In my continued evaluation of next-generation blockchain designs, DuskEVM stands out not because it merely adds EVM compatibility to a Layer-1, but because of how it integrates confidentiality directly into execution. From a systems perspective, this is not another surface-level EVM implementation. It represents a deliberate synthesis of modular execution, cryptographic enforcement, and a settlement layer purpose-built for regulated finance and privacy-centric decentralized applications. Rather than bolting privacy on after the fact, DuskEVM treats it as a first-class architectural constraint.

The timing is not accidental. By 2026, institutional participants and regulated entities face a persistent contradiction: public blockchains provide transparency and composability, yet expose transactional data in ways that are incompatible with confidentiality, compliance obligations, and competitive discretion. At the same time, developers and capital gravitate toward the EVM ecosystem because it minimizes tooling friction and maximizes network effects. DuskEVM directly addresses this tension by preserving Ethereum-compatible execution while embedding privacy and regulatory mechanisms at the protocol layer itself. This reflects a broader structural shift in which regulators increasingly favor selective, auditable disclosure over total transparency, and where privacy has moved from a niche preference to a baseline requirement for on-chain finance.

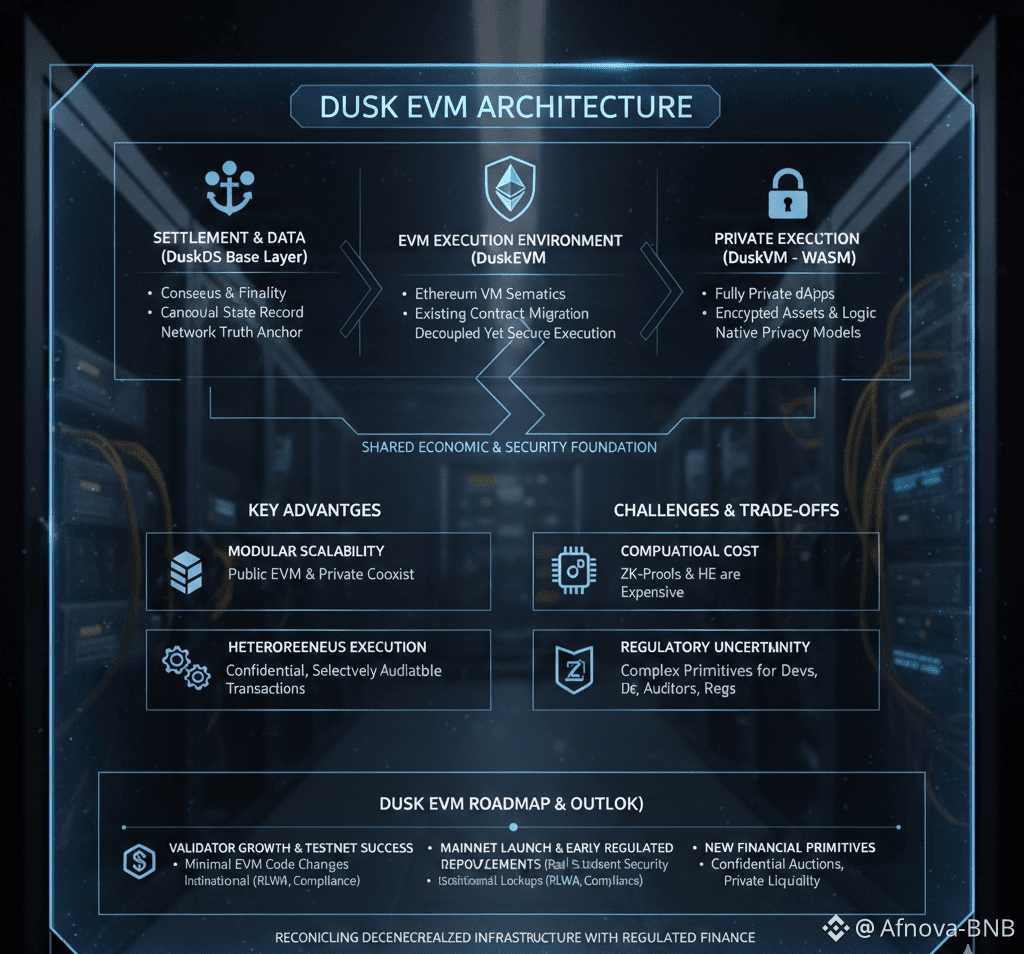

Architecturally, Dusk’s design is notable for its clean separation of concerns. The base layer, DuskDS, functions as the settlement and data availability layer, responsible for consensus, finality, and the canonical record of state transitions. It is the anchor of network truth. On top of this sits DuskEVM, an execution environment that adheres precisely to Ethereum Virtual Machine semantics, allowing existing contracts and developer workflows to migrate with minimal or no modification. Execution is decoupled from settlement, yet fully inherits its security guarantees. Running in parallel is DuskVM, a WASM-based execution layer optimized for fully private applications using Dusk’s native privacy models, where both assets and logic remain encrypted rather than merely obfuscated.

This modular structure enables two important properties. First, execution environments can scale independently of settlement. Second, heterogeneous execution models public EVM logic and deeply private WASM computation can coexist on a shared economic and security foundation. Within DuskEVM itself, advanced cryptographic primitives such as zero-knowledge proofs and homomorphic encryption can be incorporated through native mechanisms like Hedger, allowing transactions to remain confidential while still being selectively auditable by authorized parties. This goes beyond conventional rollup-style privacy and reflects a conscious attempt to reconcile cryptographic privacy with regulatory accountability.

The economic design reinforces this integration. The DUSK token is used directly for gas and execution fees within DuskEVM, aligning network usage with validator incentives in a manner analogous to ETH on Ethereum. Validators stake DUSK at the settlement layer to secure consensus and finality, tying token economics to network security. In addition, regulated financial products and real-world asset tokenization initiatives often require escrow, lockups, or compliance-driven constraints enforced through smart contracts, creating structural demand for token lockups rather than purely speculative usage. From an incentive perspective, execution demand, settlement security, and institutional integration are all pulling in the same direction instead of existing as isolated incentive silos.

When observing early network behavior, two structural signals stand out. First, validator participation and infrastructure upgrades have increased ahead of DuskEVM’s mainnet rollout, a coordination pattern that typically precedes major protocol milestones. Second, testnet activity shows Ethereum contracts being deployed with minimal code changes, confirming that EVM compatibility meaningfully reduces developer friction. This suggests that adoption hinges less on learning new tooling and more on whether privacy and compliance advantages justify migration.

The implications differ by constituency. For traders, DuskEVM enables privacy-aware DeFi activity where positions, balances, and strategies are not fully broadcast to the network. This alters market microstructure by reducing surveillance-driven arbitrage and front-running, even if it does not eliminate MEV entirely. For developers, the value proposition lies in retaining familiar Ethereum workflows while gaining access to native cryptographic and compliance primitives that would otherwise require bespoke engineering. Institutions stand to gain the most: the presence of regulatory alignment, licensed partners, and auditable privacy mechanisms lowers the legal and operational barriers to issuing and managing regulated assets on-chain.

That said, the trade-offs are non-trivial. Cryptographic operations such as homomorphic encryption and zero-knowledge proofs are computationally expensive, and performance optimization remains critical for maintaining throughput. While EVM compatibility lowers the initial barrier to entry, the correct use of privacy and compliance primitives requires education for developers, auditors, and regulators alike. Regulatory progress in the EU is a strength, but it may not translate cleanly across jurisdictions where privacy-enhancing technologies face greater scrutiny. Finally, token demand is partially linked to the pace of real-world asset issuance and institutional onboarding, which often lags technical readiness.

Looking ahead, the near-term focus is likely to center on mainnet launch and early regulated deployments, particularly around real-world assets. Speculative DeFi activity may arrive quickly due to EVM compatibility, but durable economic value will depend on successful institutional use cases. Over a longer horizon, if DuskEVM can demonstrate privacy-preserving execution with predictable settlement at scale, it opens the door to entirely new financial primitives confidential auctions, private liquidity venues, and institutional-grade vault strategies that public blockchains struggle to support.

Ultimately, the question is not whether the architecture is compelling on paper, but whether implementation can deliver on its promise: privacy without sacrificing settlement integrity, and compliance without eroding economic utility. If that balance holds, DuskEVM represents a meaningful step toward reconciling decentralized infrastructure with regulated finance.