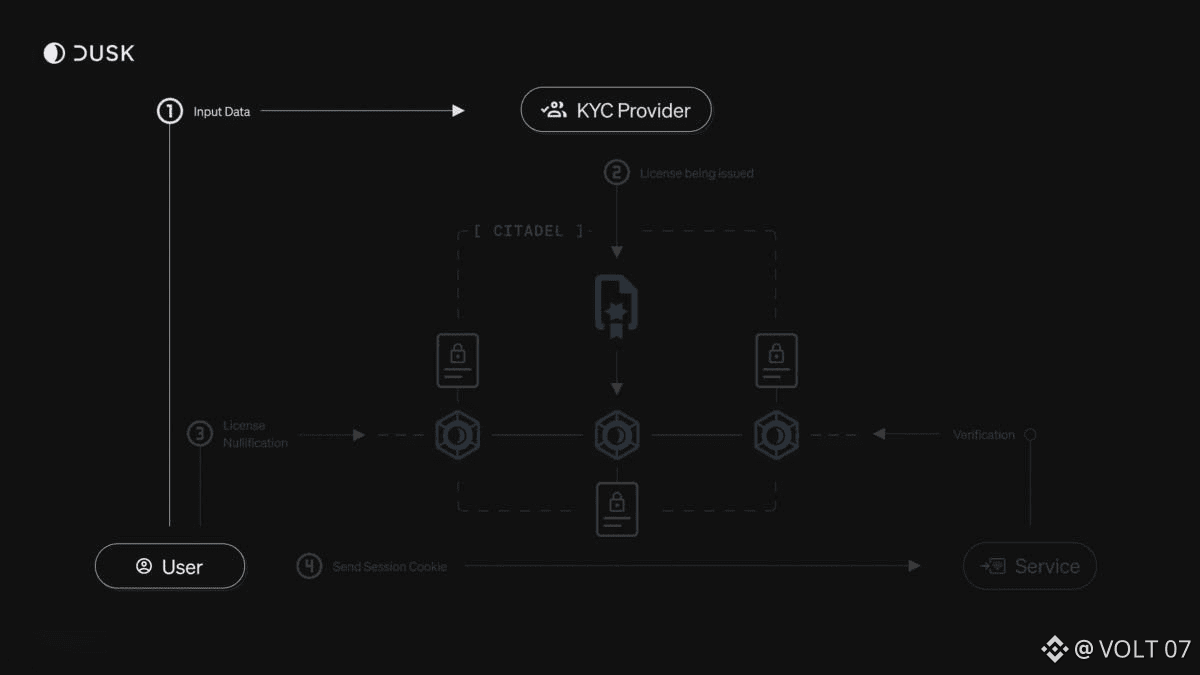

Dusk does not aim to hide activity in an otherwise transparent system. It removes transparency from the surfaces where it becomes dangerous:

private transaction contents,

confidential smart contract execution,

shielded state transitions,

opaque validator participation.

The goal is not anonymity for its own sake.

It is non-inferability.

Institutions can transact, settle, and comply without broadcasting strategy to the market.

Why this aligns with real-world financial norms

In traditional finance:

order books are protected,

execution details are confidential,

settlement does not reveal intent,

regulators see more than competitors.

Public blockchains invert this model everyone sees everything. That inversion is exactly why institutions stay away.

Dusk restores the familiar separation:

correctness is provable,

compliance is enforceable,

strategy remains private.

That is not anti-transparency. It is selective transparency the only kind institutions accept.

MEV is a symptom, not the disease

Front-running and MEV are often cited as technical issues. Institutions see them as evidence of a deeper flaw:

If someone can see intent before execution, extraction is inevitable.

Privacy-first design removes the condition that makes MEV possible. This is not mitigation. It is prevention.

Dusk’s architecture treats this as a first-order requirement, not an optimization.

Why institutions won’t wait for public chains to “mature”

Transparency is not a maturity issue. It is a design choice.

And once baked in, it cannot be undone without breaking everything built on top of it.

Institutions know this. That’s why they don’t experiment lightly on public chains and “see how it goes.” The downside is permanent.

They wait for architectures that were private by design.

This is the hidden reason adoption stalls at scale

It’s not that institutions dislike decentralization.

It’s that they cannot justify strategic self-exposure to competitors, counterparties, and adversaries.

Until blockchains stop forcing that exposure, adoption will remain shallow and cautious.

Dusk exists precisely to remove that blocker.

I stopped asking why institutions aren’t coming faster. I started asking what they see that others ignore.

What they see is simple:

Transparency without boundaries is not trustless it is reckless.

Dusk earns relevance by acknowledging that reality and designing around it, rather than pretending institutions will eventually accept public exposure as a virtue.