When evaluating blockchain architectures intended for real-world financial deployment, @Dusk Network distinguishes itself not as a general-purpose privacy chain, but as a system deliberately engineered at the intersection of confidentiality and regulation. Rather than optimizing for experimental DeFi use cases, its design assumptions are rooted in the operational realities of regulated capital markets. This positions Dusk as a potential connective layer between traditional financial infrastructure and tokenized securities operating on-chain.

The most meaningful shift in crypto infrastructure today is not about accelerating speculation, but about aligning blockchain systems with regulatory frameworks governing institutional finance. Conventional securities markets operate under strict legal regimes such as which historically conflicted with the radical transparency of public blockchains. Dusk is explicitly designed to close this gap by embedding privacy and compliance directly into the base protocol, rather than attempting to retrofit them afterward. This approach matters because institutional adoption depends on maintaining confidentiality while preserving auditability and legal accountability. Full public transparency, while advantageous for censorship resistance, introduces unacceptable risks for regulated instruments, including information leakage and market manipulation. Dusk addresses this tension directly by enabling selective privacy alongside verifiable compliance within a permissionless environment, avoiding a forced trade-off between secrecy and oversight.

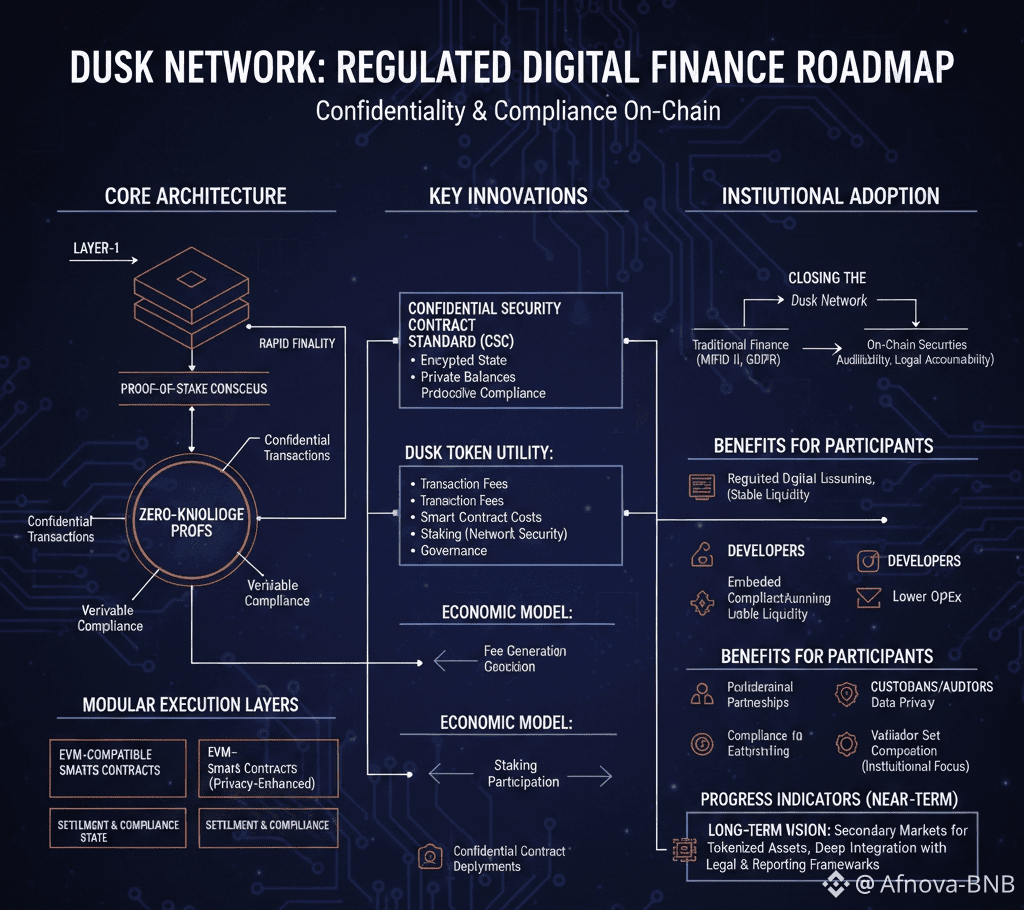

At its core, Dusk operates as a Layer-1 blockchain purpose-built for regulated financial activity. Its architecture is structured around several foundational components. Consensus is based on a proof-of-stake mechanism optimized for rapid finality and energy efficiency, with parameters tuned to support privacy-preserving execution rather than raw throughput alone. Zero-knowledge proof systems form the backbone of confidentiality across the network, allowing transaction validity, ownership, and compliance conditions to be proven without exposing sensitive data. Execution is modularized across distinct layers, with one component providing EVM-compatible smart contract execution enriched with privacy features, and another managing settlement, data availability, and compliance-related state transitions. This separation allows confidential execution without compromising the integrity or auditability of the underlying ledger.

In practice, transaction flows differ fundamentally from transparent chains. Instead of publicly revealing balances and contract states, Dusk maintains encrypted or confidential state through its Confidential Security Contract standard. Ownership, transfers, and asset states are validated cryptographically, ensuring correctness without broadcasting sensitive information to the network. By embedding compliance logic directly into protocol-level execution, the system avoids reliance on external middleware or off-chain enforcement mechanisms, treating regulatory constraints as native rather than auxiliary.

The DUSK token functions as a core economic instrument rather than a loosely defined utility asset. It is used to settle transaction fees and smart contract execution costs, anchoring network usage to economic demand. Token holders can also stake DUSK to participate in consensus, aligning capital incentives with network security and operational integrity. Governance mechanisms, while still evolving, give stakeholders influence over protocol upgrades, particularly those affecting privacy and compliance standards. This adaptability is critical in a regulatory environment that continues to evolve across jurisdictions.

From an economic standpoint, Dusk’s value accrual is closely tied to real usage. Participation and incentive alignment depend on the issuance, transfer, and settlement of regulated digital assets rather than speculative trading activity alone. If adoption by compliant issuers and trading venues expands, fee generation and staking participation follow as a structural outcome rather than a narrative-driven one.

Traditional on-chain metrics such as total value locked or retail transaction counts are less informative for evaluating Dusk’s progress. More relevant signals include the issuance of confidential securities, the deployment of privacy-enabled contracts, and the composition of the validator set, particularly the presence of participants aligned with institutional or compliance-focused objectives. Transaction composition also offers insight, as a growing share of confidential transactions indicates practical adoption of privacy standards rather than purely experimental usage. While overall activity may appear modest relative to large public chains, the nature of that activity better reflects the protocol’s intended market.

For professional traders and institutions, Dusk materially changes the risk profile of on-chain finance. Confidentiality reduces information leakage and front-running exposure, enabling deeper and more stable liquidity for regulated instruments. Markets that combine legal certainty with privacy are inherently more attractive to institutional participants than fully transparent alternatives. Developers benefit from the ability to embed eligibility checks, identity constraints, and compliance rules directly into smart contracts, reducing reliance on external compliance systems and lowering operational complexity. Custodians and auditors gain the ability to verify activity without exposing sensitive data publicly, addressing one of the long-standing barriers to institutional blockchain adoption.

Despite its targeted design, the protocol faces clear constraints. Regulatory standards are not static, and maintaining alignment across regions will require continual adaptation. Privacy-preserving systems are also inherently more complex than transparent execution models, increasing implementation risk and verification overhead. Competitive pressure from other privacy-focused or regulated-finance platforms remains a factor, requiring sustained innovation to maintain differentiation. Additionally, without meaningful participation from regulated issuers and trading venues, liquidity in confidential markets may remain limited, constraining practical utility despite strong architectural foundations.

In the near term, progress is more likely to be reflected in infrastructure development than in market pricing. Growth in confidential contract deployments, issuer partnerships, and compliance tooling will serve as early indicators of traction. Over a longer horizon, the emergence of secondary markets for tokenized regulated assets and deeper integration with custody, reporting, and legal frameworks will be decisive. Ultimately, Dusk’s proposition is not centered on speculative expansion, but on enabling regulated financial instruments to operate on-chain without compromising compliance requirements. By treating privacy as a prerequisite and regulation as a native constraint, the protocol aligns itself with the structural realities of institutional finance rather than the experimental margins of decentralized markets.